KBC – Kinh Bac Urban Development Corporation (stock code: KBC, HoSE) has recently issued a correction to its financial report for the fourth quarter of 2023, with most indicators showing a significant decline after the adjustment.

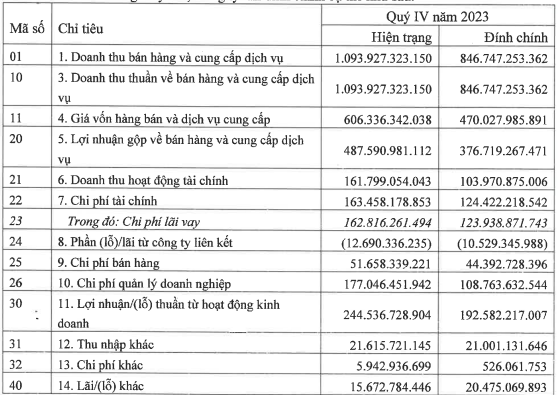

Kinh Bac stated that due to an oversight leading to errors in certain business indicators in the fourth quarter of 2023. Specifically, net revenue decreased from VND 1,094 billion to VND 846 billion. Cost of goods sold decreased from VND 606 billion to VND 470 billion, while gross profit decreased from VND 487 billion to VND 376 billion.

Source: KBC

Financial expenses, selling expenses, and business management expenses all decreased by 15-40% compared to the previously announced information. As a result, after-tax profit decreased from approximately VND 150 billion to VND 131 billion.

According to KBC’s explanation, the above-mentioned consolidated profit for the fourth quarter of 2023 significantly improved compared to the loss of VND 558 billion in the same period last year thanks to the company’s increase in recognizing business revenue from industrial park operations.

However, in the separate financial report, the company still recorded a net loss of VND 254.5 billion in the fourth quarter of 2023 due to the lack of recognition of land transfer for customers at the end of the year and the dividends received from subsidiary companies in the same period last year.

The cumulative business figures for the whole year remained unchanged. KBC recorded net revenue of VND 5,644.6 billion, nearly 6 times higher than the previous year. The largest contribution to the revenue structure is the land leasing and infrastructure segment with VND 5,247 billion.

Gross profit for the whole year increased 14 times compared to the same period, reaching VND 3,686 billion. All types of expenses were reduced, resulting in after-tax profit of VND 2,218 billion, an increase of nearly 41% compared to the previous year.

The asset structure and capital source remained unchanged after the adjustment. Specifically, Kinh Bac’s consolidated total assets at the end of 2023 were VND 33,420 billion, a decrease of more than 4% compared to the beginning of the year.

Among them, inventory accounted for 37% of total assets, amounting to VND 12,211 billion, including notable projects such as industrial parks and Trang Cat urban area with over VND 8,171 billion; Phuc Ninh urban area with over VND 1,113 billion; Tan Phu Trung industrial park and residential area with over VND 928 billion…

KBC’s cash balance decreased by more than half to VND 786 billion. In the securities trading sector, KBC is currently short-term investing in Hoa Sen Hotel Co., Ltd with nearly VND 1,855 billion.

In terms of capital structure, total liabilities decreased 22% compared to the beginning of the year to VND 13,226 billion. Total financial borrowings remained at over VND 3,659 billion, a decrease of 52% compared to the beginning of the year, accounting for 11% of the company’s capital source. Among them, long-term bank loans accounted for over VND 3,322 billion.

As of December 31, 2023, Kinh Bac’s equity was VND 20,194 billion, a sharp increase compared to VND 17,845 billion at the beginning of the year. The company still has undistributed after-tax profit of VND 7,719 billion.

In another development, in early February, Kinh Bac announced that February 22 will be the last day to finalize the list of participants in the extraordinary shareholders’ meeting for the year 2024. The time and content of the meeting have not been announced.