The determination of land prices is the basis for compensating land-related damages when the State recovers land. This is an extremely important issue and needs to be implemented accurately and comprehensively.

Over the years, the legal system related to land has made significant changes in determining land prices.

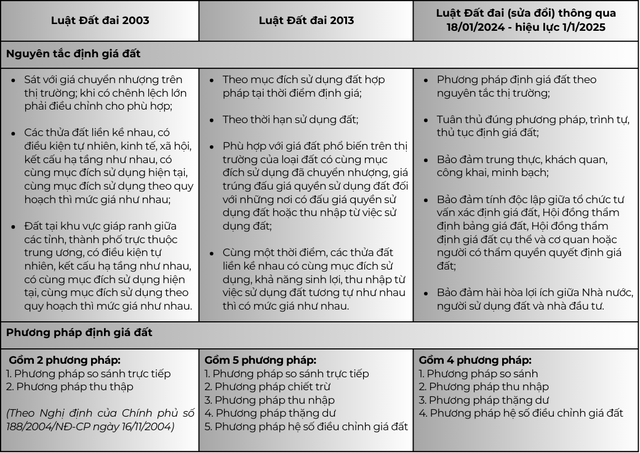

|

Principles and methods of land valuation over different periods

Source: Compiled by the author

|

The amended Land Law was passed on January 18. There are still 4 methods of land valuation including comparison (comparing 3 similar plots of land that have been transferred on the market), income (applying the current land use purpose to the land), surplus (applying the future land use purpose to the land), and land price adjustment coefficient.

So which method will most people choose?

According to economist – Dr. Dinh The Hien, the majority of us should use the comparison method to determine real estate prices. In the past, the formula for the comparison method faced many difficulties when applied in practice in local areas, especially in Ho Chi Minh City, leading to the coexistence of market land prices and land prices announced by the State.

However, the buying and selling of land is increasingly receiving attention and regulation from the State, which is more closely aligned with the market; from there, it serves as the basis for those involved in valuation work to compare appropriately with reality. Especially when all real estate transactions must be paid through banks, statistics based on these payments are very convenient.

Therefore, the comparison method is the most appropriate method for the present time.

“All transactions must follow the actual price, and if intentionally under-declaring the true value, both the buyer and the seller will be subject to criminal prosecution. There have been some cases where the State has taken action,” – said Mr. Hien.

Regarding the surplus method or the income method, according to Mr. Hien, both are standard methods of valuation worldwide. There are still many plots of land that are difficult to compare with the surrounding area, so they need to be priced using the surplus or income method.

However, with the surplus method, its products from the time of calculating the final result, which are the products sold on the market, still use the comparison method for calculation. “For example, when doing a project, we plan to build future apartments, townhouses, these products can all be compared to find a reasonable price, from which we can calculate the efficiency of the project to determine the surplus value,” Mr. Hien gave an example.

In conclusion, Mr. Hien believes that the comparison method should be the fundamental method. However, for the comparison method to be applied in practice, there needs to be synchronization, regulations that real estate transactions must be paid through banks, and land traders need to declare transparently.

How does the amended Land Law affect the market?

The amended Land Law and the Law on Real Estate Business will regulate the market in a sustainable and market-oriented development direction. Therefore, many large real estate companies cannot dominate the market and will not develop well if they continue with the old style, Mr. Hien commented.

According to experts, all entities such as functional agencies, real estate companies, brokers, appraisers, consultants, banks, investment funds… also need to gradually adapt, and no organization has a decisive role.

Therefore, construction business, housing business for middle and low-income segments will receive support, while lot divisions for selling will almost cease. Even the conversion of agricultural land to commercial-service land or residential land will be more stringent.

Finally, real estate business will no longer have living space for speculators to profit from short-term real estate speculation, but only be effective in practical business and real estate exploitation in the long term, in accordance with economic needs.

In relation to the annual land price list and the application of surplus method for land pricing, Mr. Hien believes that the annual land price list is still not comprehensive. The methods of land valuation and the published land price list still have differences. However, it is only relatively and has advantages and disadvantages.