The stock market started the new year of Giap Thin with strong momentum as the VN-Index exceeded 1,200 points and many stocks surged. One of the most impressive names is VFG of Vietnam Disinfection Joint Stock Company, as its stock has skyrocketed to a new all-time high. In the past month, this stock has increased by 64% in value.

Vietnam Disinfection, formerly a state-owned enterprise established in 1976, has been transformed into a joint stock company since 2001. The company officially listed its stock on HoSE with code VFG in December 2009, with a charter capital of over 81 billion VND. Up to now, the charter capital of VFG has increased to 417 billion VND, and PAN Farm JSC holds a controlling stake of 51.25%.

At the time of its stock market listing at the end of 2009, VFG was valued at nearly 540 billion VND. With the recent soaring stock price, the company’s market capitalization has exceeded 2,400 billion VND, more than four times its initial value. However, the more than 14 years of listing journey for this stock has not been smooth.

In fact, VFG once faced the risk of delisting. In August 2022, HoSE issued a notice pointing out that VFG could be delisted if the 2022 audited financial statements had a qualified audit opinion. Prior to that, HoSE had placed VFG under scrutiny due to the external auditing firm’s qualified audit opinion on the 2020 and 2021 financial statements.

However, the “tragedy” did not happen as VFG announced that the 2022 audited financial statements received an unqualified audit opinion. Subsequently, HoSE removed this stock from scrutiny on March 27, 2023. After being “released,” VFG had a relatively flat period before unexpectedly surging in mid-January 2024.

Continuous record profits, consistent dividends

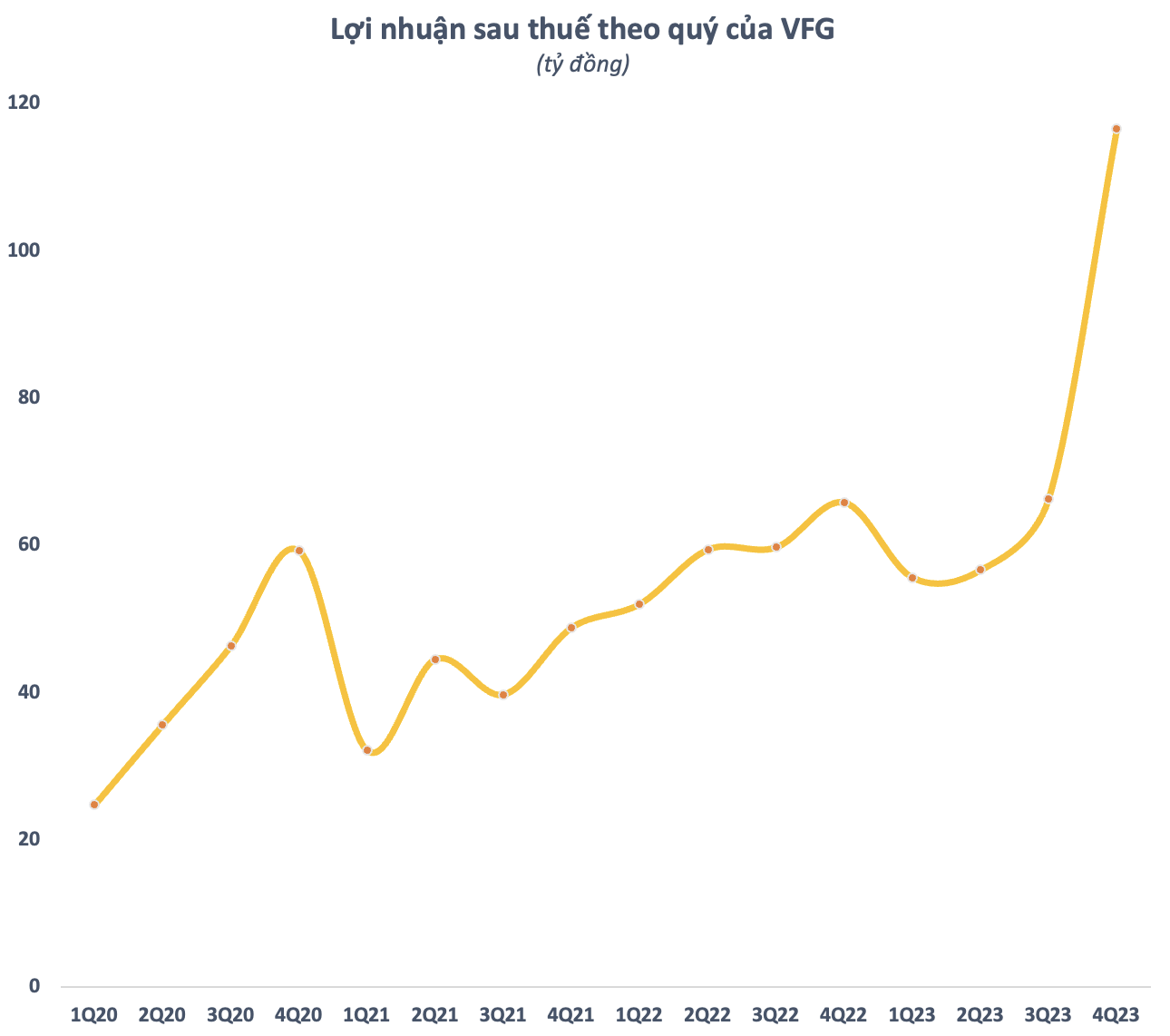

The stock surged amidst positive business developments for the company. In Q4 2023, VFG recorded net revenue of over 1,159 billion VND, a 37% increase compared to the same period in 2022. After-tax profit reached nearly 117 billion VND, a 77% increase compared to Q4 2022, and the highest quarterly profit ever achieved by the company.

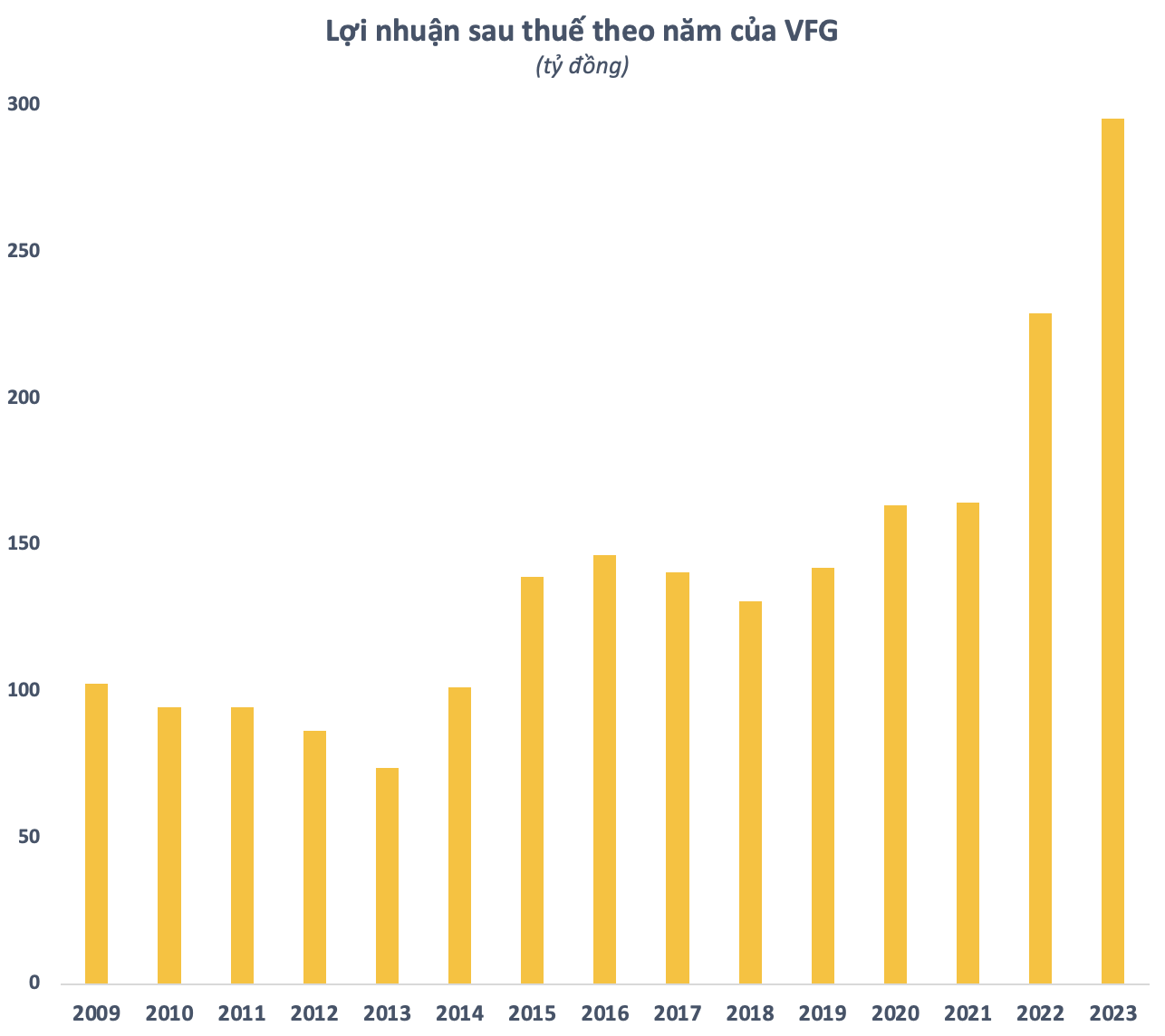

For the whole year of 2023, VFG recorded net revenue of nearly 3,262 billion VND and after-tax profit of nearly 296 billion VND, an increase of 10% and 29% respectively compared to the previous year. These are all the highest figures ever achieved by the company and break the records set in 2022. With these results, the company achieved 89% of its revenue target and surpassed its profit target by more than 18% for the full year.

With its core business activities in disinfection services and agrochemical business (pesticides, herbicides, fungicides, and fertilizers), VFG had several years of small net profits around 150 billion VND before suddenly achieving significant profits in the past two years. The average daily profit in 2023 was estimated to be over 800 million VND.

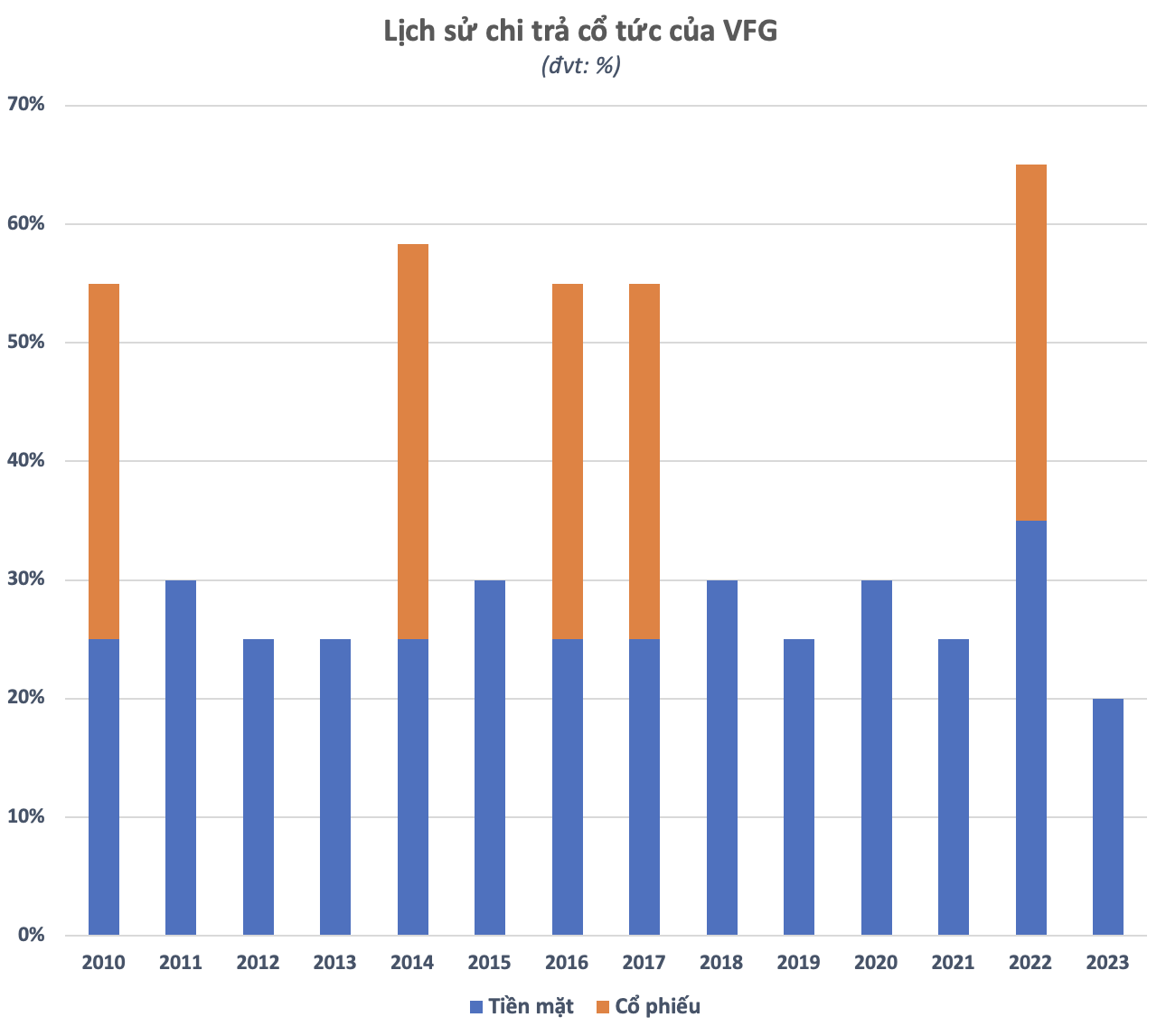

While enjoying business success, VFG has maintained its tradition of high dividend payouts. Since its stock market listing in late 2009, the company has never forgotten to distribute cash dividends, with an annual rate ranging from 25-30%. In 2023, VFG has temporarily paid two dividend installments to shareholders at a total rate of 20% in cash. With the record-breaking profits in the past year, it is likely that there will be another dividend payment in the near future.