The Vietnamese stock market started the new year with 2 exciting trading sessions. The VN-Index continued to increase, surpassing 1,200 points and maintaining its upward momentum at this level. At the end of the week, the VN-Index increased by 11.17 points to 1,209.7. Overall, with good liquidity and broad reach, this is a positive start for the Vietnamese stock market in the Year of the Tiger. The trading value on the three exchanges increased strongly by 20.2% compared to the previous week, thanks to positive sentiment after Tet, reaching a value of VND 20,637 billion per session. Foreign investors continued to be net sellers, with net selling value of approximately VND 770 billion across all 3 exchanges.

With the enthusiastic developments, most experts lean towards the scenario that the market will continue to rise after the extended Tet holiday, thanks to positive cash flow, heading towards old peaks. Investors are advised to consider buying stocks that are appearing at buy points and have not increased too much in the past period.

The main trend is still upward, the fundamental story of each sector is currently less important than the story of cash flow

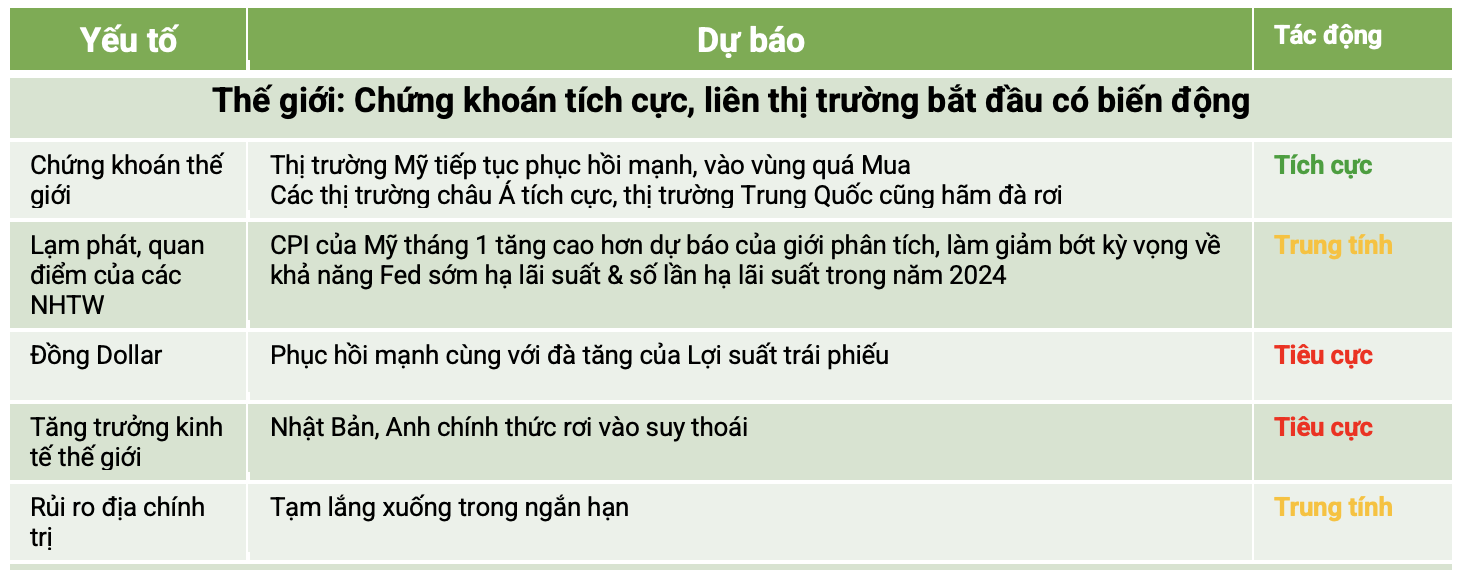

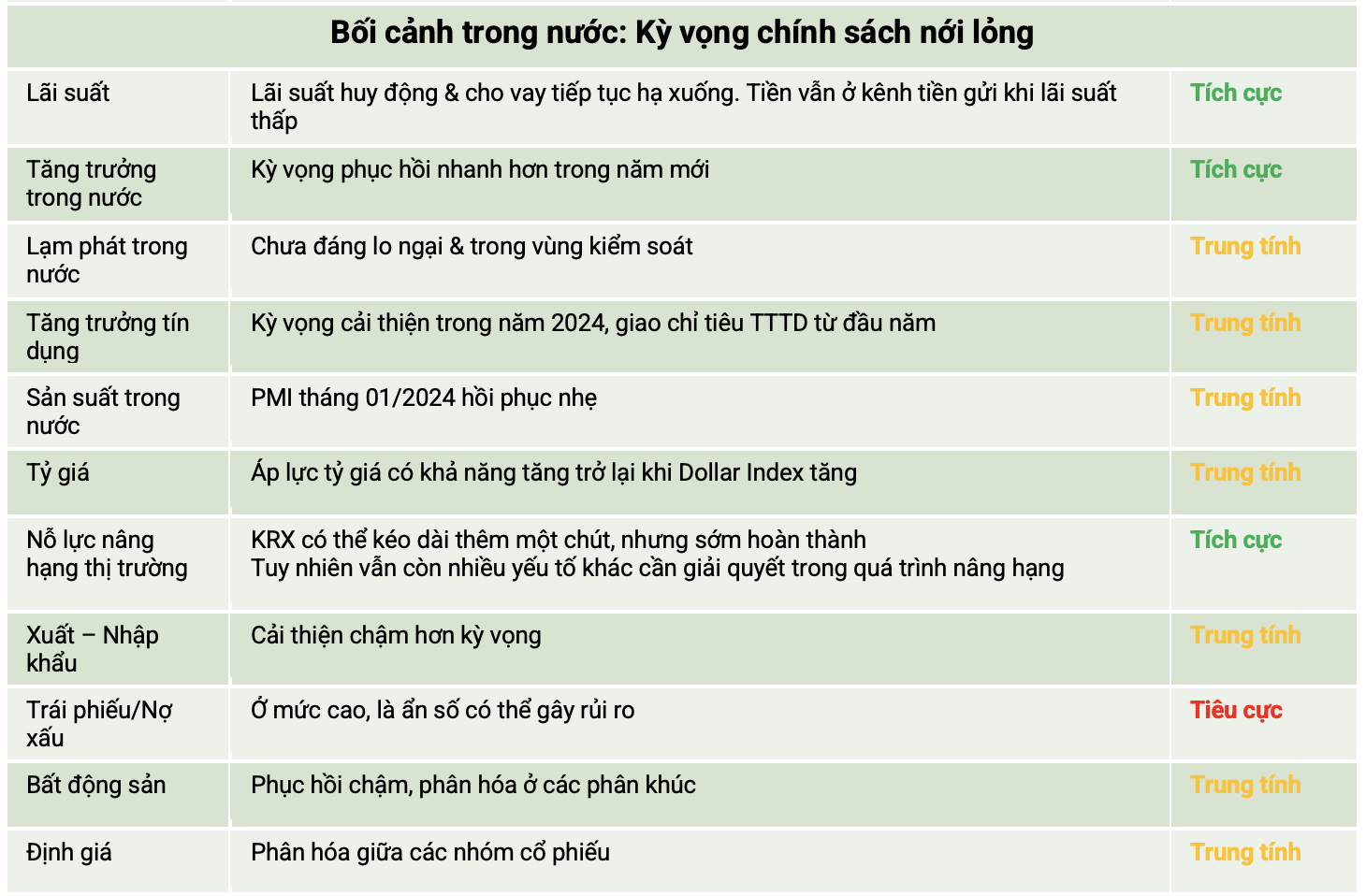

Evaluating the current context, Mr. Bui Van Huy – Director of Ho Chi Minh City Branch of DSC Securities shares that the world stock market in general is relatively positive when the US market continues to recover strongly, entering the overbought zone, positive Asian markets, and China’s stock market also showing signs of a break. The positive factors currently are still expectations of loosening monetary policies with very low interest rates, the recovery of the economy improving in the new year, expectations of the upgrading process… thereby leading to the sentiment of domestic investors being very enthusiastic.

Regarding potential negative factors, Mr. Huy believes that the international stock markets have had negative fluctuations after the US CPI information for January increased higher than analysts’ forecasts, reducing expectations of the Fed’s ability to lower interest rates & the number of interest rate cuts in 2024. The Dollar Index also rebounded strongly. Some issues in the country still remain such as bad debts and the recovery of the real estate market.

“Summing up the above factors, it can be seen that in the short term, the positive factors still have a certain advantage and there are not enough strong factors appearing to make the market reverse strongly in the short term. It should be noted that the VN-Index is in an overbought state, so profit-taking and short adjustments may occur at any time, however, there is no high probability of a deep decrease and the main trend still tends to increase”, Mr. Huy commented.

According to Mr. Huy, new buying points can be considered in stocks that have not yet spread money because the early sessions of the year have shown that money is shifting to untapped groups. Meanwhile, heavily increased groups such as banks and stocks in the overbought zone should consider not buying more, holding or taking profits when reaching short-term targets.

Regarding the selling trend of foreign investors in the sessions after Tet, experts from DSC believe that the profit-taking trend formed after the market continued to rise strongly. The market continued to rise to new levels and foreign investors continued to have profit-taking actions that are not too worrying, however, it is necessary to monitor developments in the intermarket as well as exchange rates.

In the scenario that the market continues to rise and surpasses the early stages of the year, the probability of adjustment will increase, but in the short term, the current cash flow is still positive, enthused, investors still have trading opportunities. Investors can consider stocks that have not yet increased in price; execute transactions when new money flows appear and buying points appear. Avoid chasing purchases with stocks that have increased a lot. The fundamental story of each sector at the current time is less important than the story of cash flow.

No signs of reversal, investors can continue to hold stocks

According to the viewpoint of Mr. Dinh Quang Hinh, Head of Macro and Market Strategy Department of VNDirect, investor money has returned to the stock market as expected soon after the Tet holiday and helped the indexes to break through the psychological level of 1,200 points. The breadth of the market is also better when many sectors alternate in gains and maintain market momentum instead of focusing on the banking sector as in the pre-holiday period. The sentiment of domestic investors is currently quite positive thanks to positive macroeconomic information, especially PMI, import-export, FDI data in January, and the business results of listed companies in Q4/2023 have shown clear recovery. This reinforces the market sentiment towards a 2024 shareholder meeting season and Q1/2024 financial statements with brighter colors.

Summing up the above factors, VNDirect expert believes that there are no signs capable of “reversing” the current upward trend of the market. Investors can continue to hold stocks when market indicators still support the ongoing upward trend. The VN-Index can aim for the old resistance zone around 1,240 points (+/- 10 points). This is a strong resistance zone and enough to challenge the market’s uptrend.