Strong money flow shifting into riskier asset classes

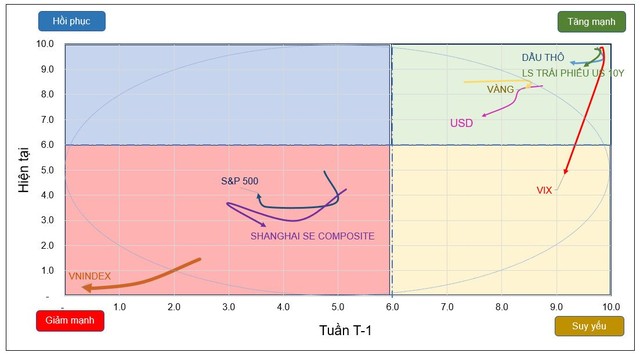

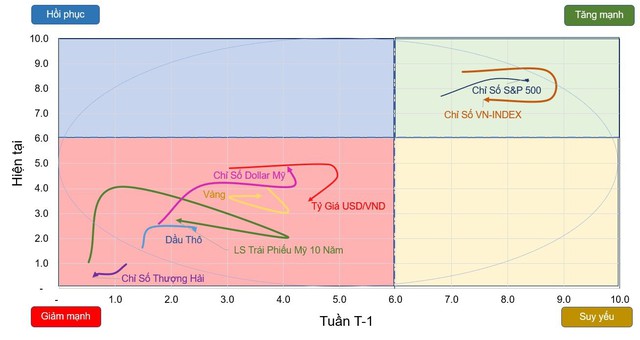

Observing the movement of asset classes, there has been a strong shift in asset allocation in just a few months from late 2023 to early 2024. The early days of November 2023 marked an important milestone as the VIX index reflected the risk of the S&P 500 moving into the Weak area (yellow), indicating the positive and confident sentiment of investors at that time. The basis of this confidence was the expectation of the Fed’s early interest rate cut, which was reinforced when the US announced lower than expected inflation. Subsequently, the US 10-year Treasury yield and the Dollar Index DXY both dropped significantly, moving away from the Far area of the Strong zone, indicating that risk appetite had shifted towards riskier asset classes such as bonds and stocks. By February 2024, most stock indices had risen and were in the Strong area, while the US 10-year bond yield and the US Dollar index were both in the Weak area.

Asset movement chart, 11/10/2023. Source: HSC synthesis

Asset movement chart, 02/08/2024. Source: HSC synthesis

Alongside the expectation that the Fed will cut interest rates in the first half of 2024, money has also shifted to emerging markets with higher risk. Over the past 10 years, emerging markets have often had lower returns compared to developed markets, even with good growth rates. The S&P 500 index has continuously reached new highs, while the VNIndex is still struggling around the 1,200 level of 2007. However, Fitch Ratings forecasts a flow of money into the 9 largest emerging markets (EM9, excluding China) starting to recover from Q3 2023 and reaching $200 billion, equivalent to 2.2% of GDP in 2024, the highest level in the past 10 years. Fidelity experts also recommend increasing investment in emerging markets, including general ETF products (such as MSCI EM Index) or specific markets, as well as actively investing in potential markets with reasonable valuation and high growth expectations due to government easing measures.

It can be said that although the VNIndex was close to the 1,200 level in mid-February 2024 and September 2023, their positions were very different due to differences in risk appetite when making asset allocation decisions by global investors. Foreign capital is also expected to return to the Vietnamese market – a market with high economic growth rates, cheaper valuation than the region, and changing daily to be upgraded to an emerging market in 2025.

Favorable money flow towards potential sectors in 2024

It is not difficult to assess that 2024 is the year when money flows into large-cap stocks in the VNIndex, as the banking sector has outperformed since the beginning of the year. The bright picture of the banking sector in 2024 has many vibrant colors, with liquidity improving significantly since 2023, and the CASA ratio of HSC’s analyzed banks returning to pre-Covid levels. In addition, the State Bank of Vietnam has all the conditions to maintain low interest rates to stimulate credit growth, which can reach an average of 15% for the whole system, with credit demand forecasted to increase from both retail and enterprise sectors.

Furthermore, the focus to achieve GDP growth above 6% in 2024-2025 (according to HSC’s estimation) comes from the recovery of exports and the prospect of strong FDI. Accordingly, export industries (textile, seafood, rice, etc.) as well as industries supporting production such as Industrial zone real estate, Logistics transportation, Energy (electricity, oil and gas),… will all have positive growth rates.

A prominent investment trend that continued from 2023 is that infrastructure investment will continue to be promoted in 2024, with a series of projects such as highways, Long Thanh airport, electricity and power transmission projects being the target of money flow in 2024.

To clarify the trend of leading money flows as well as potential sectors in 2024, HSC will organize the C2C Connecting to Customers Seminar on February 22, 2024 with the participation of HSC’s investment analysis and advisory experts with the theme “Market 2024: Leading money flows & Expert views”.

Investors can register to attend the Seminar at: https://event.hsc.com.vn/c2c_danhmuc2024/

Open an investment account at HSC in 3 minutes here: https://online.hsc.com.vn/mo-tai-khoan.html