The Ho Chi Minh City Stock Exchange (HoSE) has announced the removal of the shares of Saigon VRG Investment Corporation (SIP) from the margin trading list.

Previously, SIP was included in the list of securities not eligible for margin trading due to its listing period of less than 6 months (SIP moved from UPCoM to HoSE on August 8, 2023) but has now resolved the issue.

SIP currently has a charter capital of over 1,818 billion VND. The major shareholders of SIP include An Loc Urban Investment and Development Corporation holding 22.01% of charter capital, Mr. Tran Manh Hung, Chairman of the Board of Directors owning 11.54% of charter capital, Nam Tan Uyen Industrial Zone Corporation (NTC) holding 10.18% of charter capital, Mr. Lu Thanh Nha – General Director of the company owning 8.1% of charter capital, and Ms. Tran Ngoc Xuan Trang holding 5.57% of charter capital.

In terms of business activities, in 2023, Saigon VRG Investment Corporation recorded a revenue of over 6,676 billion VND, a 10% growth compared to 2022; and a net profit after tax of 1,036 billion VND, a 3% growth.

Comparing to the set targets of 5,312 billion VND in revenue and 755 billion VND in net profit after tax, by the end of 2023, SIP has exceeded the revenue target by 26% and the profit target by 37%.

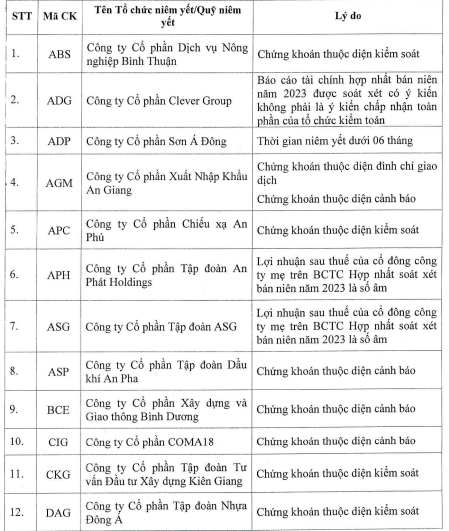

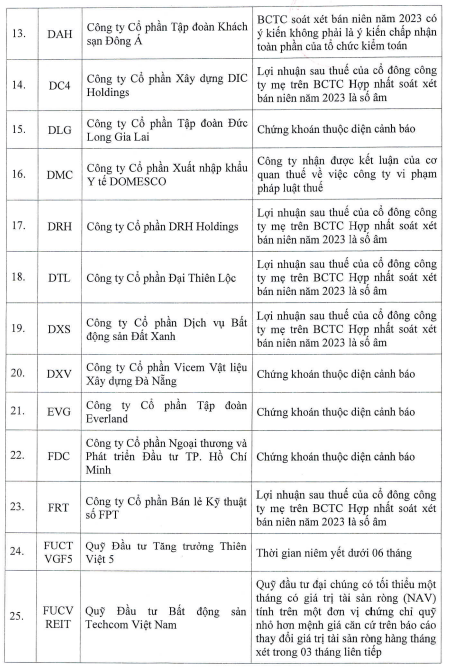

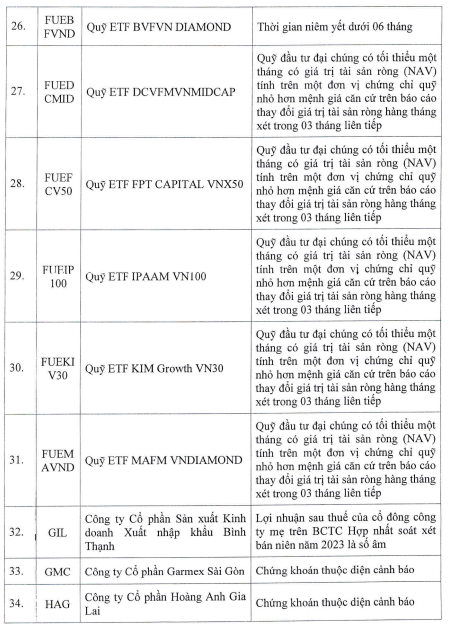

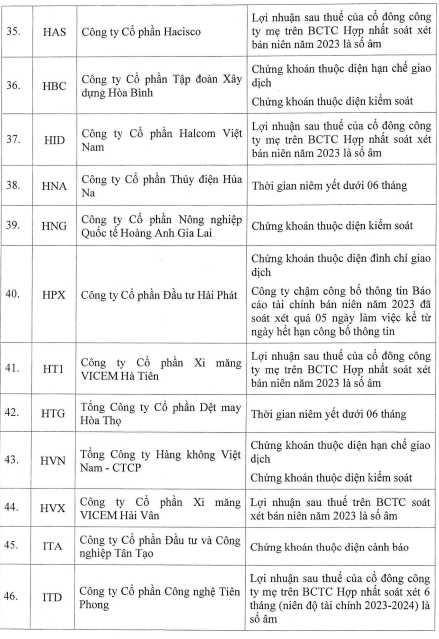

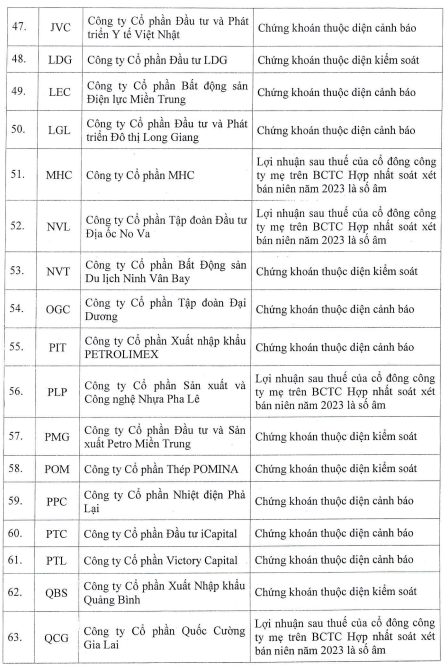

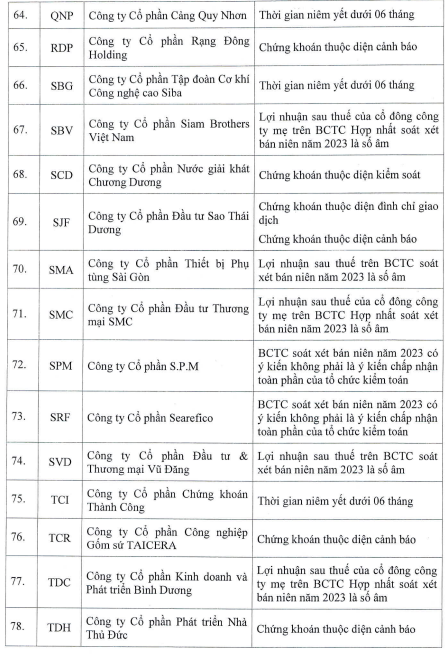

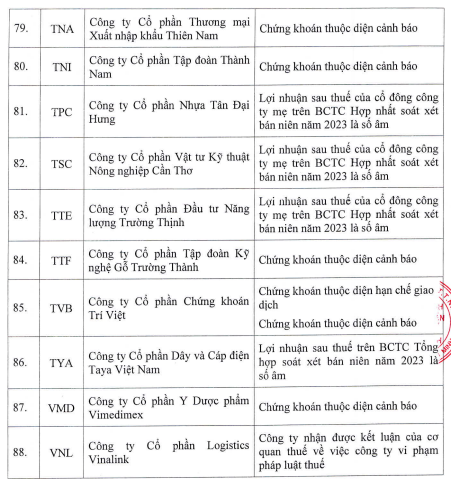

In addition, HoSE has also announced an updated list of 88 securities not eligible for margin trading. Among them, the 6 listed funds FUCVREIT, FUEDCMID, FUEFCV50, FUEIP100, FUEKIV30, and FUEMAVND are not eligible for margin trading due to the fact that the publicly offered funds have an NAV (Net Asset Value) of less than the par value of a unit of fund certificate for at least 1 month, based on the monthly changes in NAV over 3 consecutive months. In addition, the other 2 listed funds FUCTVGF5 and FUEBFVND are also included in the list due to their listing period of less than 6 months.

Along with that, many stocks have their margin trading cuts due to being penalized. HBC, HVN have their margin trading cut due to being under restrictions and control; POM is under control; TVB is under warning and trading restriction…