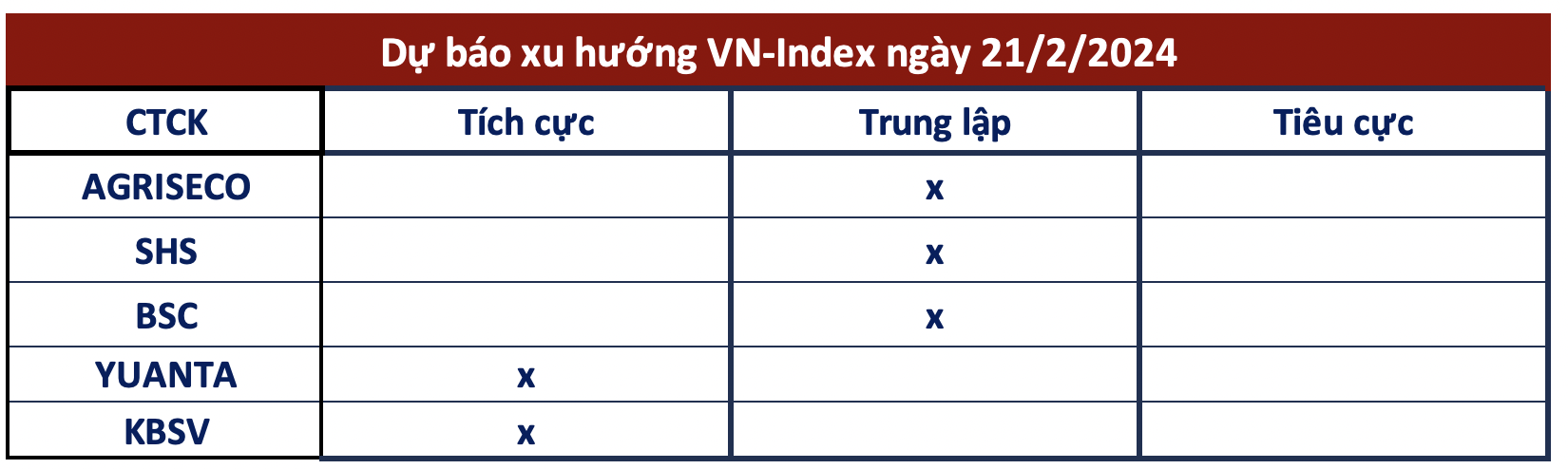

VN-Index continues to maintain a positive upward trend in the February 20 trading session. The market was active with an initial increase to the 1,230 point level, experiencing strong volatility at the 1,220 point level, and closing the session with the 7th consecutive increase to 1,230.06 points, up 5.09 points (+0.42%) compared to the previous session. Foreign trading activity remained a positive factor with a net purchase of VND 170 billion across the whole market.

With another increase in points, the VN-Index is gradually approaching the strong resistance level of 1,250 points. Therefore, many experts believe that selling pressure will gradually increase, and the market will face more volatility.

According to agriseco securities, the closing price at the highest level in the session shows that buying pressure continues to dominate and the upward trend in the medium term is still maintained. However, the increase in points is relatively steep, coupled with the VN-Index gradually approaching the important resistance range of around 1,240 – 1,250 to let the risk enter a short-term correction phase to ease the profit-taking pressure.

Short-term investors are recommended to gradually reduce their short-term trading positions when the index approaches the mentioned resistance level and only place buy orders in the market during the downturns with low liquidity. Some industry groups that may attract considerable capital inflows include banking, infrastructure investment, and industrial zones.

BSC Securities believes that liquidity is still supporting the VN-Index to move towards the 1,250 resistance level. However, the upward momentum of the index is quite steep and may pause in the next few sessions to accumulate further.

In the short term, SHS Securities evaluates the market in the upward phase, and the VN-Index is in a positive state as it approaches the strong mid-term resistance level of 1,250 points. However, the upward momentum of the Vn-Index may encounter difficulties due to the possibility of increased volatility and adjustments as the index approaches this level. Short-term investors who have been positive with their investments in previous sessions are recommended to continue holding their portfolios and refrain from chasing the market as it may experience volatility and adjustments when approaching the 1,250 level.

Meanwhile, for medium to long-term investors, if they have followed our updates, they have nearly completed restructuring their stable portfolios. If they want to invest more, they should wait for the market’s adjustment phases.

On the positive side, Yuanta Securities believes that the market may continue to rise in the next session, and the VN-Index may target the 1,245 resistance level. At the same time, short-term risks are still low, and capital inflows continue to increase, especially as the market does not show clear differentiation and capital is evenly distributed among different stock groups.