Textile enterprises promote design to gain competitive advantage. (Photo: Đức Duy/Vietnam+)

|

Over the years, Vietnamese textile enterprises have focused on developing and building brands, which not only add value to export orders but also conquer the domestic market. “Made in Vietnam” products have gained a strong position and won over consumers.

Creating a new breeze

Recently, May 10 Corporation has introduced two product lines, Generos and DeTheia, to meet customer needs. Generos targets young customers and is expected to bring a fresh, youthful, and dynamic style, while DeTheia is a premium product line for women.

In addition to these two product lines, May 10 has invested in designing and launching many fashion products with diverse styles and rich varieties, using materials and designs in line with Vietnam and international fashion trends. Products such as Eternity GrusZ, May10 M series, and ECO collection are some of the new products that feature natural materials such as silk, linen, and other natural fibers, which are environmentally friendly and safe for users.

Mr. Thân Đức Việt, CEO of May 10 Corporation, shared that the company has developed its own collections to meet the needs of customers. With a workforce of 12,000 employees, including over 300 designers, and marketing and sample development teams, May 10 aims to increase the share of ODM (design-manufacturing-sales) in addition to the current share of FOB (purchase of raw materials, manufacturing, and sales).

In addition to export, May 10 has been selling its May 10 brand in the domestic market since 1992. May 10 follows the OBM (production and original brand) method, similar to global fashion brands, but it sells its products domestically instead of exporting. May 10 gradually approaches the global market by exporting its own brand instead of being an FOB or ODM for foreign brands.

“This is how May 10 has clearly seen the value chain in its long-term strategy. May 10 also focuses on increasing value within the supply chain instead of just being a contract manufacturer,” emphasized Mr. Thân Đức Việt.

Textile industry meets Green criteria to boost exports. (Photo: Đức Duy/Vietnam+)

|

Similarly, Viet Tien Corporation has gradually established its name and position in the market with famous brands such as Viettien, Viettien Smartcasual San Sciaro, Manhattan, T-up, Vietlong, and Camellia.

With over 1,300 stores nationwide, Mr. Bùi Văn Tiến, CEO of Viet Tien Corporation, aims to further develop the domestic market and target a 10-15% share of Vietnam’s textile and garment export value under the Viet Tien brand by 2030, with a total system turnover of 1.2-1.4 billion USD.

In addition to May 10 and Viet Tien, many other companies such as Đức Giang and Nhà Bè are also focusing on brand development. These companies have implemented strategies to bring their products to the global market.

Mr. Vũ Đức Giang, Chairman of the Vietnam Textile and Apparel Association (Vitas), said that the domestic market with a population of 100 million people is the target of businesses through various methods such as designing products and promoting brands to conquer the market.

“Vitas will continue to stand alongside businesses and collaborate with international organizations to implement programs supporting businesses in management, green transformation, new technology, and brand building in order to boost production and develop the market,” said the Vitas leader.

Focus on design

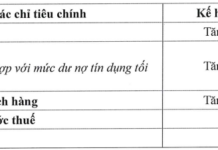

Currently, Vietnam’s textile exports rank among the top in the world. However, actively sourcing raw materials and emphasizing design will undoubtedly bring higher value.

Mr. Lê Tiến Trường, Chairman of the Vietnam National Textile and Garment Group (Vinatex), said that despite being Vietnam’s main export industry, the diversity of domestic raw materials is limited, which reduces the industry’s competitiveness.

To meet this challenge, there is a need to focus on developing domestic raw material sources that are green and circular, meeting stricter standards for identifying origin and possible additional supplementary taxes that may be applied in the future, such as ERP (extended producer responsibility) and CBAM (carbon border adjustment mechanism).

According to Vinatex, the domestic fabric production capacity only meets 36% of the demand, while imported fabrics account for 64%. Therefore, Vietnam needs a systematic strategy to diversify its supply sources to ensure a sustainable textile and garment supply chain.

“Vietnam has the advantage of being a latecomer. If we already have a large raw material production system, it is time to focus on transforming it into economically circular raw materials. While the reality is that the production of raw materials is still relatively low, investing in this area is an opportunity to meet these requirements,” said Mr. Lê Tiến Trường.

Dr. Hoàng Xuân Hiệp, Rector of Hanoi University of Textile and Garment, emphasized the importance of design in fashion development. Therefore, fashion design undergraduate programs are equipped with new content, such as virtual 3D software that integrates material selection, basic product design, fashion collection development, and virtual fashion shows for customers to view and approve models, as well as make adjustments to colors, materials, and more on virtual models.

Design plays a crucial role in fashion development. (Photo: Đức Duy/Vietnam+)

|

In addition, universities are introducing new content into their fashion design programs, such as sustainable fashion and recycling, to train high-quality human resources capable of applying the achievements of the fourth industrial revolution in design, production, and more.

Đức Duy