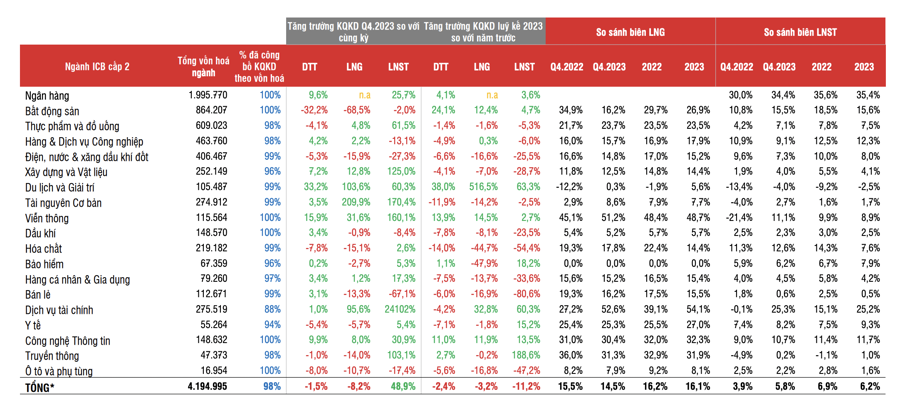

The Q4/2023 profit continues its positive recovery trend since hitting its lowest point in Q4/2022. The total after-tax profit of 1,130 listed companies as of February 5 increased strongly by 35.3% compared to Q4/2022 and by 4.8% compared to Q3/2023, recording the highest profit level in 5 quarters. Therefore, profit has regained positive growth after 4 consecutive quarters of decline, according to the latest statistics from SSI Research.

TOTAL MARKET PROFIT DECLINES SLIGHTLY BY 3.5%

For the whole year of 2023, the total after-tax profit of the entire market decreased slightly by 3.5% compared to 2022, nearly equivalent to 2021 and higher by 36% compared to 2019, a period before the Covid pandemic.

The strongest growth momentum this quarter (compared to the same period last year) came from the following groups: Banking (+25%), Food & Beverage (+52%), Construction & Materials (+162%), and Information Technology (+31%), showing a strong recovery. The Basic Resources and Financial Services groups also turned from loss to profit, while the Travel and Leisure group significantly narrowed its loss compared to the same period last year.

The gross profit margin recovered significantly in the Financial Services, Basic Resources, Food & Beverage, Construction, and Travel & Entertainment sectors, indicating that these sectors have overcome their profit lows and are gradually regaining growth momentum.

The Banking and Information Technology sectors have been the most resilient during the difficult period. The Banking sector reached near-peak profit levels in Q1/2022, and the Information Technology sector continues to set new profit records.

After-tax profit of listed banks increased by 25% compared to the same period last year. Growth drivers include strong growth in foreign exchange earnings (+23%), profits from government bond businesses (VND 5.7 trillion compared to a loss of VND 18 billion in the same period of 2022), controlled operating costs (increasing by only 1.5%), and a 4% decrease in provision expenses.

The profitability of other sectors remains significantly lower than in the 2021-2022 period. The Industry & Industrial Services (-12%), Retail (-67%), and Automobile (-17%) sectors have yet to return to a growth trajectory. These sectors all experienced narrower profit margins while revenue remained relatively unchanged.

After-tax profit of the Real Estate sector increased slightly by 3% but still low compared to previous quarters. This increase was largely contributed by extraordinary financial income, while sector revenue decreased by 30% compared to the same period, mainly due to differences in the timing of revenue recognition between quarters. Year-on-year, the after-tax profit of the sector in 2023 increased by 5.7% compared to 2022, while revenue increased significantly by 27.3%, mainly due to the increase in VIC (+59%) and VHM (+66%)

Several sectors have confirmed their bottoming out and achieved significant growth compared to the previous quarter. The Chemical Industry increased by 252% compared to the previous quarter, equivalent to Q4/2022. Impressive growth was mainly driven by DHB (+634% compared to the previous quarter), GVR (+187%), LTG (+176%). Excluding extraordinary income, the gross profit of the sector also reached a good increase (+56% compared to the previous quarter), the highest in the past 4 quarters.

The Basic Resources sector (+34% compared to the previous quarter) recorded its highest profit in 6 quarters. The gross profit margin of this group improved to 8.6% compared to 2.8% in Q4/2022.

The Personal & Household Goods sector recorded a recovery in the first quarter with a growth of 58% compared to the previous quarter and 19% compared to the same period. Many businesses recorded positive growth such as PNJ (+149% compared to the previous quarter), GIL (+566%), VGT (+68%), RAL (+101%).

The Utilities, Petroleum, Electricity & Natural Gas sector also rebounded from the low point of Q3/2023, with a growth of 29%. Many businesses recorded positive growth such as QTP, PPC, NT2, POW, PGV, GAS, VSH.

EXTRAORDINARY PROFITS INCREASE SHARPLY, INTEREST PAYMENT ABILITY DECREASES

Behind the impressive net profit growth, there are some points that need to be carefully considered, according to SSI Research. The scale of revenue has not increased proportionally. The total revenue of the entire market continues to decrease slightly by 2% compared to the same period, mainly due to the Real Estate (-30% compared to the same period), Food & Beverage (-11%), Chemicals (-9%), Utilities (-5%). The Travel & Entertainment sector is the group with the best revenue growth (+33%) thanks to the gradual recovery of international tourists after the pandemic.

The gross profit margin of the Non-Financial group has decreased significantly from 15.3% in Q4/2022 to 14% in Q4/2023. However, this decrease is mainly due to the Real Estate sector, which has a gross profit margin decrease of -69%, and the Utility, Chemical, and Retail sectors, while some sectors have shown certain recovery such as Basic Resources, Food & Beverage, Travel & Entertainment. Excluding the Financial (Banking, Insurance, Securities) and Real Estate sectors, the gross profit of Q4/2023 continued to recover from the lowest level in Q1 and grew by 8.1% compared to the same period last year.

Extraordinary profits increased sharply with a total of net other incomes and net financial incomes reaching VND 26.5 trillion (compared to – VND 300 billion in Q4/2022), contributing 23% to the total pre-tax profit. These income items increased significantly compared to the previous period, mainly thanks to some companies such as VIC, VHM, HNG, DHB, NVL.

Excluding these extraordinary items, the total profit only increased by 3% compared to the same period. Interest costs decreased in some sectors such as Food & Beverage, Basic Resources, Retail, but increased in Real Estate, Construction, and Utilities, so the total interest costs remained high at VND 27.2 trillion in Q4/2023 (+11.2% compared to the same period).

The interest payment coverage ratio continued to decrease, averaging 3.74 times in Q4/2023. Of which, 217 companies recorded a ratio of less than 1, accounting for 13.6% of the total market debt. The Debt/Equity ratio also increased to the highest level in the past 6 quarters, reaching 0.63 times.