Is the era of Vietnamese people drinking a lot of alcohol and beer over?

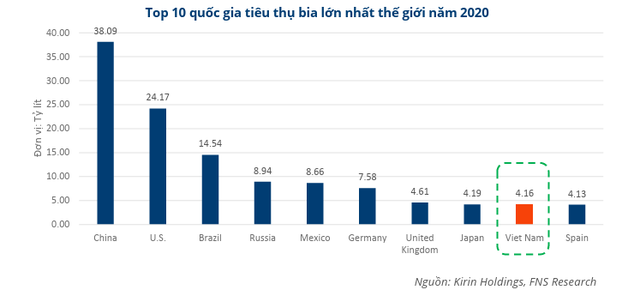

According to Kirin Holdings, Vietnam ranked 9th in the world in terms of beer consumption in 2020, consuming over 4 billion liters, accounting for 2.2% of the global total. In the region, according to the data of the Ministry of Information and Communications, Vietnam ranks second in Southeast Asia and third in Asia in terms of average alcohol and beer consumption per person, with an average of 8.3 liters of pure alcohol per person (over 15 years old) in Vietnam. Equivalent to 170 liters of beer per person per year.

From 2019 onwards, the beer industry has grown by an average of 5% -6% per year, and 2019 is considered the peak year for the beverage industry in general and beer in particular. If this growth rate continues, the beer industry will have to increase by 20% compared to 2019 by 2022, but in reality, the beer industry has decreased by 10% -15% in 2021 and is expected to decrease by about 5% -7% in 2022 compared to 2019.

In 2023, there continues to be a decline. Beer consumption has shown no signs of recovery, and typical beer businesses have reported declining revenue, according to a report by Bao Viet Securities Joint Stock Company.

According to statistics, continuous declines have caused the annual revenue of beer industry businesses in 2023 to drop to over 45 trillion VND from over 55 trillion VND. After-tax profit declined even more, with a decrease of over 23%, to less than 5.1 trillion VND.

Illustrative image

The objective reasons given by large companies include: Strict regulations on alcohol concentration, consumer spending cuts due to global economic recession. Chinese and Japanese tourists are also a secondary factor. In addition, a recent study also indicates that Gen Z will drink less alcohol and beer.

Alcohol Concentration Regulations

Once the fastest-growing beer market in the world, since January 1, 2020, the regulation of punishing drivers with alcohol concentration has officially been implemented and has heavily affected the sales of the Vietnamese beer industry.

With strict regulations applied to all traffic participants (including cars, motorcycles, bicycles, tractors, specialized vehicles) with the highest fine of up to 40 million VND and driver’s license revocation, it has forced anyone intending to consume alcohol to think twice.

Many beer places now provide discounted or even free taxi or motorbike taxi service to customers in order to improve the situation. However, the beer industry’s sales are still declining.

Consumer Spending Cuts due to Global Economic Recession

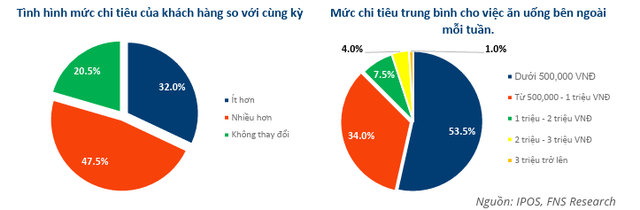

According to a random survey of 200 people nationwide by IPOS, under the influence of the global economy, along with the wave of layoffs at many companies, customer spending in the first 6 months of the year also fluctuated. Up to 32% of customers said they have reduced their spending, with the age group from 26 to 31 having the highest rate of spending cuts at 52.6%.

An additional factor is that tourists who like to drink beer have not recovered strongly

According to statistics from Kirin Holding in 2021, China and Japan are the two countries with the largest beer consumption in Asia, with 38 billion liters and 4.19 billion liters respectively. The spending of tourists from these two countries is expected to contribute to the beer consumption in Vietnam. However, the recovery of tourism for these two groups of tourists in 2023 is still slower than before the Covid period.

According to statistics from the Vietnam National Administration of Tourism, in the 12 months of 2023, there were 1,743,204 Chinese tourists and 589,522 Japanese tourists coming to Vietnam. Although this number has increased compared to 2022, it is still much lower compared to the pre-Covid period in 2019 (there were 5,806,425 Chinese tourists and 951,962 Japanese tourists coming to Vietnam in 2019).

Will Gen Z be less interested in alcohol and beer?

Looking at the international market, in the US, beer consumption has dropped to below 200 million barrels for the first time since 1999. Even in 2022, for the first time, beer market share dropped to second place after spirits, something that has never happened before in the US.

The world’s largest beer company, Anheuser Busch InBev, even forecasts that the non-alcoholic beverage segment will account for up to 1/5 of total sales by 2025.

According to Forbes, the increasing restrictions on alcohol and beer consumption among young people have led to a sharp decline in demand for alcoholic beverages. Many forecasts show that the non-alcoholic beverage product category will grow by 25% in the 2022-2026 period as beer companies are forced to shift their businesses.

Forbes states that the Gen Z generation now drinks 20% less alcohol than the Millennial generation and the increasing focus on health is also causing a significant decline in the demand for alcoholic beverages.

Illustrative image

One noteworthy point is that previous positive forecasts for the development of Vietnam’s beer and alcohol market were based on the golden population structure, young population, and increasing average income.

Euromonitor once forecasted that with the young population structure, the increasing average income along with the rapid growth rate of the middle class, alcoholic beverages including beer and wine in Vietnam are expected to continue to maintain strong growth with a CARG of 9.2% in the 2022-2026 period and reach 4.83 billion liters by 2023, heading towards nearly 6 billion liters by 2026.

Whether the new consumer behavior of today’s young people is the driving force for growth or the demise of the beer and alcohol industry still needs time to answer.