Investors who have been experiencing ups and downs with blue-chip stocks such as VIC, VHM, VNM, MSN, and GAS for several months are starting to reap the benefits. There has been a sudden surge in investment into these stocks after a long period of accumulation, which has caught attention in today’s session.

Notably, the liquidity of the banking group stocks today was not too low, around 4.3 trillion VND, higher than the 20-day average of this group (3.6 trillion VND/session), but the total trading volume on HSX today reached 22.9 trillion VND. This means that new capital has poured into non-banking stocks, experiencing a sharp increase. Stocks like VIC, VHM, VRE, MSN, VNM are all among the top 15 most liquid stocks in the market in today’s session.

The increase in liquidity after Tet holiday is a noteworthy signal, especially considering that the average trading volume 2 months before Tet was only around 15 trillion VND/session. It is highly likely that the money on the sidelines has started to enter the market.

In the context where VN-Index has increased significantly and is nearing the high peak of 2023, the sudden surge in liquidity is a cautionary signal. However, it is also necessary to examine which stocks the capital is concentrated in. The banking and securities group stocks also had a large trading volume today, with prices mostly being weak and even experiencing sharp declines, reflecting the need for profit-taking after a prolonged period of growth. Conversely, stocks that have recently exploded have also shown high liquidity with lower levels of risk. It is likely that the capital will shift towards stocks with more room for growth. In this situation, the index will be supported and may not experience sudden fluctuations, but it will also not reflect individual opportunities.

Currently, the information effect is almost non-existent, the market simply welcomes the return of large capital. Therefore, what needs to be concerned about is not the index, but the level at which liquidity reaches its peak. Furthermore, if the pillar stocks continue to offset each other’s points for a long time, the potential for individual stocks will be greater. In the coming sessions, slow-paced stocks in the past 3-month uptrend may increase liquidity and improve prices, confirming the rotation of capital.

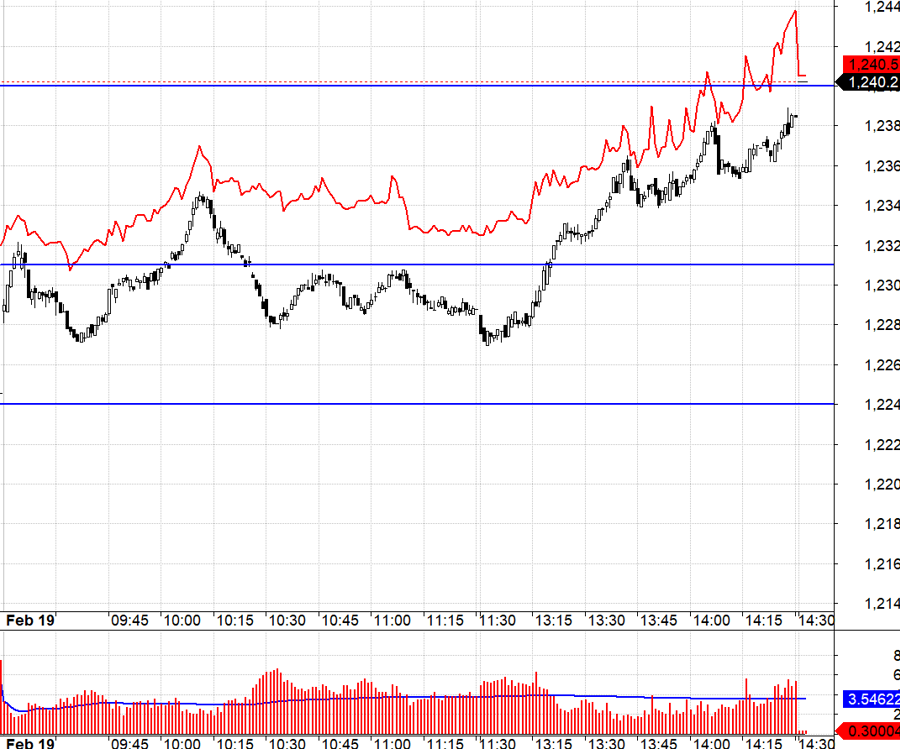

One point to note is that the derivatives market is showing increasing caution despite a relatively strong underlying market. The difference in F1 at the close today is only +0.3 points and the average basis per session is +3.5 points. Last week’s closing difference was +7.46 points and the average basis per session was +5.8 points. This reaction may be because VN30 is approaching the peak of 2023 and the sharp increase since the beginning of February.

In fact, the increase in VN30 today depends mainly on the intensity of VIC, VHM, HPG, MSN, VNM, VRE. It will be difficult to maintain the intensity like today, and even short-term profit-taking pressures may appear in the coming sessions. The derivatives market is showing caution in the situation where these new pillars are slowing down and the banking group continues to decline.

The F1 liquidity today is not high, about 146.8k contracts, an increase of 12.4% compared to the previous session. The total nominal trading volume of this market also increased by 13.2% and was quite small. Therefore, the Long side is not really strong. In the coming sessions, if derivative liquidity increases and the basis expands with a positive difference, it means confidence is returning. Conversely, if the basis remains narrow, it is highly likely that short positions are being built.

VN30 closed today at 1240.2, right at a level. The next resistance tomorrow is 1249; 1256; 1261; 1265; 1272; 1279. Support is at 1231; 1224; 1219; 1209.

“Blog chứng khoán” (Stock Market Blog) is a personal opinion and does not represent the views of VnEconomy. The opinions and evaluations are those of individual investors, and VnEconomy respects the views and writing style of the author. Neither VnEconomy nor the author is responsible for any issues related to the published evaluations and investment opinions.