Illustrative image

In 2019, Vietcombank became the first bank in Vietnam to achieve a profit of 1 billion USD, but after only 4 years, this profit milestone has become outdated. In 2023, there were 5 banks that recorded profits of over 1 billion USD, including Vietcombank, BIDV, MB, Agribank, and VietinBank. With the current profit growth rate, it is expected that in 1 – 2 years, more banks will achieve a profit of billions of USD, and there may even be a bank reaching the threshold of 2 billion USD, equivalent to 50,000 billion dong.

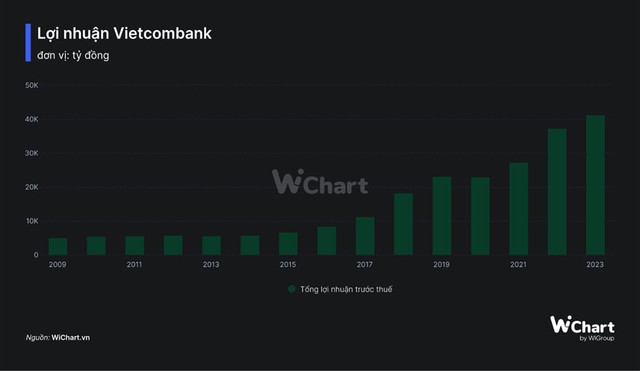

In 2023, Vietcombank recorded a consolidated profit before tax of 41,244 billion dong, a growth of 10.4% compared to 2022. With these results, Vietcombank continues to establish a new record for profitability in the banking industry.

Despite the slower growth in the past year, Vietcombank still far outperforms other “giants” such as BIDV (27,650 billion dong), MB (26,306 billion dong), Agribank (25,400 billion dong), and VietinBank (25,100 billion dong). This bank has been at the top of the industry for 8 consecutive years (from 2016 until now). Moreover, the gap between Vietcombank and its competitors in the industry is growing.

Entering 2024, Vietcombank sets a preliminary profit target of over 44,000 billion dong, a 10% increase compared to 2023. With all the indicators of assets expected to enjoy stronger growth than in 2023, such as total assets’ expected year-end growth of over 8% (compared to 1.4% in 2023) and credit growth of over 12% (compared to 10.6% in 2023), it is highly likely that Vietcombank will achieve, or even exceed, the profit target of 44,000 billion dong and may reach a profit of 2 billion USD in 2024 (equivalent to a growth rate of about 21% compared to the realized level in 2023).

Mr. Nguyen Thanh Tung, CEO of Vietcombank, commented that the global economy this year is forecasted to “soft land” due to the continued risks outweighing growth factors. The economic growth of major countries is also predicted to face challenges. However, the global economic landscape in the second half of the year will be more optimistic due to the booming consumer demand, investment, and employment opportunities. The CEO of Vietcombank also mentioned that the State Bank has given the bank a credit growth target of 16%, higher than the industry average of 15%.

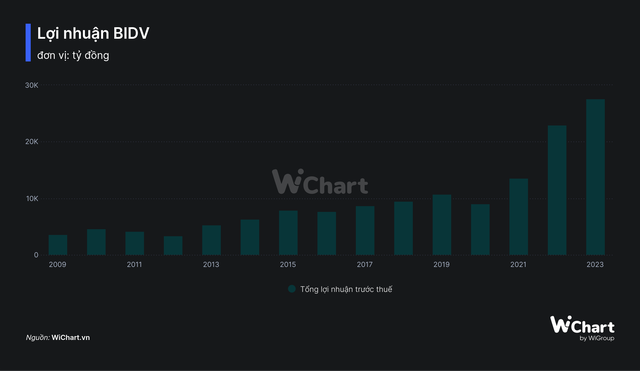

At the end of 2023, BIDV’s consolidated profit before tax reached nearly 27,650 billion dong, an increase of 20.6% compared to 2022. In addition to reducing provisions for bad debt and generating non-credit income such as services, foreign exchange business, securities trading, investment, these are the driving forces that help BIDV achieve higher profit growth than the industry average.

With an average annual profit growth rate of 24%, BIDV’s profit scale has almost tripled over the past 5 years. If it maintains this growth rate, BIDV may achieve a profit of 2 billion USD by 2026.

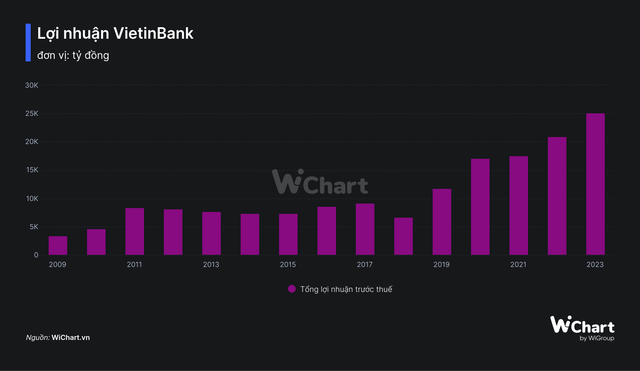

Similarly, VietinBank’s profit scale is expected to double to about 2 billion USD in the next 3 years if it maintains an average annual growth rate of 30% as in the period of 2019 – 2023.

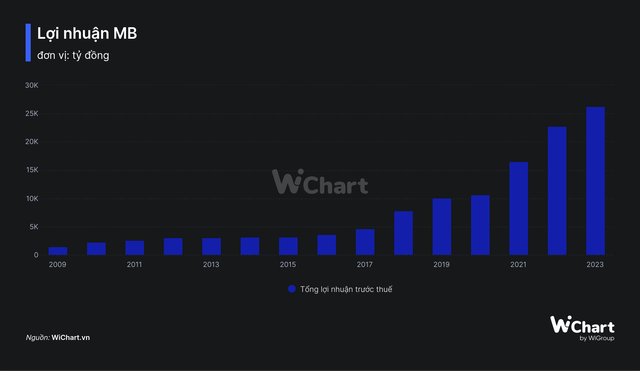

For MB, it is considered the only joint-stock commercial bank that can compete in terms of profitability with the Big 4 at the present time. In 2023, MB made it to the Top 3 in terms of profits in the entire industry, not only surpassing VietinBank and Agribank but also being far ahead of large joint-stock banks such as Techcombank (22,888 billion dong), ACB (20,068 billion dong), VPBank (10,987 billion dong), etc. With the same average annual growth rate of 27% over the past 5 years, MB’s profit will also exceed 50,000 billion dong in 2026.

In a recent published analysis report, SSI Securities Company believes that in 2024, the ongoing process of consolidating provisions will prevent the overall industry’s profits from rapidly taking off. However, the analysis group still highly appreciates Vietcombank because the bank will complete the bad debt resolution process much earlier than other stocks in the industry. For VietinBank, as the bank has intensified its provisions over the past 2 years, SSI believes that the profit growth rate may have a new turning point, possibly at the end of 2024 or 2025. With Techcombank and MB, the growth rate will depend heavily on the process of removing bottlenecks in the real estate market.

SSI projects that Vietcombank’s consolidated profit before tax in 2024 could reach around 47,200 billion dong, equivalent to a growth rate of 14.3%. Meanwhile, BIDV’s profit could reach 31,300 billion dong, MB (29,200 billion dong), VietinBank (27,800 billion dong), Techcombank (26,000 billion dong), ACB (22,800 billion dong), and VPBank (16,700 billion dong).