On February 20, banking stocks did not perform well in the morning session as they were dominated by red. However, towards the end of the session, many banking stocks recovered and narrowed their declines, with several stocks closing at the reference price.

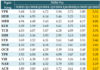

Out of the 27 banking stocks, only 6 stocks increased on February 20. Among them, the strongest performing stock was VCB of Vietcombank (+1.22%), closing at 91,300 VND per share. VCB’s stock also had the most positive impact on the VNIndex in today’s session.

Other banking stocks that saw price increases included HDB of HDBank (+1.07%), VIB (+0.91%), PGB (+0.67%), LPB (+0.28%), and BID of BIDV (+0.2%).

There were 10 banking stocks that remained flat, closing at the reference price. This included MSB, STB of Sacombank, TCB of Techcombank, and more.

There were 11 banking stocks that closed in the red, although the declines were not too significant. OCB and SHB were the two stocks that saw the biggest declines today, with -1.27% and -1.25% respectively. Many large-cap stocks also saw price decreases today, such as VPB (-1.01%), CTG (-0.56%), and MBB (-0.42%).

Foreign investors showed a strong buying trend for one banking stock in today’s session, which was MSB. Specifically, foreign investors bought 16.4 million MSB shares while selling only 1.3 million shares, resulting in a net purchase of over 15 million shares worth 233 billion VND. Prior to that, on February 15, foreign investors also bought a net 8.2 million MSB shares worth 122 billion VND.

This stock attracted strong buying from foreign investors when it unexpectedly had an “open” room of over 58 million shares on February 15. Specifically, according to data from the Vietnam Securities Depository and Clearing Corporation, at the beginning of February 7, 2024, the total number of securities that foreign investors held (foreign room) was 599.7 million shares, equivalent to a 29.99% ownership ratio, nearly reaching the maximum foreign room according to the regulations of the State Bank. However, by the beginning of February 15, the foreign room of the bank decreased to 27.09%, equivalent to 541.8 million shares. The total number of shares that foreign investors had after the February 15 session was an additional 58.2 million shares. By the end of February 20, the amount of MSB shares that foreign investors had acquired was 31.5 million shares.

MSB’s stock has been on a rising trend recently, increasing for 6 consecutive sessions (+15.5%). Liquidity also surged after the Lunar New Year, with a record-breaking trading value on February 15.

In terms of business results, MSB has achieved fairly positive results in 2023. As of December 31, 2023, MSB’s total assets reached over 267 trillion VND, a 25% increase compared to 2022. Credit growth reached 22.43%, ranking among the highest in the industry. MSB’s pre-tax profit for 2023 was 5.83 trillion VND, a 0.7% increase compared to 2022.