In the recently published document, Pomina presented at the General Meeting of Shareholders to approve the actual investment capital increase for the blast furnace project from 4,975 billion dong (in 2020) to 5,880 billion dong. This is likely just a procedural step, as auditors from AFC Vietnam have determined the actual investment capital for the project at 5,880 billion dong in a document signed in February 2023.

At this extraordinary meeting, what investors are waiting for is Pomina’s capital mobilization plan after suspending the private placement plan for 70 million shares to Japanese investor Nansei.

Pomina unexpectedly cancels the private placement plan for strategic investor Nansei

The move to suspend the private placement raises doubts about Pomina’s restructuring plan as they are facing severe liquidity shortages and mounting debts. By the end of 2023, Pomina only had over 10 billion dong in cash, over 1,600 billion dong in short-term receivables at the end of 2023. Meanwhile, short-term debts nearly 8,000 billion dong, of which short-term financial borrowings were nearly 5,500 billion dong.

Found a new investor

In the explanation of the business results for the fourth quarter of 2023, Pomina’s management revealed that they have found a new investor.

“The company has found an investor. All procedures are awaiting approval at the extraordinary General Meeting of Shareholders. After that, the company will resume operations at Pomina 3 plant, expected in the beginning of the second quarter of 2024,” Pomina said.

In addition to the capital mobilization plan from the new investor, Pomina also intends to transfer part of the capital in Pomina 3 Co., Ltd. and borrow money from BIDV.

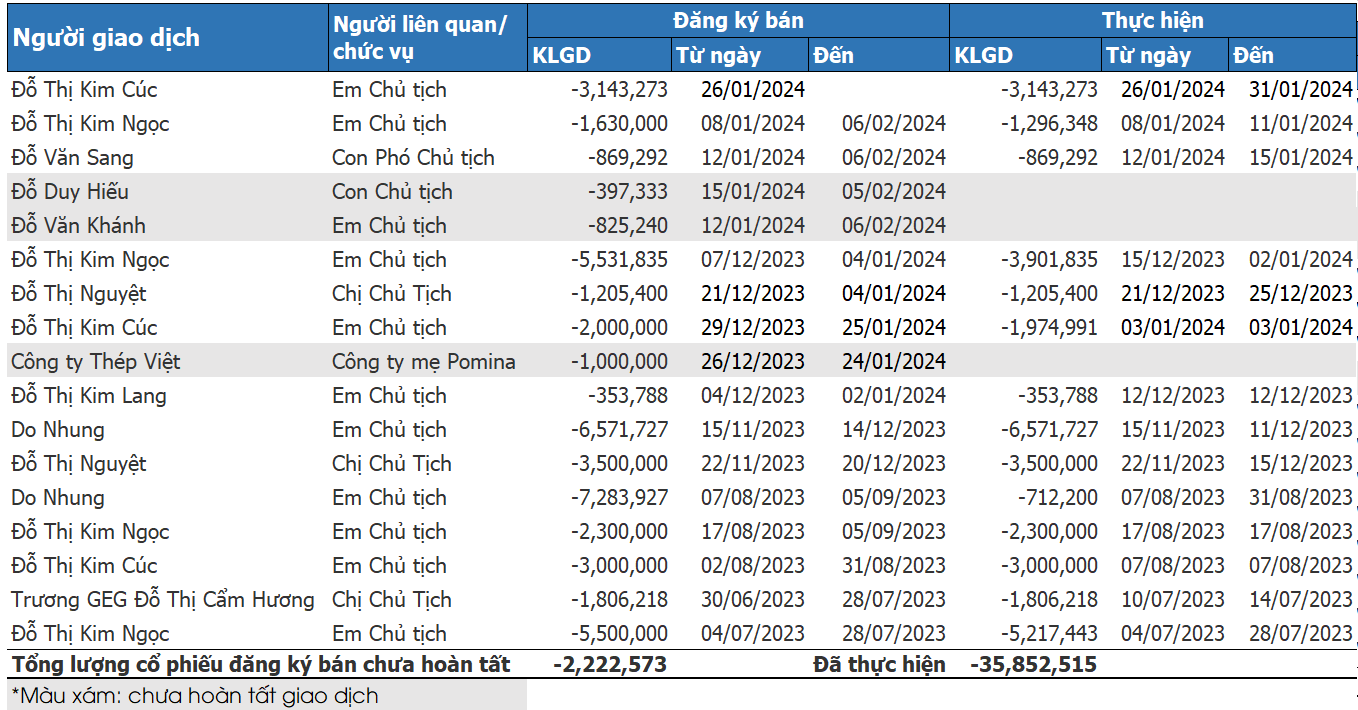

Family members of Pomina’s Chairman Do Duy Thai have also collectively sold shares and the company stated that the purpose is to pay off debts. So far, the leadership family group has sold nearly 36 million POM shares.

|

Transactions of Pomina’s leadership family members

Source: VietstockFinance

|