The State Bank of Vietnam (SBV) data released at the “Online Conference on Boosting Bank Credit in 2024” showed that by the end of 2023, credit across the economy increased by 13.71% compared to the end of 2022. However, in January 2024, the overall credit system decreased by 0.6% compared to the end of 2023.

Prior to that, credit had grown strongly in the final weeks of 2023. In December alone, the total credit debt across the economy increased by 4.56 percentage points (equivalent to over VND 540 trillion), accounting for one-third of the total increase for the entire year 2023.

According to SBV Deputy Governor Dao Minh Tu, the decline in the overall credit system in the first month of the year indicates both a seasonal trend (credit growth tends to slow down before and during the Lunar New Year holiday) and a slow recovery of the economy, resulting in weak credit absorption. In order to promote credit growth, credit institutions need to focus on specific solutions, such as directing credit capital flow to priority sectors with good recovery potential as guided by the government.

Explaining the decrease in credit in the first month of the year, bank executives noted that this is a normal phenomenon in the early months of the year due to customer psychology and relatively subdued economic activities during the holiday season.

At the Conference, Agribank General Director Pham Toan Vuong said that the bank’s credit growth had experienced a significant decline at the beginning of the year, about 1%, but had recovered since January 15, and as of now, the decrease is less than 1%.

According to Mr. Pham Toan Vuong – Agribank General Director, there are no hindrances in the mechanism governing credit growth from SBV’s perspective for 2024. However, credit growth in the first month of the year decreased due to the slow recovery of the economy. In addition, many old investment projects are still facing obstacles that have not been thoroughly resolved by local authorities after years of delays, leading to a lack of disbursement of capital.

In addition, Mr. Vuong also mentioned that due to Agribank’s nature of having 70% of personal loans, credit debt usually decreases significantly at the beginning of the year and increases towards the end of the year. “The recovery is still slow and there will be a clear recovery in the third and fourth quarters,” he projected that Agribank’s credit growth could reach 5-6% by the end of the second quarter.

Mr. Nguyen Thanh Tung – Vietcombank General Director, stated that by the end of January 2024, the bank’s loan portfolio had decreased by 2.3%, equivalent to VND 30 trillion compared to the end of 2023. Specifically, wholesale credit decreased by VND 19,000 trillion, while retail credit decreased by VND 11,000 trillion. Regarding retail credit, the decline in borrowing in January resulted from a decrease in the demand for real estate and consumer loans.

Explaining this, Mr. Tung explained that the difficult economic situation and reduced incomes of the population have caused a decline in the demand for housing loans. The number of newly licensed projects is also lower, leading to limited supply.

In the wholesale aspect, legal obstacles are a major problem for the investment and expansion needs of many businesses. Vietcombank has been working with clients to resolve difficulties, but addressing legal obstacles takes time. In addition, in this context, businesses are reluctant to make new investments and expand, resulting in a decrease in borrowing. A specific characteristic of Vietcombank is that short-term wholesale debt accounts for a large proportion. International payment debt has seasonal factors. The general psychology of customers is to avoid borrowing in the first month of the year.

Similarly, Mr. Tran Long – BIDV Deputy General Director, said that BIDV’s credit debt decreased by 1.25% compared to the end of the previous year, equivalent to a decrease of VND 25,000 trillion. However, according to Mr. Long, this decrease is commonly seen in recent years.

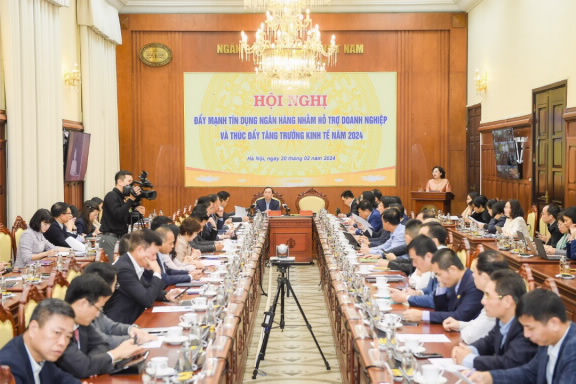

The scene of the Conference. (Photo: SBV)

In 2024, based on the target economic growth of about 6-6.5% and inflation of about 4-4.5% set by the National Assembly and the Government, SBV sets the target for credit growth across the entire system at about 15%, adjusted appropriately based on the development, actual situation. On December 31, 2023, SBV had announced all credit growth targets for 2024 to credit institutions, publicly declared the principles for determining credit growth, so that credit institutions can proactively implement credit growth to provide credit capital for the economy.

On February 7, 2024, SBV issued the Dispatch No. 1088/NHNN-CSTT instructing credit institutions to vigorously implement the solutions set out in Directive 01/CT-NHNN dated January 15, 2024 to contribute to promoting economic growth. In particular, credit institutions need to resolutely implement accurate and on-target credit growth solutions from the beginning of the year, enhance the review and simplification of credit approval processes and procedures, optimize the application of digital transformation to credit approval processes, create favorable conditions for access to bank credit capital, etc.

Speaking at the Conference, Governor Nguyen Thi Hong said that credit activities would continue to be a focal point in 2024. Accordingly, SBV proactively announced credit growth targets for each credit institution, based on classification according to Circular 52. Therefore, credit institutions have been able to proactively plan their business and operations.

“This year, credit institutions must have a full assessment and recognition to achieve credit growth in line with reality. Along with that, continued cost reduction to reduce lending interest rates for individuals and businesses. At the same time, credit institutions must balance capital mobilization sources and credit capital sources to ensure control over credit risks, liquidity,…” Governor Nguyen Thi Hong emphasized.