TPBank has recently adjusted its interest rates for loans to buy real estate or renovate homes.

Notably, TPBank’s preferential loan interest rate is now only 0% per year. Compared to the general market, this is the lowest preferential interest rate for home loans.

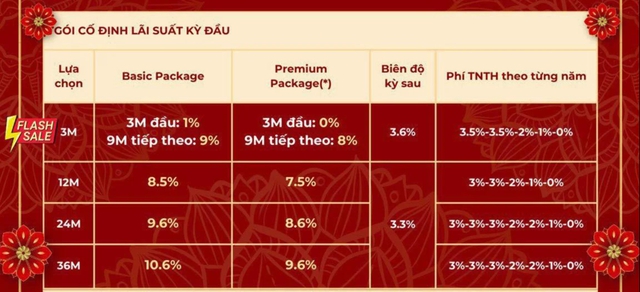

Specifically, the bank offers 2 loan packages: Premium Package (for loans below 65% of the total property value) and Basic Package (for loans above 65% of the total property value).

For the Premium Package, the applicable interest rate is 0% per year for the first 3 months, and 9% per year for the following 9 months.

In addition, for customers who choose a fixed term of 12 months: the interest rate is 7.5% per year, for the 24-month fixed package: 8.6% per year, and for the 36-month fixed package: 9.6% per year.

For customers who choose the Basic Package, the preferential loan interest rate is 1% per year for the first 3 months, and 9% per year for the following 9 months when customers choose a 3-month fixed package.

8.5% per year is the applicable interest rate for the first 12 months, 9.6% per year for the 24-month package/year, and 10.6% per year for the 36-month package/year.

After the preferential period, the interest rate will float. Specifically, for customers who choose a 3-month loan package, the floating interest rate is calculated based on the base interest rate plus 3.6% margin. For the remaining loan packages, the interest rate margin is 3.3%. The prepayment penalty ranges from 1-3.5% per year within 1-5 years.

TPBank’s loan interest rates applied from January 22, 2024.

Previously, TPBank applied interest rates for customers who borrow below 65% of the property value ranging from 8.2-10.2% per year. Specifically, the 1-year fixed interest rate package was 8.2% per year, the 2-year fixed interest rate package was 9.8% per year, and the 3-year fixed interest rate package was 10.2% per year. Therefore, up to the present, the interest rates adjusted by this bank have decreased by an average of 0.6-0.7% per year at different terms.

As surveyed in reality, up to now, many banks have reduced interest rates for home loans. According to real estate experts, this is a good opportunity for home buyers to consider.