Despite not reaching the set goals, Vietnam still ranks among the countries with the highest GDP growth rates in the world in 2023, estimated at 5.05%, according to the General Statistics Office. In the context of a complex and unpredictable global situation, this is one of the bright spots in Vietnam’s economy, alongside many difficulties and challenges facing Vietnamese businesses.

According to the Business Registration Management Agency, the Ministry of Planning and Investment, the number of businesses leaving the market in 2023 reached the highest level in the past 5 years, increasing by 20.5% compared to 2022. Also in the past year, for every 10 businesses that entered the market, 8 businesses left the market.

CASH FLOW MANAGEMENT SHOULD BE THE TOP PRIORITY

According to statistics from the State Securities Commission, as of the end of November 2023, the number of listed stocks also decreased by 18 compared to the same period last year. Even if they are not delisted according to regulations, other listed companies are also affected by market fluctuations. According to the analysis report on the cash flow pressure of listed companies on all three exchanges by the Private Economic Development Research Committee (Committee IV), the revenue of industries has been declining from mid-2022 to mid-2023.

“For larger companies that have been listed on the stock exchange, most Vietnamese companies still rely mainly on borrowing and have relatively thin equity.”

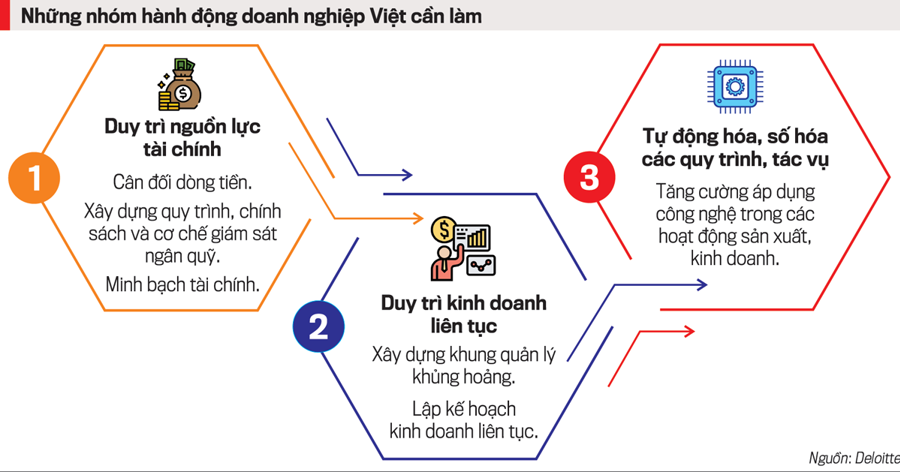

Therefore, regardless of scale or industry, cash flow management needs to be the top priority for businesses to maintain continuous business operations.

Planning, monitoring, evaluating, and having clear and transparent cash management processes and mechanisms will optimize available resources, ensure liquidity, and contribute to achieving business goals.”

The decline in global and domestic demand, stricter regulations on sustainable development and competition criteria, along with liquidity pressures, are forcing companies to exit the market or make great efforts to reverse the situation.

Cash flow can be seen as the lifeblood that keeps businesses going. In recent years, businesses have been constantly facing pressures in terms of liquidity, especially difficulties in debt management, capital arrangements, and cash flow. To support businesses in overcoming capital difficulties, the government has implemented timely policies such as reducing certain types of taxes and fees for businesses, extending the deadline for value-added tax and corporate income tax payments, and adjusting credit access conditions.

However, to go the distance, businesses need to enhance their internal capacity in cash flow management. SMEs, in particular, will face more difficulties in accessing capital when they fail to meet collateral requirements or have feasible projects. Even with capital, SMEs often lack experience in financial management and operation, resulting in suboptimal utilization of mobilized cash flow. In particular, the lack of experience in allocating financial resources and balancing cash flow causes the cash flow to be insufficient or surplus, not synchronized with the business production and operation cycles. This problem becomes even more challenging for businesses in a period of instability and strong fluctuations like the present.

For larger companies that have been listed on the stock exchange, most Vietnamese companies still rely mainly on borrowing and have relatively thin equity. Therefore, regardless of scale or industry, cash flow management needs to be the top priority for businesses to maintain continuous business operations. Planning, monitoring, evaluating, and having clear and transparent cash management processes and mechanisms will optimize available resources, ensure liquidity, and contribute to achieving business goals.

In recent years, global capital has been flowing into sustainable initiatives and projects. Attracting capital from Vietnamese businesses has also found a solution: focusing on development strategies. However, the number of businesses that truly care about and invest significantly in sustainable development on all three pillars of environment, society, and governance (ESG) is not many. In other words, building and implementing a sustainable development strategy poses a trade-off for companies between generating profits and fulfilling obligations related to environmental, social, and governance factors.

In terms of the environment, green transformation is no longer a choice but a mandatory requirement. Especially for businesses involved in global supply chains, either green transition or market loss.

According to Deloitte’s 2023 Sustainability Outlook (CxO 2023 Sustainability), even in a context of many changes, business leaders in the Asia-Pacific region still consider “climate change” as one of the top three urgent issues for businesses.

SUSTAINABLE DEVELOPMENT – THE KEY TO OPENING DOORS AND ATTRACTING CAPITAL

The Vietnamese government’s commitment to achieving net-zero emissions by 2050, along with regulations and market requirements from key markets such as the United States and Europe, as well as pressures from parent companies and partners in the supply and production chains in which Vietnamese businesses are a link, are external factors forcing businesses to develop a net-zero strategy. However, if businesses change their perspective and see resources for green transition not as costs but as investments for the present and future, they will find it easier to link short-term costs to long-term benefits.

Businesses will need to find action plans to minimize the impact of business operations on the environment, implement resource and energy-saving solutions, use renewable energy, and manage waste more sustainably.

In terms of society, businesses focus on creating value for employees, the community, and all stakeholders, through efforts to take care of employees, promote social justice, ensure safety, occupational health, and participate in positive social activities.

One of the recent emerging issues is sustainable supply chain management in terms of both environmental and social factors. With this pillar, issues related to the workforce of partner companies in the supply chain also need to be considered. Accordingly, businesses, especially large ones, can incorporate supplier management policies that require suppliers to commit to human rights issues, minimum labor policies, etc.

Lastly, corporate governance is related to how a company is managed and operated. Corporate governance involves establishing transparent management processes, ensuring the responsibility of the Board of Directors and the Board of Management, promoting transparency and honesty in financial reporting, management reporting, and sustainable development reporting. Good corporate governance is the foundation for building a sustainable business and also a competitive advantage for businesses when attracting responsible investors who will consider their investment decisions carefully. According to many studies, good governance will bring good financial results to businesses.

Similar to the approaches to environmental and social factors, the implementation process of corporate governance needs to be reviewed, evaluated, and designed from the smallest steps. Despite facing difficulties, businesses can take initial steps through improving management practices, internal control systems, and developing transparent and public corporate governance reports. Actively seeking knowledge, consulting experts, participating in training courses organized by associations and government agencies are effective ways to not only elevate businesses, attract abundant green capital from domestic and international financial institutions but also have a positive impact on the supply chain and stakeholders that businesses are directly involved in.

Although resources vary among businesses, sustainable development will still be the way out for businesses in difficult times, enabling them to continue to exist, maintain competitive capacity, and deeply participate in the domestic and international markets in the long run.

(*) The author is the Acting Deputy General Director, Deloitte Vietnam

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam