According to a report by the Construction Economics Institute, after the rapid local housing boom that occurred in many areas in early 2021, although localities have taken early measures to prevent overheating of land prices, until now land prices in many areas remain high, causing low transaction volume and a stagnant market.

The increase in land prices also leads to an increase in housing prices, making it increasingly difficult to develop real estate projects and commercial housing. To increase profits, investors often focus on the high-end real estate segment. This situation makes it more difficult for ordinary workers, middle-income earners, and low-income earners to own homes, especially in large cities.

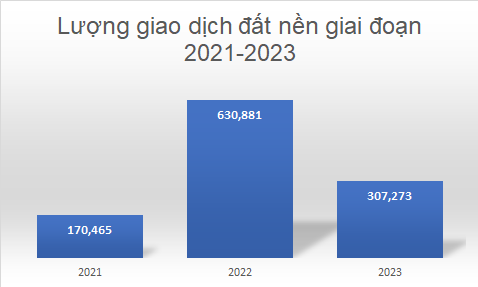

According to statistics from the Ministry of Construction, the number of successful land transactions nationwide in 2023 reached 307,273, a decrease of more than 51% compared to 2022, less than half of the previous year.

Talking about the psychology of real estate consumers, Mr. Le Bao Long – Strategic Director of Batdongsan.com.vn, said that due to the mindset of “land is gold”, the demand for real estate ownership and wealth accumulation of the Vietnamese people is huge. Therefore, the land market always receives the most attention and will continue to be the leading segment of consumer demand in 2024.

Source: Ministry of Construction. Unit: Transactions

|

Supply of land in 2024 continues to be scarce

VARS forecasts that the supply of new land in 2024 will be scarce as new laws could change the game in this market. The scarcity of supply could push land prices to increase by about 5 – 7% compared to 2023 in major cities. Meanwhile, developing areas with comprehensive infrastructure tend to remain stable.

For Ho Chi Minh City and its surrounding areas, the 2023 real estate market report by DKRA Group predicts that the supply of new land in 2024 will continue to be scarce, ranging from 2,900 to 3,100 plots.

|

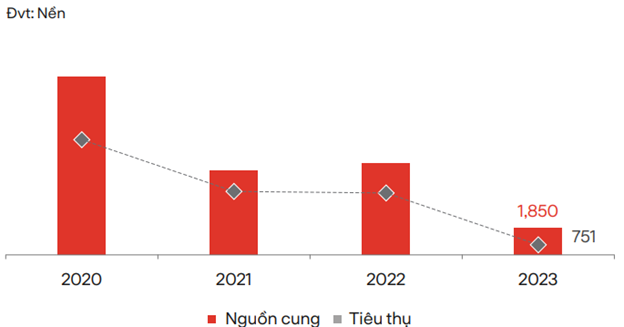

Supply of new land and consumption in Ho Chi Minh City and surrounding areas by year

Source: DKRA Group

|

In particular, Long An province leads the market in 2024 with about 850 – 950 plots available. Dong Nai has about 750 – 850 plots, Binh Duong has about 600 – 700 plots. The remaining areas such as Ho Chi Minh City, Ba Ria – Vung Tau, and Tay Ninh are allocated sporadically with a total of about 200 – 400 plots.

The market’s attention will focus on products developed by reputable investors, with strong financial resources and projects that have completed infrastructure and legal procedures.

Primary market prices are not expected to fluctuate much compared to 2023. Incentive policies, discounts, and extended payment schedules will continue to be applied by investors to stimulate the market.

In secondary markets, transactions mainly occur in products with completed infrastructure and legal procedures, with prices that are moderately suitable for the majority of investors’ financial capabilities.

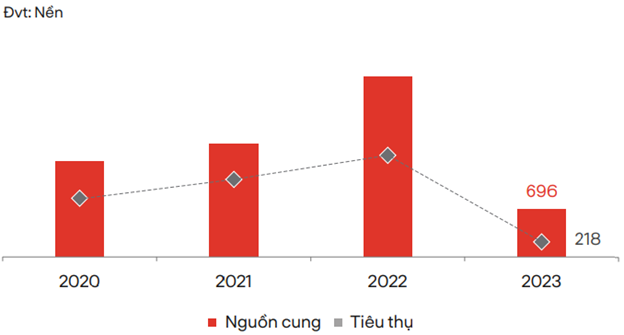

In Danang and its satellite provinces, the situation is similar as the supply in 2024 decreases slightly compared to 2023, with about 450 – 550 plots.

The supply mainly focuses on early stages of sales, with about 200 – 250 plots in the Da Nang market and about 250 – 300 plots in Quang Nam. The Hue area continues to suffer from a scarcity of new sales supply.

|

Supply of new land and consumption in Danang and its satellite provinces by year

Source: DKRA Group

|

The market demand remains low. Projects developed by reputable investors with strong financial capabilities, completed infrastructure and legal procedures continue to attract investors’ attention.

Primary market prices are expected to remain relatively stable compared to 2023. Policies to stimulate the market will continue to be implemented by investors. Secondary market liquidity and prices continue to decrease in 2023, especially for projects with legal complications and customers using loan capital.

Is there still potential in the land market?

Mr. Nguyen Quoc Anh – Deputy General Director of Batdongsan.com.vn, said that it will be very difficult for the land market to experience a virtual land fever like in previous years. The slow recovery of land prices is understandable because until now, this segment mainly serves the needs of speculation and investment, and has little to do with actual housing needs. Therefore, the land market is likely to be the slowest segment to improve in the market.

Regarding legal issues, Mr. Dinh Minh Tuan – Director of Batdongsan.com.vn in the Southern region, believes that the revised Laws on Real Estate Business and Housing will have a significant impact on the land market from 2024 onwards. The tightened regulations on land subdivision are a hot topic, and the demand for land will likely decrease significantly due to concerns about legal risks for buyers. Land prices will also be adjusted down, especially for large plots of land.

However, in the long term, land prices may continue to increase and transactions will resume. Real estate prices depend on other factors such as infrastructure deployment, economic growth, and people’s income levels. “Land is a type of investment that anyone in the market can participate in due to its diversity in terms of area, price, and location. With areas experiencing economic development, land in these areas will continue to grow sustainably,” Mr. Tuan commented.