Adjusting pensions when salary is reformed

Based on Resolution 104/2023/QH15 on the state budget estimate for 2024, pension adjustments will also be made when salary is reformed. Accordingly, the social insurance contribution of officials, civil servants, and public employees is currently calculated based on their salary level, rank, grade, and additional allowances for positions, exceeding-grade seniority, and professional seniority (if applicable).

When the salary is reformed, the basic salary level will be eliminated, thus changing the average monthly calculation of social insurance contributions for these individuals. At present, the lowest monthly pension is calculated using the basic salary level of 1.8 million VND.

Currently, there is no specific guidance on how to calculate pensions when salary is reformed. However, when salary is reformed, retirement benefits should be adjusted, ensuring that the new salary level is not lower than the current level according to the spirit of Resolution 27-NQ/TW 2018.

It is worth noting that when salary is reformed, the salary of officials, civil servants, and public employees can increase by about 30% compared to the current level due to an increase in the average starting salary of civil servants and an expansion of the coefficient range from 10 (current) to 12 for the highest equivalent grade 3.

Furthermore, the allocation of bonuses and allowances, which accounts for 30% of the total salary fund, can also contribute to salary increases for officials, civil servants, and public employees. Consequently, when social insurance contributions increase, the pensions for retired officials, civil servants, and public employees will also increase.

Pension increase due to minimum regional wage increase

Recently, all members of the National Wage Council agreed on a proposal to increase the minimum regional wage by 6% effective from July 1, 2024, at the same time as the salary reform in the state sector.

Specifically, the proposed monthly minimum wage will range from 200,000 to 280,000 VND depending on specific regions, and the proposed hourly minimum wage will range from 16,600 to 23,800 VND.

Therefore, when the minimum regional wage is increased, the social insurance contributions of workers based on this wage will also increase. Naturally, pensions based on social insurance contributions will also significantly increase.

Pension increase when social insurance sliding scale is raised

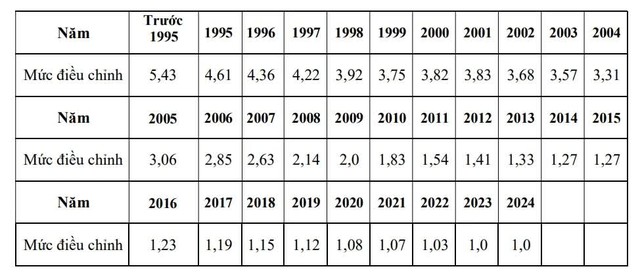

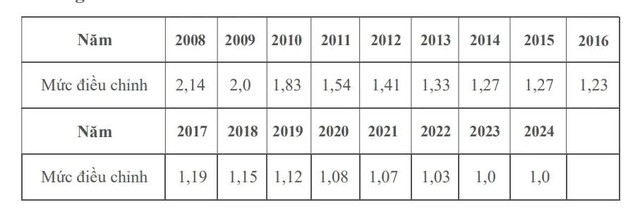

Recently, the Ministry of Labor, Invalids and Social Affairs issued Circular 20/2023/TT-BLDTBXH regulating the latest social insurance sliding scale, effective from January 1, 2024. Specifically, the social insurance sliding scale for mandatory and voluntary participants in 2024 is as follows:

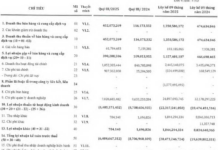

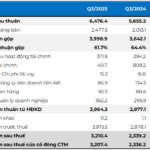

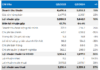

Social insurance sliding scale for mandatory participants

Social insurance sliding scale for voluntary participants

Based on Article 7 of Decree 115/2015/ND-CP, pensions are calculated by multiplying the pension rate with the average salary or average monthly income subject to social insurance contributions.

Pension = Pension rate x average salary or average monthly income subject to social insurance contributions

In addition, the adjustment of salaries subject to social insurance contributions for each year or the social insurance sliding scale affects the salary or monthly income subject to social insurance contributions after adjustment for each year.

Moreover, based on two social insurance sliding scales applicable to mandatory and voluntary participants in 2023 according to Circular 20/2023/TT-BLDTBXH and Circular 01/2023/TT-BLDTBXH, the social insurance sliding scale for 2024 has been adjusted and increased.

Therefore, when the social insurance sliding scale increases, the monthly pensions of workers will also increase.