The new headquarters is the building owned by PDR and has been under construction since 2020 with an area of 673.5 m2, including 10 office floors, not including mezzanine and rooftop.

This is the second time this real estate company has changed its headquarters since it went public. Before 2020, the company’s main office was registered at 422 Dao Tri, Phu Thuan Ward, District 7, Ho Chi Minh City.

PDR’s new headquarters at 39 Pham Ngoc Thach, Vo Thi Sau Ward, District 3, Ho Chi Minh City

|

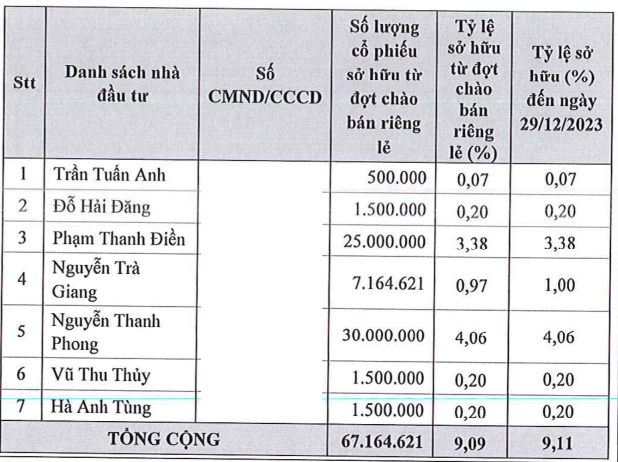

In addition to changing its headquarters, PDR also updated the plan to offer more than 134 million shares to existing shareholders after the company privately placed over 67 million shares to professional investors.

Basically, PDR retains the same number of shares, ratios, offering prices, and capital utilization levels for each project compared to the Annual General Meeting’s Resolution 2023.

Specifically, the company will issue more than 134 million shares at a price of 10,000 VND/share to existing shareholders, with a offering ratio of 5.5:1 (shareholders holding 5.5 shares have the right to buy 1 additional share). Shareholders are not allowed to transfer their purchase rights.

It should be noted that the 7 professional investors who purchased over 67 million shares in the private placement by PDR in 2023 will not be eligible to participate in this offering.

|

List of 7 shareholders commitment not to participate in the purchase of over 134 million shares offering to existing shareholders

Source: PDR

|

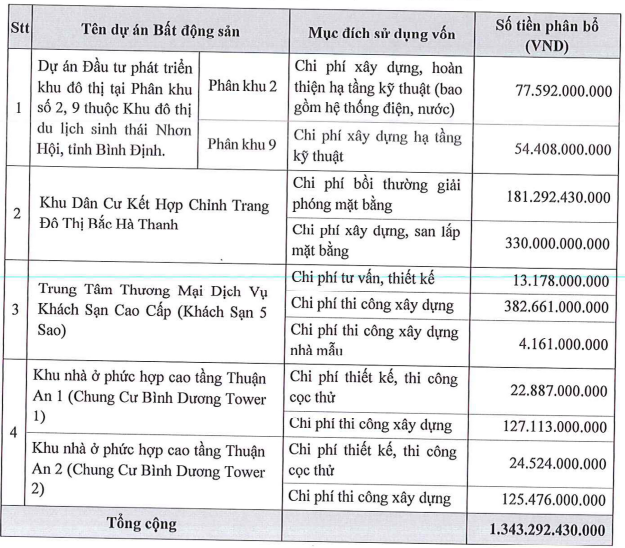

In this announcement, PDR also updated the foreign ownership ratio as of December 29, 2023 to 7.03%, instead of 2.88% as stated in the Annual General Meeting’s report 2023. In addition, the company also specifies the use of funds allocated to projects after the offering.

|

Estimated amount to be allocated for each specific project item

Source: PDR

|

If the amount raised from the offering does not reach 100% of the planned target, the Board of Directors will consider supplementing the capital shortfall with funds raised from credit institutions such as Military Commercial Joint Stock Bank (MBBank), Vietnam Prosperity Joint Stock Commercial Bank (VPBank),… In addition, the company can use the cash flow from sales activities at projects to supplement capital if necessary.

MBBank is currently the bank with the highest amount of loans to PDR, with a balance of over 1,361 billion VND as of December 31, 2023, accounting for 80% of the total bank loans and nearly 44% of the total debt.

Phat Dat signs comprehensive cooperation with MB