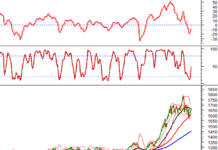

The market sentiment has started to wane in today’s trading session after the Vn-Index had made a considerable gain. However, real estate stocks continue to lead the index higher. Throughout the session, the market was volatile, but thanks to the Vin group attracting funds, the Vn-Index ended up gaining more than 5 points to reach the 1,230 level. The breadth was still positive with 245 stocks advancing and 231 stocks declining.

The trading liquidity on all three exchanges amounted to VND 23.7 trillion, lower than the previous session. Foreign investors remained net buyers with a total net buying value of VND 135 billion, mainly focused on buying Vin and MSB, VIX stocks.

Foreign investors made a net buying value of VND 158.4 billion, but when it comes to matched orders, they had a net selling value of VND 118.8 billion. The major sectors that foreign investors were the net buyers of were Real Estate and Financial Services. The top net buyers from foreign investors in matched orders included VIX, VHM, VRE, VIC, DGC, SSI, GMD, BID, HDB, and VHC.

As for the net sellers in matched orders, the major sector was the Banking sector. The top net sellers from foreign investors in matched orders included MWG, STB, VPB, CII, GEX, DCM, CTG, SAB, and VCG.

Individual investors were net buyers with a total net buying value of VND 199 billion, with a net buying value of VND 183.2 billion from matched orders. When it comes to matched orders, they were net buyers in 13 out of 18 sectors, with the Banking sector being the focus. The top net buyers from individual investors included STB, CII, VPB, NVL, MWG, HPG, MSN, SHB, HCM, and VCG.

As for the net sellers in matched orders, they were net sellers in 5 out of 18 sectors, mainly in the Financial Services and Real Estate sectors. The top net sellers included VIX, VRE, VHM, VIC, GMD, DGC, EVF, MSB, and VNM.

Proprietary traders were net sellers with a total net selling value of VND 402.1 billion, with a net selling value of VND 390.2 billion from matched orders. When it comes to matched orders, they were net buyers in 3 out of 18 sectors. The strongest net buying sector was Financial Services and Industrial Goods & Services. The top net buyers from proprietary traders in matched orders today included GEX, EVF, FUEVFVND, VRE, ASM, ORS, E1VFVN30, PVT, CRE, and HSG.

The top net sellers were in the Banking sector. The top net selling stocks included NVL, MBB, HPG, ACB, TCB, PC1, MWG, VSC, DBC, and VHM.

Domestic institutional investors were net buyers with a total net buying value of VND 80.3 billion, with a net buying value of VND 325.9 billion from matched orders. When it comes to matched orders, they were net sellers in 6 out of 18 sectors, with the Basic Materials sector having the largest net selling value. The top net sellers included DGC, FUEVFVND, CII, DGW, NKG, KBC, VND, VHC, VPB, and VCG.

The largest net buying value was in the Banking sector. The top net buyers included MWG, VNM, TCB, MSB, NVL, VRE, MBB, VHM, DCM, and CTG.

Off-market transactions were lively again and reached VND 3,753.8 billion, an increase of +368.6% compared to the previous week’s session, contributing 12.9% to the total trading value. Most of the off-market transactions were between individual investors in large-cap stocks, including TCB, HPG, HDB, FPT, VJC, VPB, MWG, and MSN.

The allocation of fund flows increased in the Real Estate, Construction, Securities, Banking, Electrical Equipment, and Beer sectors, while it decreased in the Steel, Chemicals, Agriculture & Seafood, Food, and Oil & Gas sectors.

When it comes to matched orders, the trading value share returned to the VNMID and VNSML groups, while it sharply decreased in the VN30 large-cap group.