|

Top 10 stocks impacting VN-Index session 19/02/2024 Measured by points |

Market liquidity increased compared to the previous trading session, with a matched trading volume of more than 975 million shares for VN-Index, equivalent to a value of nearly 23 trillion VND; HNX-Index achieved more than 83 million shares, equivalent to a value of over 1.5 trillion VND.

|

Source: VietstockFinance

|

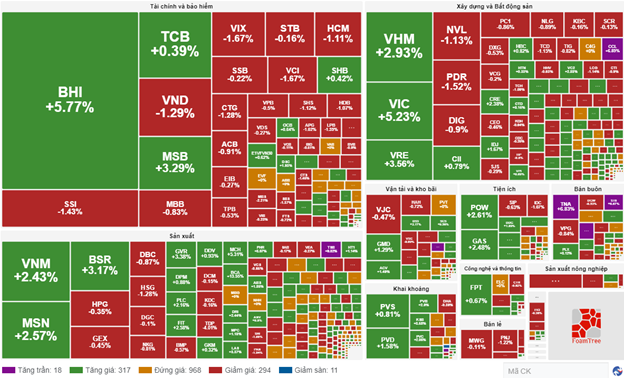

VN-Index opened the afternoon session with an optimistic atmosphere as buying pressure appeared right from the start, pushing the index to continuously increase and close near the day’s highest level. In terms of impact, VHM, VIC, GAS, and BID are the most positive contributing stocks to VN-Index with an increase of more than 8.8 points. On the contrary, LGC, LPB, and PNJ are the most negative contributing stocks, taking away more than 0.4 points from the index.

HNX-Index also had a similar trend, in which the index was positively influenced by stocks such as NRC (6%), LAS (4.49%), BCC (3.13%), PLC (2.47%),…

The real estate sector is the strongest recovering sector with a 3.63% increase mainly coming from stocks like VHM (+6.67%), VIC (+6.94%), VRE (+6.89%), and BCM (+1.1%). Following that are the food and beverage sector and the utilities sector with increases of 2.08% and 2.04% respectively. On the contrary, the consulting and support services sector had the sharpest decline in the market with -1.73%, mainly due to the stock TV2 (-2.64%).

Source: VietstockFinance

|

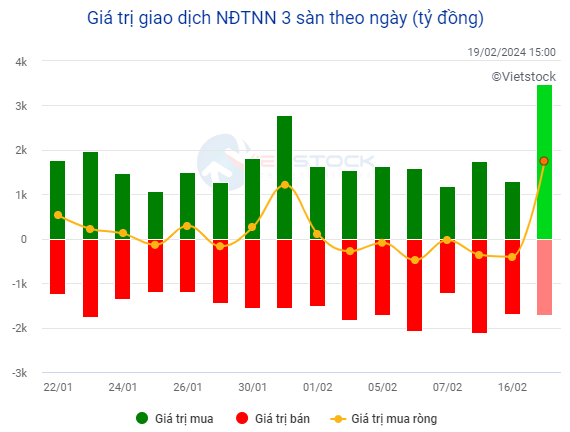

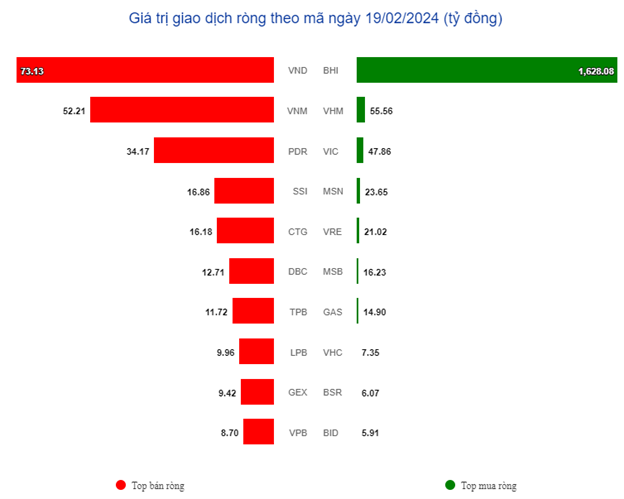

In terms of foreign trading, this group returned to net buying of nearly 110 billion VND on HOSE, mainly focusing on stocks like VND (146.67 billion), DBC (61.55 billion), MWG (60.83 billion), and CTG (54.38 billion). On HNX, foreign investors net sold more than 5 billion VND, focusing on stocks like PVS (13.59 billion), MBS (4.32 billion), and INN (3.94 billion).

Morning session: Net selling by foreign investors, VN-Index narrows its gain

At the end of the morning session, the upward momentum was gradually narrowing along with continuous net selling by foreign investors recently. This shows that investors are still cautious in trading. The main indices increased and decreased in opposite directions; VN-Index increased by 4.42 points, reaching 1,214.12 points; HNX-Index decreased by 0.4 points, to 232.64 points. Temporary declining stocks outnumbered gaining stocks with 301 stocks increasing and 354 stocks decreasing.

The trading volume of VN-Index recorded in the morning session reached over 517 million units, with a value of over 12 trillion dong. HNX-Index recorded a trading volume of over 46 million units, with a trading value of over 882 billion dong.

Source: VietstockFinance

|

Most of the growth sectors were somewhat overshadowed at the end of the morning session. The plastics and chemicals sector, despite its strong start, did not maintain its position and lost its leading position. Instead, the real estate and utilities sectors took turns contributing positively to the index’s upward trend.

Specifically, the positive contributing stocks in the real estate sector came from Vingroup stocks, as they all started strong with VHM increasing by 3.16%, VIC up 5.8%, and VRE up 5.33%.

On the other hand, the insurance sector also received attention from investors’ funds, with BVH increasing by 0.82%, BMI up 2.43%, BIC up 0.69%, PRE up 5.56%, and VNR up 0.42%. The rest of the stocks in this sector remained flat with MIG, PGI, PTI, and PVI.

Meanwhile, the banking sector showed a negative trend with major stocks declining slightly, such as BID down 0.51%, CTG down 1.28%, VPB down 0.76%, and ACB down 0.18%…

At the end of the morning session, major sectors such as securities, banking, construction materials, rubber, and electrical equipment recorded relatively dull trading.

10:40 AM: Tilted towards an increase

Investor sentiment still remains skeptical about the short-term prospects of the market, causing the main indices to fluctuate around the reference level. However, buyers are currently in a temporary advantage. As of 10:30 AM, VN-Index increased by more than 5 points, trading around 1,215 points. HNX-Index decreased by 0.15 points, trading around 232 points.

Stocks in the VN30 basket had a fairly balanced increase and decrease. Specifically, VIC, VHM, VNM, and MSN contributed 2.63, 1.41, 1.36, and 1.29 points respectively to the overall index. On the contrary, banking stocks ACB, VPB, MBB, HDB, and CTG are facing selling pressure, but the decrease is not significant, and they also took away more than 2 points from the index.

Source: VietstockFinance

|

Industry groups that have shown positive growth have become narrower at the end of the morning session. The plastics and chemicals group, despite its good start, lost its momentum and was no longer leading. Instead, the real estate and utilities groups alternately made positive contributions to the index’s upward trend.

The real estate group saw an impressive increase in the market. In particular, the stocks contributing positively to the growth of the real estate sector came from Vingroup, as they all started strong with VHM up 2.81%, VIC up 5.12%, and VRE up 3.33%…

On the other hand, the banking group did not show much positive growth from the beginning of the session. Stocks like CTG, VPB, MBB, ACB, LPB all declined. The remaining stocks like VCB, BID, HDB, SSB, VIB, TPB in the group also did not show much positivity.

By the end of the morning session, major sectors such as securities, banking, construction materials, rubber, and electrical equipment recorded relatively dull trading.

The overall market breadth is leaning towards the buying side, with more than 320 advancing stocks, exceeding the number of declining stocks by around 300.

Source: VietstockFinance

|

Total trading volume on all 3 exchanges reached over 519 million units, equivalent to over 11.7 trillion dong. In addition, foreign investors returned to net buying of over 1.471 trillion dong, mainly focusing on BHI and stocks like VHM, VIC, MSN.

Source: VietstockFinance

|

Market open: Plastic and chemical stocks lead

In the beginning of the morning session on 19/02, as of 9:30 AM, VN-Index recorded positive gains, reaching 1,214 points. HNX-Index increased slightly to 233 points. Notably, the plastics and chemicals group made a strong contribution to the index’s increase with a 2.5% gain.

In particular, stocks in the chemical group started strong and led the growth of the group at the beginning of the session, such as GVR up 4.88%, PHR up 3.44%, ABS up 1.52%, LAS up 5.62%, and SFG up 5.8%…

The wholesale group also made a significant contribution as all stocks were in the green, such as PLX up 1.27%, VFG up 3.63%, and PET up 0.59%.

In addition to these two groups, many Large Cap stocks are also showing positive trends. GVR, VNM, GAS, POW, VRE, MSN, VIC all contributed to the index’s increase.

By Lý Hỏa