Vietnam Export Import Commercial Joint Stock Bank (EIB-HOSE code) has announced the Report on the results of selling mutual fund shares.

Specifically, EIB registered to sell 6,090,000 mutual fund shares to supplement its business capital. This is the entire number of mutual fund shares that Eximbank currently holds, purchased from January 2, 2014 to January 16, 2014.

The transaction period is from January 5 to February 7, 2024, using the matching order method on the HOSE floor. However, at the end of the trading session, EIB did not sell any shares because there were no matching orders due to the market price not meeting the bank’s target selling price.

It is known that Eximbank’s Board of Directors has assigned the CEO/General Director to implement the content of the Resolution. In addition, the Board of Directors requires the target selling price not to be lower than 20,199 dong/share (calculated based on the average deposit interest rate from 2014 to 2023).

With the above price, it is expected that Eximbank will receive at least 123 billion dong. On the other hand, the Q3/2023 financial statements recorded this mutual fund shares as 78.273 billion dong – equivalent to 12,853 dong/share.

At the end of the trading session on February 20, EIB’s stock price decreased by 0.80% to 18,650 dong/share and only increased by 0.81% since the beginning of the year.

In terms of business results, as of the end of Q4/2023, Eximbank’s net interest income reached over 1,397 billion dong, a decrease of about 3% compared to the same period of the previous year (1,437 billion dong). Revenue from services decreased by more than 31%, from 185 billion to just over 128 billion dong in this quarter. It is worth noting that the profit from foreign exchange business in Q4/2023 of Eximbank significantly decreased, only reaching over 24 billion dong, while in the same period of 2022, it reached nearly 255 billion dong.

Accumulated for the whole year of 2023, Eximbank’s net interest income decreased by 18% compared to the previous year, from 5,592 billion to just over 4,597 billion dong. Profit from service business remained almost unchanged at over 514 billion dong; profit from foreign exchange business decreased by 20% to 514.3 billion dong. Securities trading activities were a bright spot with a revenue of 121 billion dong, an increase of nearly 40% compared to the previous year (87.55 billion dong). At the same time, other revenues also increased dramatically by 73%, from 493 billion to over 835 billion dong.

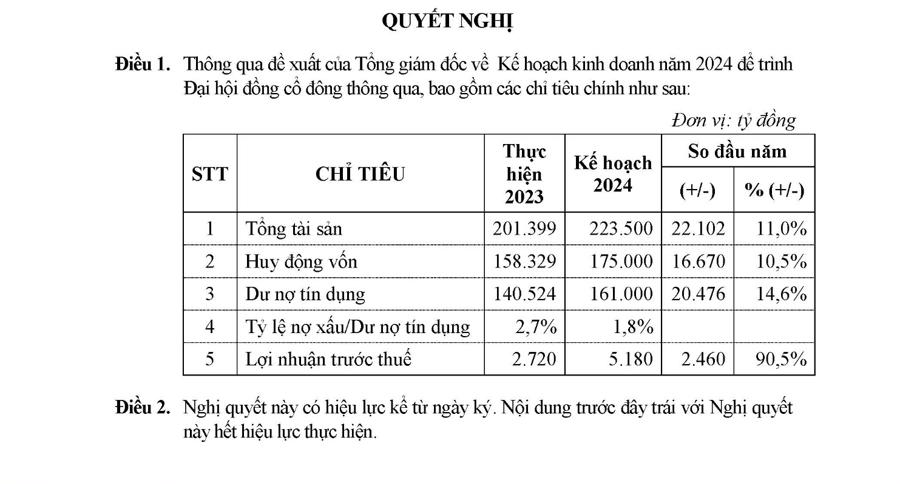

In 2023, Eximbank’s operating expenses decreased by 10% compared to the previous year, to only 3,140 billion dong, but the net profit from business operations still decreased by 10%, to only 3,414 billion dong. In 2023, Eximbank set aside more than 694 billion dong for credit risk provision, nearly 7 times higher than the previous year. As a result, pre-tax profit was only about 2,720 billion dong, a decrease of 27% compared to 2022 (3,709 billion dong).

According to Eximbank, it was influenced by factors such as actively reducing lending interest rates to support customers in accordance with the State Bank of Vietnam’s policy to stimulate demand in the context of a difficult economy and to retain customers before the situation where other banks attract customers to borrow.

It is expected that on April 26, the company will hold the annual general meeting of shareholders in 2024 in Ho Chi Minh City. The last date for shareholders to exercise their right to attend the meeting is March 14.

In terms of plans for 2024, Eximbank expects pre-tax profit to reach 5,180 billion dong, an increase of 90.5% compared to the results of the previous year. Total assets are expected to increase by 11%, to 223,500 billion dong, and mobilized capital will increase by 10.5%, to 175,000 billion dong.

At the same time, Eximbank sets a target for credit outstanding to increase by 14.6%, to 161,000 billion dong, while the bad debt ratio is reduced from 2.7% to only 1.8%.