The decision is based on considering the audited financial statements of 2023, which shows that PEG remains in the warning category due to the auditor’s opinion, except for three consecutive years. HNX also requires PEG to explain the reasons and provide a remedial plan within 15 days.

Previously, in March 2023, PEG was put under warning by HNX for the same reason, based on the audited financial statements of 2022.

At that time, PEG reported recording other receivables from Vietnam Oil and Gas Group (PVN) of nearly VND 170 billion. This is an accrued loss as of May 18, 2011 – the date PEG officially converted to a joint-stock company. This other receivables arises from the determination of the State’s capital as of May 18, 2011, but it has not been approved for settlement by PVN and relevant state agencies.

PEG also stated that it will continue to collaborate with PVN to work with relevant state agencies to carry out the share capital settlement.

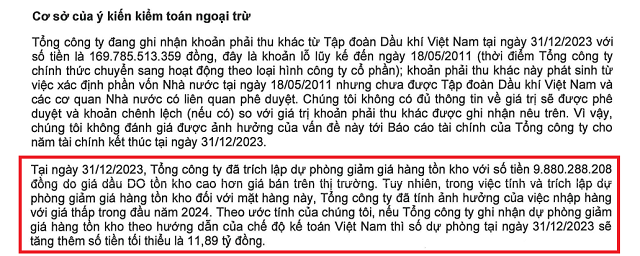

Returning to the audited financial statements of 2023, besides the mentioned issue, another qualified opinion also arose, regarding the provision for inventory price reduction.

Therefore, in addition to not resolving the long-standing issue, PEG now faces another qualified opinion from the auditors, raising doubts among investors about the day when this stock can escape the warning status.

Audited financial statements for 2023 of PEG have another qualified opinion from auditors compared to the audited financial statements for 2022 Audited financial statements for 2023 of PEG have another qualified opinion from auditors compared to the audited financial statements for 2022 |