Water and Fire are two contrasting elements, so with the Giap Thin in 2024 having the Fire element, Thuy investors need to prioritize safety in the investment process.

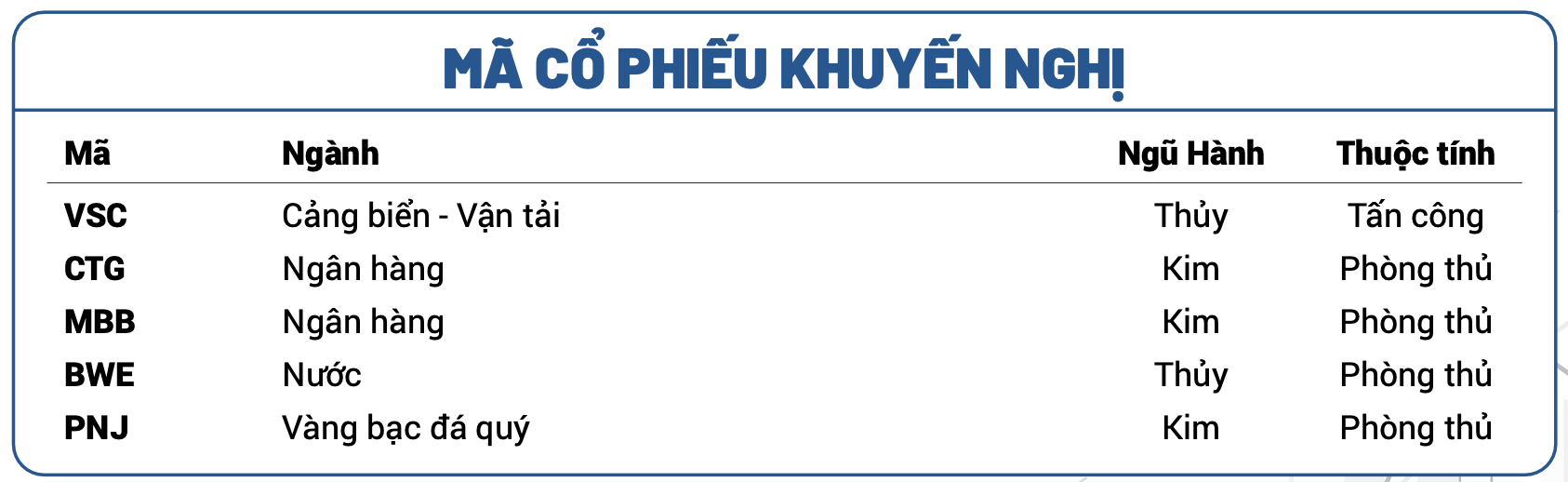

Based on (1) Prioritize industries that have high growth rates due to benefits from Government policies or the overall economic growth forecasted to remain high in the coming years; (2) Prioritize leading companies to maximize the growth of the industries, BIDV Securities (BSC) has identified 5 stocks suitable for Thuy investors in both aggressive (VSC) and defensive (CTG, MBB, BWE, PNJ) investment approaches.

The aggressive stocks are projected to have revenue and profit growth of more than 20% in 2024. The defensive stocks are reasonably priced with P/E, P/B ratios close to the average of the past 3 years or provide stable dividend payments, maintaining a good market share in the industry.

Viconship (VSC) operates in the container agency, shipping, and maritime brokerage services, mainly in the Hai Phong port area. According to BSC, with a low debt/equity ratio (only about 30%) and relatively high cash (cash and short-term financial investments of about 700 billion VND, equivalent to 50% of long-term debt), VSC ensures financial safety.

In addition, VSC owns a large port cluster. After acquiring the Nam Hai Dinh Vu port from GMD, VSC has the largest position in the Hai Phong port area. Acquiring more ports helps VSC (1) minimize operating costs thanks to the advantage of a port length of over 800m (2) limit the need to rent outside when there is a clash of schedules, helping optimize revenue. With the advantage of scale and growth potential in the region, VSC’s growth rate is guaranteed in the 2024-2026 period.

VietinBank (CTG) is one of the three state-owned banks in the stock market with a leading position in terms of total assets and equity. Thanks to the increase in retail lending portfolios (contrary to the general trend of the industry), CTG is maintaining a better NIM than other banks.

BSC believes that a strong handling of bad debts and provisioning will pave the way for growth from 2025. BSC expects that the credit costs of the bank will still be high in 2024 but will start to decrease from 2025 onwards, helping profit growth achieve >20% per year in 2025-2026. Furthermore, with a 2024F P/B of 1.0x, CTG is currently priced cheaply compared to private banks.

MBank (MBB) with the advantage of cheap CASA funding has shown a better ability to protect NIM than competing banks, leading the industry in terms of individual NIM. BSC cautiously forecasts MBB’s 2024F NIM will recover 10bps YoY.

During the 2023F-2027F period, BSC forecasts MBB will record (1) credit growth of >20% thanks to taking over a weak FSI, (2) NIM of >5.0% in the top of the industry due to the stable CASA advantage from the military ecosystem, helping (3) ROAE to reach >20%. The valuation is also relatively cheap compared to the industry with a 2024F P/B of 0.8x and a 2024F ROAE of 23%, compared to the respective averages of 0.9x and 18% for listed private banks in BSC’s watchlist.

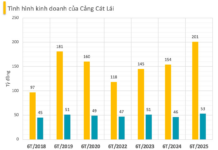

Biwase (BWE) is the sole provider of clean water and waste treatment services operating in the Binh Duong province area. In which, clean water supply currently contributes significantly to the Company’s business results, benefiting greatly from the ability to attract investment capital in Binh Duong province.

BWE has a strong financial position with a cash and cash equivalents balance of approximately 1,000 billion VND, maintaining a relatively attractive 12% dividend per par value. Sustainable revenue and profit growth come from urbanization and industrial development. In addition, the selling price is adjusted upwards according to cycles to ensure sustainable growth for the business.

With the advantage of abundant cash, BWE has increased its ownership ratio in water companies in the Mekong Delta region to leverage the high growth potential in this area as transport infrastructure completes and urbanization rates increase in areas such as Dong Nai, Can Tho,…

PNJ is the largest jewelry enterprise with the largest retail system in Vietnam. Continuously opening stores, PNJ now has more than 240 stores distributed in many provinces and cities nationwide. In addition to the domestic market, the PNJ brand is also present in 13 countries on 4 continents.

BSC forecasts that PNJ will continue to grow above the high baseline in 2024, thanks to factors such as (1) continued market share expansion, (2) increased store coverage, and (3) operational cost optimization. Furthermore, the valuation has been deeply discounted compared to the business’s financial performance with a 2024 PE FW of 12.4 times – lower than the 5-year historical average of 15.2 times.