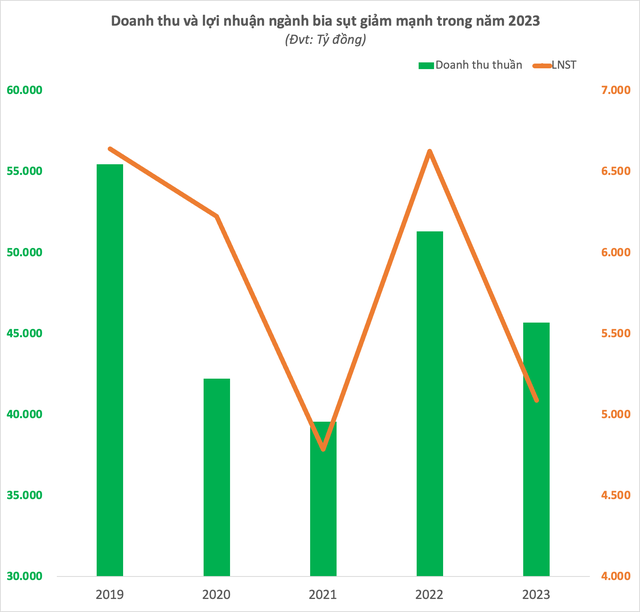

Beer consumption shows no signs of recovery, with typical beer industry businesses reporting declining revenues, according to a report by Bao Viet Securities Joint Stock Company.

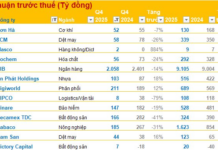

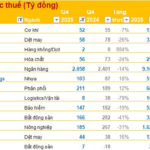

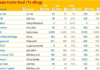

According to statistics, continuous decline has led to a decrease in annual revenues for beer industry businesses in 2023 by over VND 45,000 billion from over VND 55,000 billion. After-tax profits experienced an even steeper decline at over 23%, totaling less than VND 5,100 billion.

One of the most heavily affected entities is Saigon Beer-Alcohol-Beverage Corporation (Sabeco), with revenues falling from VND 35.2 trillion in 2022 to just VND 30.7 trillion in 2023.

According to Kantar, consumer sentiment has slightly improved but remains cautious. As a result, households continue to be cautious in managing expenses, cutting back on dining and entertainment activities.

In addition, Sabeco’s leadership also believes that strict compliance with Decree 100 on Alcohol Concentration has contributed to pressure on consumers.

Hanoi Beer-Alcohol-Beverage Corporation (Habeco) also lamented the increased alcohol concentration control measures in the last months of 2023, which affected their profitability. Moreover, the company faces increasingly fierce competition in the beer market, coupled with reduced consumer demand.

In 2023, Habeco achieved gross revenue of VND 7,757 billion and after-tax profit of VND 356 billion, representing respective decreases of 8% and 30% compared to the same period.

Bao Viet’s report also estimated a 15% decline in Heineken’s sales revenue for the first 9 months of 2023.

Illustrative image.

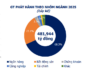

Together with weak demand, the beer market continues to shift from the premium segment to the mass market in the context of a difficult economy. Therefore, according to Bao Viet’s analysis, Sabeco, with its established strength in this segment and various product lines such as Lager, Export, 333, Lac Viet… has recorded a lower decline in sales volume compared to Heineken, as the latter relies more on the premium Tiger brand.

In addition, some argue that if the Special Consumption Tax Law is revised, including changes in calculation methods and tax rate adjustments for alcohol and beer, the situation for these businesses will become even more challenging.

Regarding the overall market, Nguyen Van Viet, Chairman of the Vietnam Beer-Alcohol-Beverage Association (VBA), stated that the domestic consumption market has declined by 20% – 30%.

“2019 was the peak year for the beverage industry in general and beer in particular. From 2019 and earlier, the beer industry grew an average of 5% – 6% per year. If this growth rate continued, by 2022 the beer industry would have had to increase by 20% compared to 2019. However, in reality, the beer industry experienced a 10% – 15% decline in 2021 and about a 5% – 7% decline in 2022 compared to 2019. In 2023, the beer industry has yet to show signs of recovery. From now until the end of the year, the beer market will still be quite gloomy,” said Mr. Viet.

Heineken, one of the leading companies in the industry, had a subsidiary that ranked among the top 5 largest taxpayers in Vietnam (Heineken Vietnam Brewery Limited Liability Company) in 2019, surpassing both Samsung and Vinamilk. By 2020, the company had dropped to 9th place on the list. In the latest update of the ranking of the top tax-paying companies in Vietnam (2022), Heineken’s subsidiary fell to 19th place.