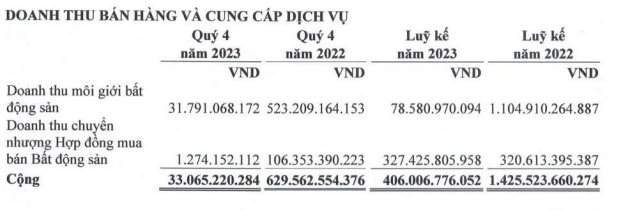

Khải Hoàn Land Joint Stock Company (Khải Hoàn Land; stock code: KHG) has just announced its consolidated financial statements for the fourth quarter of 2023, reporting a net revenue of VND 31.4 billion, a decrease of 95%. The main reason is the significant drop in real estate brokerage revenue of 94%, reaching only VND 31.7 billion; Transfer revenue from real estate sales contracts also decreased by 99%, down to only VND 1.2 billion.

Despite a 95.1% decrease in cost of goods sold to VND 18 billion, gross profit still decreased significantly by 95% to only VND 13.2 billion.

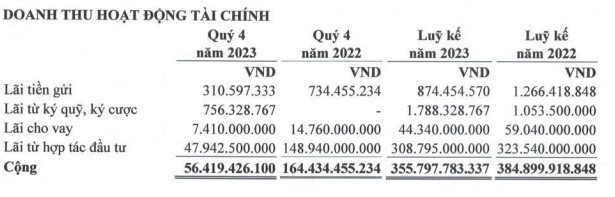

In addition, financial operating revenue amounted to VND 56.4 billion, a decrease of 65.7%; Other profits reported a loss of VND 369 million, compared to a loss of VND 30.7 billion in the same period in 2022.

During the quarter, the company managed to reduce most of its costs, such as financial expenses of VND 33.4 billion, a decrease of 10.6%; Sales expenses of VND 16.2 billion, a decrease of 50.8%; and Business management expenses of VND 8.3 billion, a decrease of 31%.

As a result, Khải Hoàn Land’s after-tax profit “evaporated” by 97%, leaving only VND 7.4 billion.

Accumulated in 2023, Khải Hoàn Land recorded a gross profit of VND 27.7 billion, a decrease of 94.7%.

Of which, net revenue brought in VND 330 billion, down 76.3%. However, the cost of goods sold decreased by only 65.2% to VND 302 billion, resulting in a sharp decrease in gross profit.

In 2023, financial operating revenue brought in VND 355.7 billion, a decrease of 7.6%. The majority of which comes from interest on loans and interest from investment cooperation, reaching VND 44.3 billion and VND 308.8 billion, respectively. The financial revenue structure of Khải Hoàn Land mainly comes from related parties, including Khải Minh Land Real Estate Company with over VND 105.3 billion; Môi Giới Community Limited Company with over VND 73.3 billion; and Khải Hoàn Group – Vũng Tàu Limited Company with VND 58.8 billion (since September 15, 2023, this company is no longer related to Khải Hoàn Land).

In addition, other profits reported a loss of over VND 1 billion, compared to a loss of VND 30.8 billion in 2022.

A bright spot in the report is that Khải Hoàn Land has managed to significantly reduce most of its costs this financial year, such as financial expenses of VND 121 billion, down 13.7%; Sales expenses of VND 71.2 billion, down 44.2%; and Business management expenses of VND 32.4 billion, down 43.3%.

Despite a sharp decrease in core business activities, financial operating revenue continues to be the “lifesaver” that helps Khải Hoàn Land report a profit of over a hundred billion dong. As of the end of 2023, the real estate company’s after-tax profit reached VND 123.8 billion, a decrease of 72% compared to the previous year.

As of December 31, 2023, Khải Hoàn Land’s total assets were VND 6,500 billion, a decrease of 7.7% compared to the beginning of the year. Cash and cash equivalents decreased significantly from VND 195.7 billion to VND 70 billion. Inventory decreased by 54.3% to VND 210.6 billion.

Notably, Khải Hoàn Land is being heavily dependent on customers/partners as about 91.5% of its assets are held outside the company, with accounts receivable totaling VND 5,951 billion (short-term accounts receivable of VND 1,217 billion and long-term accounts receivable of over VND 4,733 billion).

The largest proportion is the long-term accounts receivable from Khải Minh Land Real Estate Joint Stock Company with VND 1,884 billion, Solution Development Investment Limited Company with VND 940 billion, Khải Hoàn Group – Vũng Tàu Limited Company with VND 500 billion, Giao Hưởng Xanh Limited Company with VND 440 billion, and Môi Giới Community Limited Company with VND 445.5 billion, ….

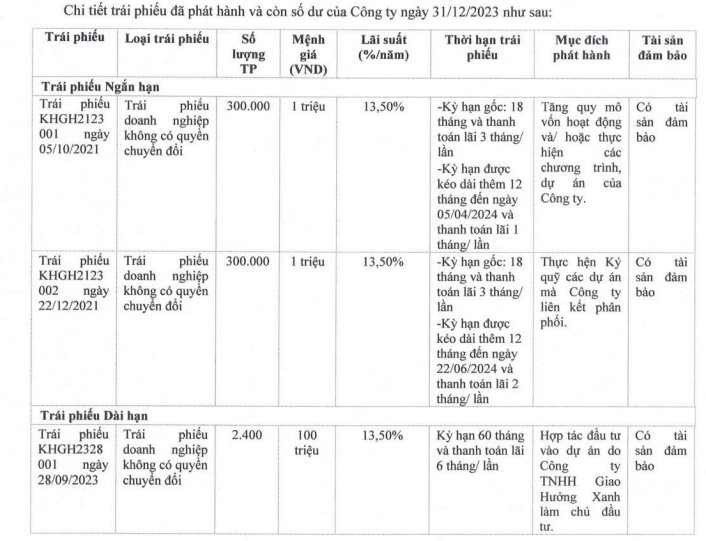

As of the end of 2023, Khải Hoàn Land’s total debt payable is VND 1,237 billion, a decrease of 35% compared to the beginning of the year. Of which, financial debt amounts to VND 1,005 billion, including VND 840 billion in bonds with an interest rate of 13.5% per year.

In the stock market, at the end of the trading session on February 16, the price of KHG shares was VND 6,290 per share, an increase of 0.48% compared to the previous trading session, with a trading volume of nearly 4 million shares.