The online conference to promote 2024 banking credit took place on the morning of February 20th. (Photo: SBV)

According to the latest data released by the State Bank of Vietnam (SBV) at the online conference to promote 2024 banking credit, by the end of 2023, total credit to the entire economy increased by 13.71% compared to the end of 2022. However, in January 2024, credit to the entire system decreased by 0.6% compared to the end of 2023.

Prior to that, credit had seen a strong increase in the final weeks of 2023. In December alone, credit to the entire economy increased by 4.56% (equivalent to over 540,000 billion VND), accounting for 1/3 of the total increase for the entire year of 2023.

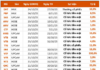

By economic sector, as of the end of 2023, credit to the agriculture, forestry, and fisheries sector increased by 6.95%; credit to the industry and construction sector increased by 10.29%; credit to the trade and services sector increased by 15.83%. Credit for priority areas also saw good growth, by the end of 2023, credit to agriculture and rural areas increased by 11.56%; credit for small and medium-sized enterprises increased by 13.61%; credit for export activities increased by 6.57%; credit for the supporting industry and high-tech enterprises increased by 26.18% and 17.52%, respectively.

Credit for potentially risky sectors continued to be under control. Loans for living needs by the end of 2023 increased by 7.83% compared to the end of 2022, accounting for 21.19% of the total outstanding loans to the economy. Policy credit at the Social Policy Bank as of January 31st, 2024, the total outstanding loans for policy credit programs reached 336,431 billion VND, an increase of 1.36% compared to December 2023, with nearly 6.9 million customers with outstanding loans (an increase of 17% compared to the end of 2023).

Regarding the results of some credit programs and policies, the program to provide 15,000 billion VND in loans for the forestry and fisheries sector has disbursed 100% of the program’s target for over 6,000 customers;

The program to provide 120,000 billion VND in loans for social housing, worker housing, renovation projects, and condominium reconstruction has disbursed for 06 projects with a total amount of 531 billion VND and disbursed to homebuyers with a total amount of 4.5 billion VND;

The program to provide 20,000 billion VND in loans to workers under the cooperation agreement between the Vietnam General Confederation of Labour (VGCL) and 02 financial companies HDSaison and FECredit has disbursed to workers about 10,056 billion VND;

The debt repayment term restructuring policy and maintaining the same debt group according to Circular 02/2023/TT-NHNN, as of December 31st, 2023, nearly 188,000 customers have had their debt repayment term restructured and maintained the same debt group with a total value of principal and interest to be restructured of over 183.5 thousand billion VND;

The interest support policy from the state budget for loans of enterprises, cooperatives, and business households according to Decree 31/2022/NĐ-CP, the total accumulated interest support amount from the start of the program to December 31st, 2023 (the end of the policy period) reached about 1,218 billion VND for nearly 2,300 customers.

According to SBV, in 2024, based on the set economic growth target of about 6-6.5% and inflation of about 4-4.5% by the National Assembly and the Government, SBV aims for a credit growth rate of about 15% for the entire system, with adjustments suitable for the situation and actual developments. As of December 31st, 2023, SBV has allocated the entire credit growth target for 2024 to credit institutions, and announced the principles for determining target credit growth for credit institutions to proactively implement and provide credit capital for the economy.

On February 7th, 2024, SBV issued document No. 1088/NHNN-CSTT, directing credit institutions to promote the implementation of measures already set out in Directive 01/CT-NHNN dated January 15th, 2024, in order to contribute to promoting economic growth. Specifically, it urged credit institutions to promptly implement credit growth solutions, enhance review and streamline credit approval procedures, optimize the application of digital transformation in credit approval procedures, and create favorable conditions for accessing bank credit capital,…