Illustrative image

On the morning of February 20, 2024, the State Bank of Vietnam held an online conference for the whole banking sector to promote banking credit in 2024. The conference was co-chaired by the Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong and the Standing Deputy Governor Dao Minh Tu.

According to the SBV, from the beginning of 2024, the agency has resolutely implemented the government’s direction and the Prime Minister’s direction on prioritizing supporting growth associated with macroeconomic stability, controlling inflation in Resolution 01/NQ-CP and guiding documents, implementing credit operation measures, resolving difficulties, and improving credit access. Accordingly, the SBV has implemented a comprehensive set of solutions to create conditions for credit institutions to supply credit, as well as to create favorable conditions for individuals and businesses to access credit.

In particular, the SBV continued to manage the interest rates to help resolve difficulties for the economy. At the beginning of 2024, the SBV maintained the same interest rate levels to create favorable conditions for credit institutions to access low-cost capital from the SBV, contributing to supporting the economy.

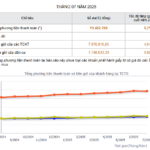

By January 31, 2024, the interest rates on deposits and loans continued to decrease; the average interest rates on new transactions of credit institutions decreased by about 0.15% per year and 0.25% per year compared to the end of 2023. The SBV also issued Official Letter No. 117/NHNN-CSTT dated February 7, 2024, requesting credit institutions to continue implementing the Prime Minister’s directions and the SBV’s directions regarding interest rates and reporting the average lending rates, the interest rate differentials for deposits and loans.

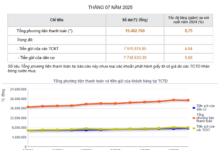

In addition, the SBV implemented credit growth to supply capital and support economic growth. In 2024, based on the target of the economy’s growth at around 6-6.5% and inflation at about 4-4.5% set by the National Assembly and the Government, the SBV aimed for a credit growth rate of about 15% for the entire banking system, with appropriate adjustments according to the situation, practical conditions. By December 31, 2023, the SBV had allocated the entire credit growth target for 2024 to credit institutions, publicly announced the principles for determining credit institutions to actively implement credit growth to supply credit capital to the economy.

On February 7, 2024, the SBV issued Official Letter No. 1088/NHNN-CSTT instructing credit institutions to vigorously implement the measures outlined in Directive 01/CT-NHNN dated January 15, 2024, aiming to promote economic growth. Specifically, credit institutions were directed to implement credit growth measures accurately and hit the targets from the beginning of the year, strengthen review, streamline credit process and procedures, optimize the application of digital transformation in the credit process, create favorable conditions for accessing bank credit.

Furthermore, the SBV actively implemented credit programs, policies, and solutions for priority sectors, growth motivations, key sectors of the economy; resolved difficulties and increased credit access. The SBV also actively implemented banking tasks in national target programs; supported and provided favorable conditions for social policy banks to implement credit programs.

The SBV urgently developed Directives 01 and 02/CT-NHNN, Action Program 83/QD-NHNN to implement Resolutions, Directives of the government and the Prime Minister for the focal activities of the banking sector in 2024, setting out specific objectives, tasks, and operational solutions for the entire system, especially for credit operations to ensure the provision of capital to the economy, support people and businesses in accessing credit for production, business, consumption, legitimate living needs, contributing to promoting economic growth, controlling inflation, ensuring macroeconomic stability, and ensuring the safe operation of credit institutions.