CTCK VietCap recently released an update report, according to a sharing from the leadership of Vingroup (stock code: VIC) at an investor meeting, Pham Nhat Vuong’s company has raised about VND 78,000 billion (over USD 3.25 billion) by 2023 (excluding credit limit loans).

The raised capital comes from the USD 239 million of VFS obtained from SPAC, and the investment amount from strategic investor Gotion Inc. Pham Nhat Vuong himself has also contributed over VND 20,600 billion to Vingroup. In addition, the group has also issued new bonds worth VND 15,400 billion in the domestic market and USD 250 million in international bonds. Lastly, there are the loans. Vingroup has also been granted credit limits by commercial banks totaling VND 70 trillion by the end of 2023.

According to the management board of Vingroup, the company will continue to explore various capital raising options, including the domestic market (issuing bonds and bank loans), raising international loans, international capital markets, especially the US market for VinFast. In addition, there are also the sponsorships of Pham Nhat Vuong (including the proceeds from the upcoming sale of VFS shares) and the restructuring of some assets.

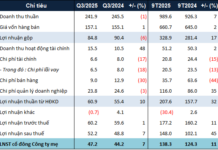

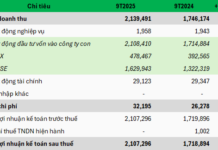

In 2023, Vingroup recorded a revenue of VND 161,634 billion, increasing by 59% compared to the previous year. This is also the record revenue of this business.

Specifically, this year’s real estate transfer revenue increased by 59% compared to the previous year, mainly due to the strong handover speed of low-rise properties at Vinhomes Ocean Park 2 and Vinhomes Ocean Park 3 projects. Thanks to that, real estate transfer brought in over VND 94,000 billion, accounting for 58% of the total revenue structure.

Secondly, the production segment when electric vehicle sales also soared. In the fourth quarter of 2023, VinFast delivered 13,513 electric vehicles, bringing the total number of vehicles delivered for the year to 34,855 electric vehicles. Total revenue from the production segment is VND 28.419 trillion, an increase of 125%.

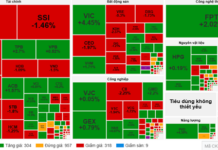

In terms of revenue contribution ratio, the real estate transfer segment is still the mainstay when it accounted for 58.4%, an increase compared to 2022. The production segment increased its proportion, accounting for 17.6%, the highest ever.

In the context of both real estate transfer and production increasing revenue, the proportion from real estate rental, resorts, hospitals, and education decreased, although last year set a new revenue peak.

As a result, Vingroup’s pre-tax profit in 2023 reached VND 13,681 billion, and after-tax profit reached VND 2,051 billion, fulfilling the business plan set at the annual general meeting in 2023. As of December 31, 2023, Vingroup’s total assets reached VND 669,617 billion, an increase of 16% compared to the beginning of the year.

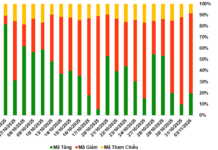

At the end of the morning trading session on February 19, the stock price increased by 5.8% to VND 46,550 per share. At one point in the session, VIC’s market price increased to nearly the ceiling. This is also the highest price of this share since the beginning of October 2023.