In the first month of 2024, the investment fund led by CEO Le Chi Phuc recorded a performance of 4.84%, higher than the 3.04% increase of VN-Index and marked the second consecutive month of outperforming the market. In December 2023, the fund achieved a performance of 4.15%.

The positive performance of Ballad Fund comes from maintaining a high proportion of stocks when the market is booming, with the largest contribution coming from the banking and retail sectors (which also have the highest proportions in the fund’s portfolio).

Capitalizing on the victory, the proportion of banking stocks has increased to 38%

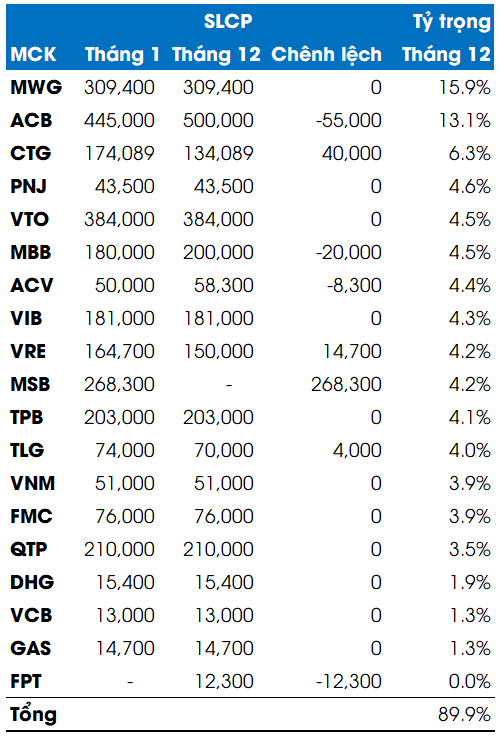

During this period, Ballad Fund continued to increase the proportion of banking stocks to nearly 38%, with the purchase of nearly 270,000 shares of MSB (4.2%). In addition to the banking sector, the two retail stocks, MWG and PNJ, also have a high proportion in the portfolio, accounting for 15.9% and 4.6% respectively. On the other hand, all shares of FPT were sold off.

By the end of January 2024, Ballad Fund had allocated 90% of its capital to stocks, while maintaining only 4.5% in cash.

Changes in the portfolio of Ballad Fund in January 2024

Source: SGI Capital

|

Avoid holding cash

Assessing the macro situation at the beginning of 2024, Mr. Le Chi Phuc, the head of Ballad Fund, believes that the major trends are still declining interest rates and stable exchange rates.

The deposit and lending interest rates have started to reach a level lower than the COVID-2021 bottom period, where the deposit interest rates have never decreased rapidly and reached such low levels as currently.

“This will certainly stimulate a large amount of maturing money to flow in search of investment opportunities in various asset classes. The rapid decline in lending interest rates also reactivates the demand for borrowing for production, business, and consumption. We see that the general message that global investment banks are sending to customers this year, ‘do not hold cash’, is correct for Vietnam,” Mr. Phuc said.

After cautious periods last year, the stock market in 2024 has shown signs of recovery led by the banking sector.

According to Mr. Phuc, the financial reports for the fourth quarter have shown that the overall picture of the banking sector is gradually moving past the most difficult period, with Net Interest Margin (NIM) reaching the bottom, non-performing loans peaking, and provisioning established with state-owned banks and healthy joint-stock commercial banks.

“At historically low pricing levels like the end of 2023, it’s not difficult for the stock prices of this sector to be reassessed by the market for a more positive outlook in 2024,” said the head of Ballad Fund.

Be cautious with excessive expectations

However, Mr. Phuc warns that the valuation of many stocks has approached or even exceeded the long-term average valuation, and when the VN-Index surpassed the 1,200-point mark, it also returned to near the average historical valuation range with P/E at 14 times and P/B at 1.9 times.

“This valuation level reflects the expectations of growth recovery in many stocks. Investment efficiency will only come when these expectations become reality. Conversely, when valuations have increased, overly optimistic and distorted expectations will become traps for investors this year. Therefore, the market will be highly differentiated in 2024,” Mr. Phuc noted.

Vu Hao