The BDA Partners M&A Market Report reveals that the healthcare industry is one of the most active sectors for M&A activities in 2023, both in terms of transaction volume and value, with a total of 15 deals taking place in 2023, amounting to nearly $765 million in disclosed value.

The average transaction value in the healthcare sector in 2023 has increased compared to the previous year, averaging around $100 million in 2023 compared to $65 million in 2022.

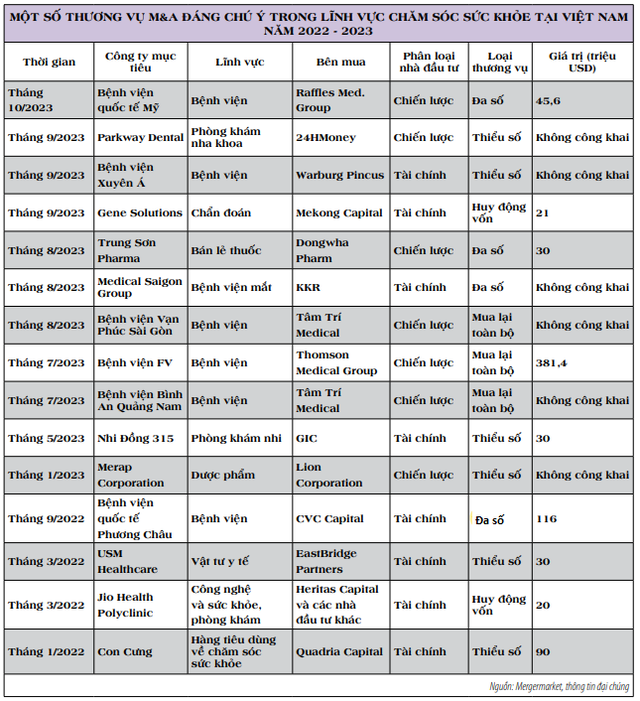

Notable deals

Among the publicly disclosed M&A deals in the healthcare sector in 2023, the highest-valued deal was Thomson Medical Group’s acquisition of FV Hospital for $381.4 million, followed by CVC Capital’s acquisition of Phuong Chau International Hospital for $116 million. These two deals had a value exceeding $100 million.

Another noteworthy deal was the investment in Xuyen A Hospital (a hospital system with 6,000 beds) by Warburg Pincus, but the value was not disclosed.

Another interesting deal was the acquisition of Parkway Dental shares by 24HMoney Company. According to information from 24HMoney, the strategic investment value was under $5 million.

24HMoney Company, the owner and operator of the Financial and Economic Investment Social Network, 24HMoney, was founded and managed by Mr. Phan Minh Tam, who has had success with many big brands such as 24H, 30Shine, and Siêu Việt.

With a multimillion-dollar investment in the Parkway dental chain, Mr. Phan Minh Tam shared: “24HMoney aims to find investment partners in enterprises with growth potential and good positions within the industry. Along with financial support, we also share and contribute “know-how” to support businesses in building strategies, operations, and risk management.”

The attractiveness of the healthcare market in Vietnam

BDA Partners assesses that healthcare is the most active sector for M&A activities in 2023, both in terms of transaction volume and value, due to the following factors:

Stability and resilience against economic downturn: During a recession, healthcare remains a stable and solid industry. Healthcare services are essential needs that are not affected by fluctuations in the general economy. Even in the face of various economic challenges, people still need to use healthcare services. Therefore, from an investor’s perspective, the healthcare sector is considered a stable pillar.

Favorable demographic factors along with the increasing middle class: Favorable demographic factors contribute to the attractiveness of the healthcare sector in Vietnam. With a population of over 100 million people and a rapidly growing middle class, it is predicted that by 2030, the middle class will account for over 70% of the population, compared to 40% in 2020. The demand for access to quality healthcare services and facilities is increasing. This demographic transition helps stimulate the demand for high-quality healthcare services and provides a solid foundation for investment in this sector.

Unmet demand for quality healthcare services: The demand for healthcare services in Vietnam is substantial. In the past, these services were mainly provided by public healthcare facilities, leading to overloaded conditions in major cities and considerable pressure on healthcare staff. Private healthcare facilities have emerged as a supplementary and supportive option for the public healthcare system, providing more choices for the Vietnamese people. However, the demand of the population has not been met in full.

According to the General Statistics Office of Vietnam, in 2022, Vietnam had 2.9 hospital beds per 1,000 people, lower than the WHO recommendation of 5 beds per 1,000 people. In terms of the number of doctors, in 2022, Vietnam had 0.9 doctors per 1,000 people, lower than the WHO recommendation of 2.5 doctors per 1,000 people, and much lower than the average of developed countries which is 3-4 doctors per 1,000 people. As available income increases and the need for quality healthcare services becomes essential, private healthcare has become the focus, attracting special attention from investors.

Rising health awareness: Health awareness has significantly improved recently, as evidenced by the annual spending figures of Vietnamese people on healthcare goods and services, rising from $90 in 2017 to $141 in 2022. Although there has been considerable improvement, the average expenditure of Vietnamese people is still much lower than the global average of $709.

Living through the pandemic and being exposed to information and content about health and healthy lifestyles, people are increasingly willing to spend more to improve their health. This trend contributes to the growing demand for high-quality healthcare products and services, making the healthcare sector more attractive from an investment perspective.

Improved legal framework: The Investment Law 2020 and the Enterprise Law 2020 aim to create more favorable conditions for investment in Vietnam. Some notable changes include the removal of the requirement for M&A approval when the transaction does not lead to an increase in the foreign investor’s ownership percentage of the enterprise, and some changes to enhance the protection of minority shareholders’ rights, such as adjusting the ownership threshold of shareholders/shareholder groups to require the convocation of a General Meeting of Shareholders from 10% down to 5%.

Scarcity factor: In Hanoi and previously in Ho Chi Minh City, expanding the land use area and bed capacity of existing healthcare facilities within the inner city area is not allowed. Therefore, approved projects and operating facilities in Hanoi and Ho Chi Minh City have attracted considerable interest from foreign investors and often traded at higher prices than the market average.