AB InBev, the Belgian beer manufacturer known for brands such as Budweiser, Stella Artois, and Corona, revealed that their total sales volume decreased by 3.4%, but revenue in Q3 2023 increased to $15.57 billion from $15.09 billion.

The North American market in particular witnessed a 17.1% decline in sales compared to a 14.5% decline in Q2. This came after the company collaborated with Dylan Mulvaney, a transgender social media influencer, and subsequently faced a boycott from customers, leading to unoptimistic sales of AB InBev’s Bud Light brands.

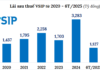

However, overall, in Q3 2023, the results showed that net profit in the quarter still increased to $1.47 billion from $1.43 billion in the same period in 2022. Furthermore, overall revenue increased by 5%, surpassing the market’s predicted growth of 4.7%.

The company’s EBITDA increased to $5.43 billion from $5.31 billion, and the beer giant also announced a $1 billion share buyback. AB InBev also stated that they would provide $3 billion in cash to repurchase bonds as they continue to reduce their debt – a situation created by previous acquisitions that saw them acquire several large beer manufacturers.

Despite ensuring their brand’s reputation, following the acquisition of SABMiller in 2016, AB InBev needed to reduce its debt of over $100 billion. To address this issue, they have refocused on organic growth and finding ways to decrease debt.

The beer manufacturer reported in Q3 that their non-alcoholic beer portfolio yielded over 10% revenue growth in this quarter, reflecting the success of similar products from other beer manufacturers like Carlsberg and Heineken. Performance is particularly driven by Budweiser Zero in Brazil and the development of Corona Cero in Canada, Mexico, and Europe.

With its premium brands, they noted that Corona saw nearly a 1/5 revenue increase to 18.8%, Bud increased by 11.8%, while Stella Artois achieved a 20.3% growth in revenue.

In other business operations, this segment contributed $385 million in revenue in the quarter, a slight increase from the same period in 2022.

Michel Doukeris, CEO of AB InBev, commented on the company’s positive business results: “The strength of our global footprint delivered an additional quarter of revenue and profit growth. Revenue increased by 5.0% with EBITDA up by 4.1%. We continue to invest in our strategic priorities for the long term.”

In the entirety of 2023, AB InBev’s revenue reached $57.83 billion – leading the beer industry. Following that is Heineken Holding with revenue of $30.18 billion.

Unit: $ Billion.

Overall, despite changing consumer preferences and shopping habits, with economic barriers such as cost of living crisis and inflation limiting income and spending ability, beer drinkers’ tendency is not to drink more but to drink better. Therefore, beer brands consistently generate billions of dollars in revenue each year.

Henry Farr, Assistant Director at Brand Finance, stated: “It seems that beer drinkers don’t necessarily have to drink more but instead drink better. Visiting bars and restaurants has become less frequent and less spontaneous, meaning many consumers are looking for a change in the type of beer they choose, prioritizing taste and quality over price. Premium beer brands seem to be performing well by offering high-quality premium beers.”

According to the Global Beer Market Overview Report 2023-2028, the market is projected to surpass a scale of $945 billion, increasing from $663.15 billion in 2022.

In the dynamic global commercial arena, the beer market stands out as a prominent force, attracting consumers across continents and cultures.

The growth and development of the beer market are driven by numerous factors, including changing consumer preferences, globalization, and advancements in production technology.

China, with its large population and growing middle class, is the largest beer consumer globally, encompassing both domestic and international brands. India, with its young population and expanding beer culture, also sees significant consumption growth.

The global beer market is dominated by major brands such as Anheuser-Busch InBev, Heineken, SABMiller, Carlsberg, Tsingtao Brewery, Asahi Breweries, and Molson Coors.

Phương Linh