According to the Five Elements Feng Shui, for houses with the Wood element as their birth element, the year 2024, which is under the influence of the Fire element, will be relatively peaceful. Wood and Fire are compatible elements, with Wood generating Fire. As a result, there is a wide range of suitable choices for stocks that align with the Wood element’s birth. The BIDV Securities Company (BSC) has recently released an investment recommendation report based on the Five Elements Feng Shui.

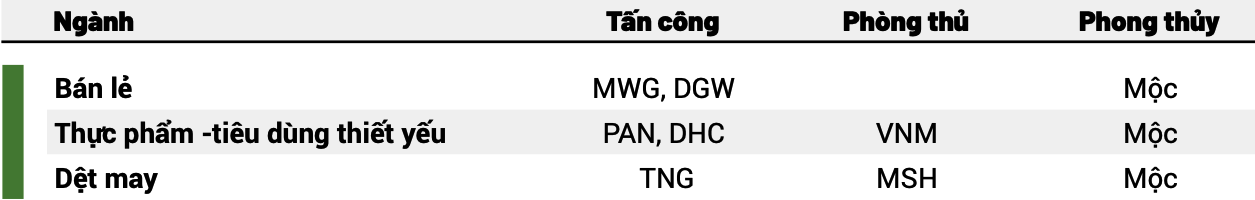

According to BSC, for investors with the Wood element as their birth element in 2024, it is advisable to prioritize industries that are experiencing high growth due to government policies (Retail, Infrastructure) or benefiting from the projected high economic growth of Vietnam in the coming years (Retail, Electricity, Water, Consumer Goods, and Banking).

When it comes to stock selection, it is recommended to focus on leading companies in each industry to capitalize on the industry’s growth potential. The selection can be made based on the top 3-5 stocks with the highest total revenue in each industry, depending on the industry’s size or projected growth rate.

BSC suggests that stocks with aggressive growth potential are suitable for investors with the Wood element as their birth element, with projected revenue and profit growth of over 20% in 2024. On the other hand, defensive stocks should be considered, which have reasonable and affordable valuations, with P/E and P/B ratios approximately equal to the 3-year average or stable dividend payouts and a good market share in the industry.

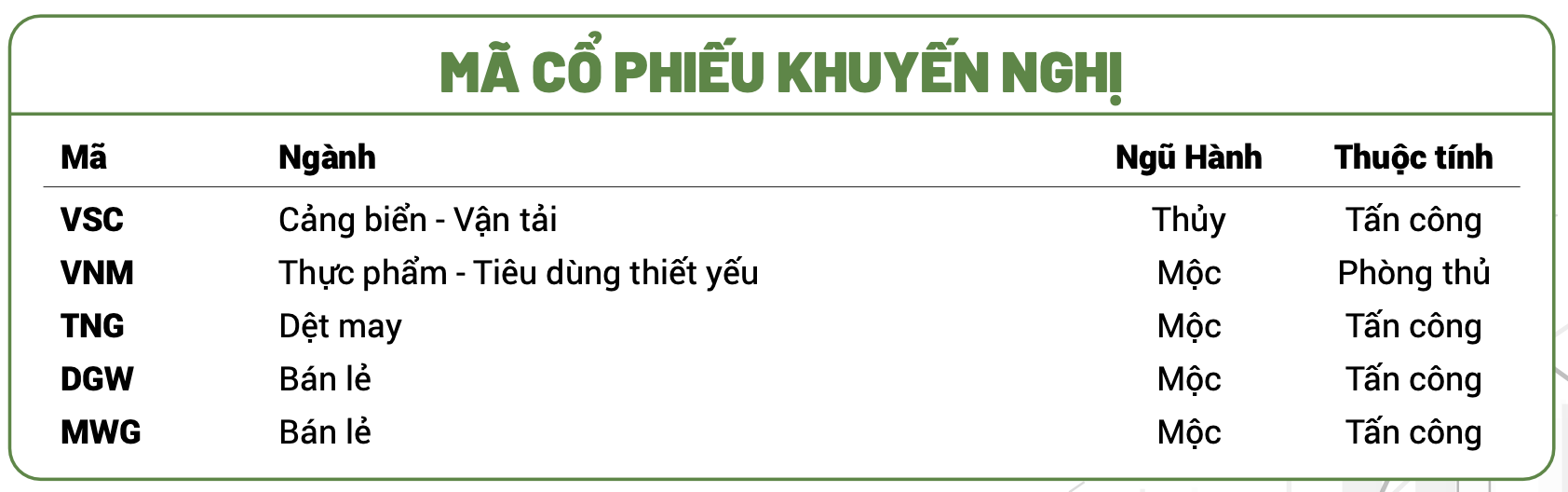

BSC has identified 5 stocks that align with the Wood element for both aggressive (VSC, TNG, DGW, MWG) and defensive (VNM) strategies.

Dragon “affiliated” year favors aggressive strategies

BSC recommends that investors with the Wood element focus on aggressive stocks this year. One suitable option is Container Corporation of Vietnam (VSC), which has strong financial capabilities. With a low debt-to-equity ratio (approximately 30%) and a relatively high amount of cash (short-term financial investments of about 700 billion VND, accounting for 50% of long-term borrowings), VSC ensures financial stability.

The company also owns a large port cluster. After acquiring Nam Hai Dinh Vu Port from GMD, VSC has the largest market share in the Hai Phong port cluster. This acquisition helps VSC (1) reduce operating costs thanks to the advantage of a longer wharf (over 800m) and (2) minimize external rentals when there are overlapping ships, optimizing revenue. With the scale and growth potential of the region, VSC’s growth rate is expected to remain high in the 2024-2026 period.

TNG Joint Stock Company for Investment and Trading (TNG) is also recommended by BSC for investors with the Wood element, considering its increased order value by 16% compared to the same period last year, (1) decreasing inventory pressure, (2) recovery expected in the US market by the end of 2024, and (3) new customers (H&M, Walmart, LIDL).

In addition, TNG’s profit margin is expected to improve by 0.5% compared to the previous year thanks to the adjustment in prices and decreased interest expenses due to lower interest rates.

Related to the retail industry, BSC has provided two recommendations for investors with the Wood element in 2024, including Mobile World Corporation (DGW) and The Gioi Di Dong Corporation (MWG).

Regarding DGW, BSC expects the company’s 2024 business performance to recover from the low point of 2023 due to the recovery demand – the 2G termination trend and the replacement cycle of ICT products, and an increased contribution from high-profit margin segments such as consumer electronics and mobile phones.

Furthermore, the long-term growth potential from M&A strategies and expanding business lines helps DGW increase its market size and distribution channel. Currently, DGW is focusing on the industrial tool business, with an expected growth rate in the 2024-2026 period of over 100% annually. The participation of DGW’s Chairman as a large shareholder of CTR also opens up cooperation opportunities between the two companies.

At MWG, the company is maintaining revenue growth and improving profit margins from its retail chains. The Dien May Xanh and The Gioi Di Dong chains are maintaining market share and improving profitability by optimizing costs. Meanwhile, the Bach Hoa Xanh chain is expected to achieve a positive profit margin of 1.5% in 2024, compared to a low margin of -3.7% in 2023, thanks to reduced depreciation and enhanced operations.

The successful sale of BHX will allow the market to better assess the value of BHX in particular, and MWG in general. With MWG’s current market capitalization of only around 65 trillion VND, which is relatively low compared to the valuation of Bach Hoa Xanh at about 1.5 billion USD (about 30 trillion VND) in the sale transaction, it will be an attractive story for capital to pour into the company to increase its valuation.

Defensive options still available for conservative investors

For investors looking for defensive stocks, BSC recommends investing in Vinamilk (VNM). Vinamilk still maintains its leading market share in the dairy industry through product diversification. With over 200 dairy products and dairy-based products, Vinamilk serves a wide range of customer segments, ensuring its leading market position in the Vietnamese dairy market.

Gross profit margins have been improving thanks to lower input material prices. In Q4 2023, operating margins are expected to improve by 1.5 bps YoY due to lower input material prices compared to the same period last year.

In terms of valuation, Vinamilk’s valuation is attractive, with a forward P/E ratio of 16 times, lower than the 5-year median P/E ratio of 18.5 times. The dividend yield is 6.5% annually, higher than the average fixed deposit interest rate of 18 months at 5.5% annually.