Illustrative image

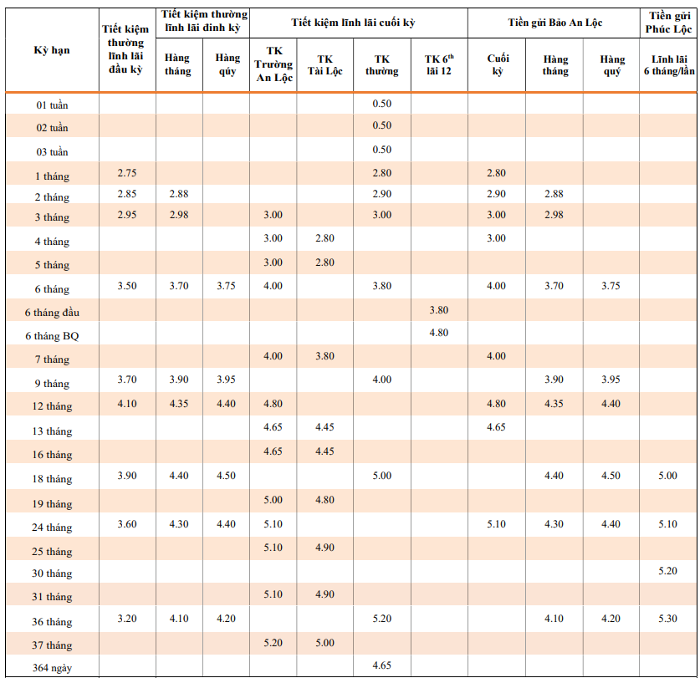

TPBank interest rates for individual customers in February 2024

According to the latest data, TPBank offers interest rates ranging from 0.5% to 5.2% per annum for its individual customers in the form of end-of-term savings with accrued interest.

The interest rate for deposits with a maturity of 1 – 3 weeks is 0.5% per annum. For a 1-month term, the interest rate is 2.8% per annum. The interest rate for a 2-month term is 2.9% per annum, and for a 3-month term, it is 3% per annum.

For a 6-month term and a 9-month term, the interest rates are 3.8% per annum and 4% per annum, respectively. Deposits with a term of 18 months are entitled to an interest rate of 5% per annum.

The highest interest rate of 5.2% per annum is applicable for a 36-month term deposit.

In addition, TPBank also offers various savings packages such as: Initial interest (approximately 2.75% – 4.1% per annum); Monthly interest (approximately 2.88% – 4.4% per annum); Quarterly interest (approximately 3.75% – 4.5% per annum); Truong An Loc deposit (Approximately 3% – 5.2% per annum); Bao An Loc deposit (Approximately 2.8% – 5.1% per annum); Phuc Loc deposit (Approximately 5% – 5.3% per annum).

In case a customer who uses a fixed-term savings product according to the aforementioned regulations has a need for early termination, the interest rate applicable will be the lowest indefinite interest rate in effect on the early termination date.

TPBank may also offer different interest rates than those stated above for certain customer segments, provided that these rates do not exceed the maximum interest rate ceiling set by the State Bank of Vietnam for each term.

TPBank deposit interest rates for individual customers at the counter in February 2024

Source: TPBank

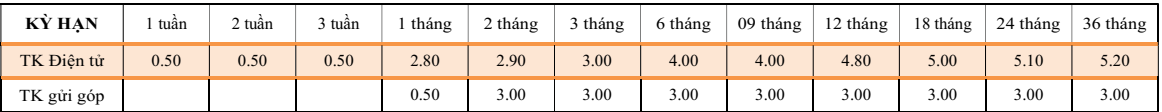

For online deposits, TPBank currently offers 3 forms of deposit services: Electronic Savings, LiveBank, and Savy. Among them, the highest preferential interest rate of 5.25% per annum is applied to deposits made through LiveBank with a 36-month term.

Specifically, electronic savings deposits through the TPBank mobile banking app have interest rates ranging from 0.5% to 5.2% per annum. Among them, the interest rate of 5.2% per annum is applied to the 36-month term.

Source: TPBank

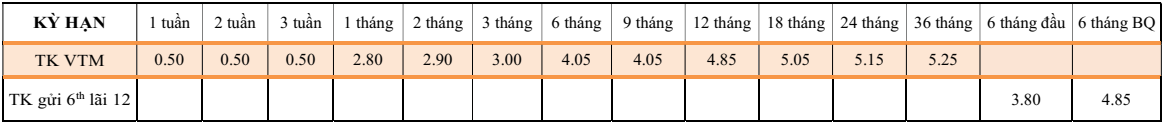

Deposits made through LiveBank at TPBank counters have interest rates ranging from 0.5% to 5.25% per annum. Among them, the highest interest rate is 5.25% per annum for the 36-month term.

Source: TPBank

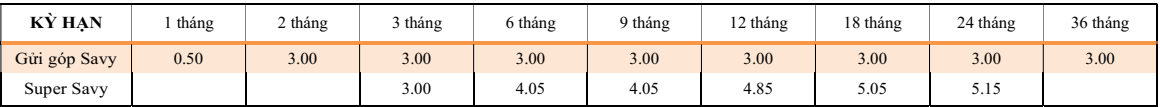

The interest rate for Super Savy deposits ranges from 3% to 5.15% per annum. Among them, the highest interest rate of 5.15% per annum is applied to deposits with a 24-month term.

Source: TPBank

TPBank interest rates for corporate customers in February 2024

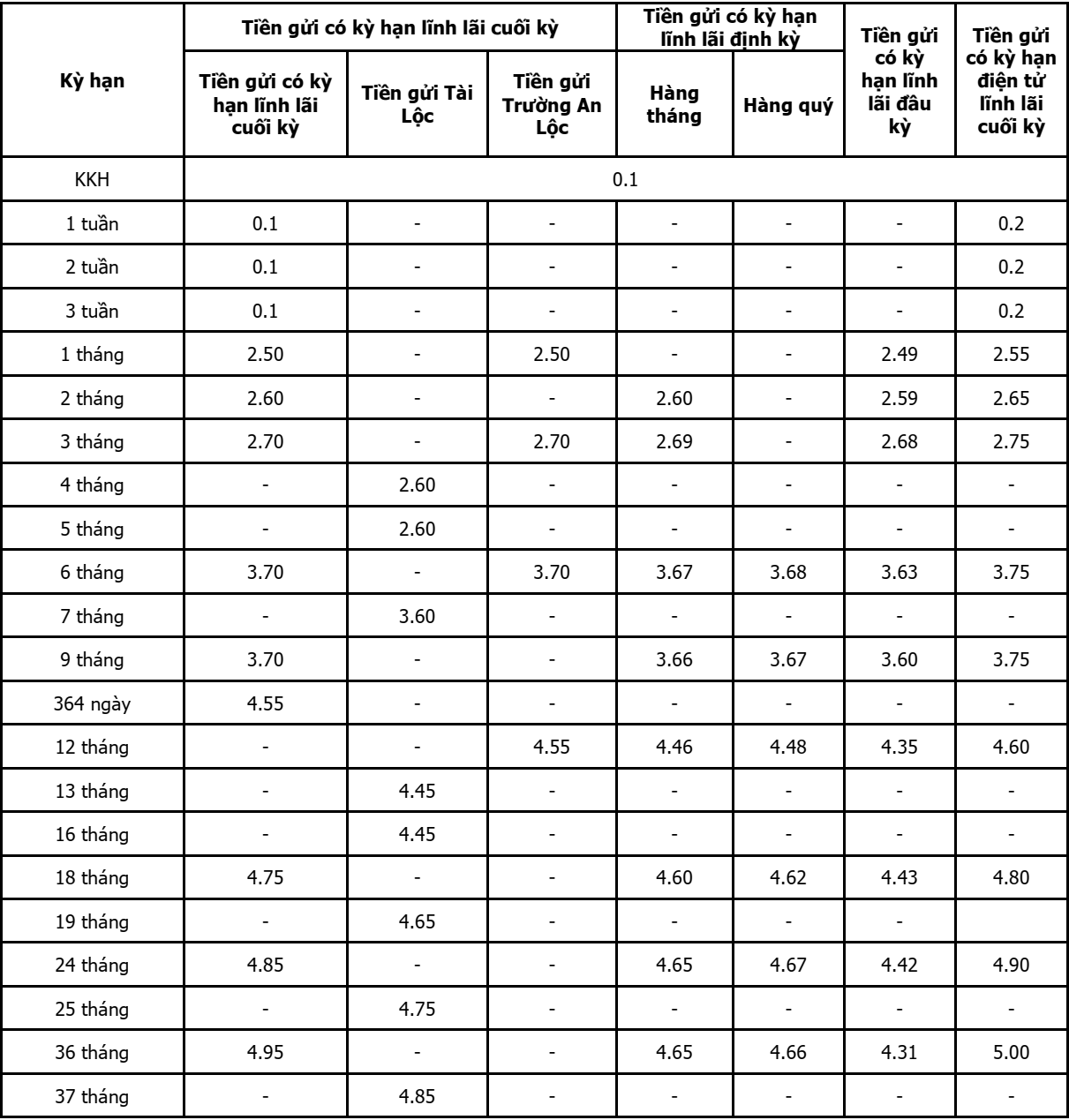

Based on the survey of TPBank deposit interest rates in February 2024 for corporate customers with accrued interest, the rates range from 2.5% to 4.95% per annum, depending on the term.

Specifically, TPBank sets an interest rate of 2.5% per annum for a 1-month term. The interest rate for a 2-month term is 2.6% per annum, and for a 3-month term, it is 2.7% per annum.

Customers who deposit money for a term of 6 to 9 months will receive a common interest rate of 3.7% per annum.

Deposits with a term of 364 days receive an interest rate of 4.55% per annum.

For deposits with terms of 18 months and 24 months, the interest rates are 4.75% per annum and 4.85% per annum, respectively.

The highest preferential interest rate for corporate customers depositing money at TPBank is 4.95% per annum, for a 36-month term.

Meanwhile, deposits with terms of less than 1 month are subject to an interest rate of 0.1% per annum.

Corporate customers can also choose from a variety of flexible savings options, such as Monthly Interest (approximately 2.6% – 4.65% per annum); Quarterly Interest (Approximately 3.68% – 4.66% per annum); Initial Interest (Approximately 2.49% – 4.43% per annum); Electronic Higher Rate Deposit (Approximately 2.55% – 5% per annum).

TPBank deposit interest rates for corporate customers in February 2024

Source: TPBank