Market liquidity today is lower than the average of the previous session as well as the average of the previous 5 sessions.

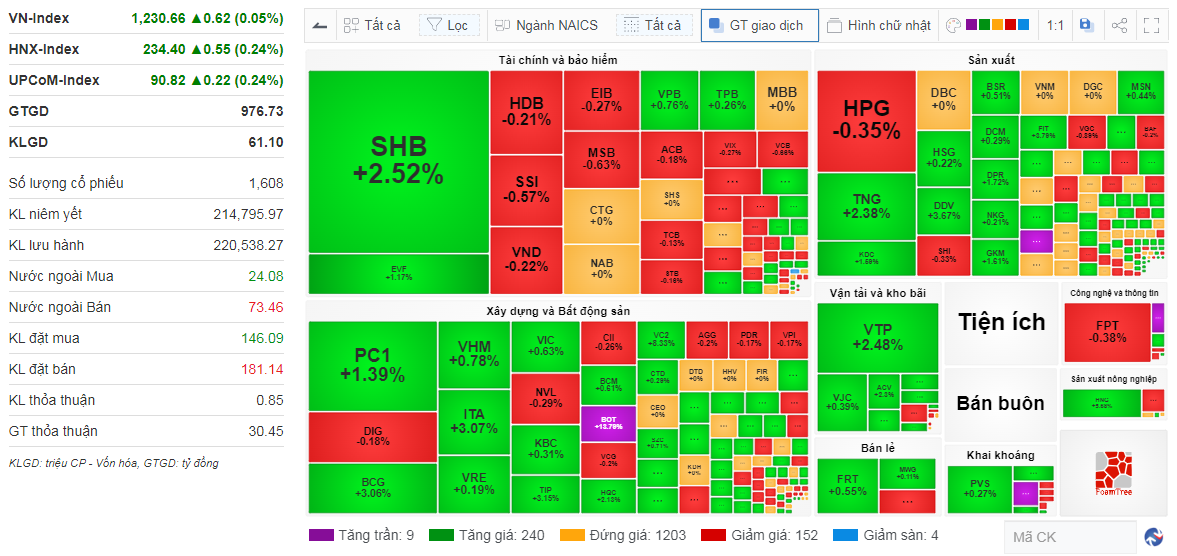

The banking and securities group is seeing more red than green. In terms of price increase, SHB stock is showing superiority (+2%) and VND stock (+0.2%). On the other hand, stocks like MSB, HDB, STB are decreasing by around 1% or less.

The construction and real estate group, in general, is more positive with many impressive price-increasing stocks such as LCG, ITA, up nearly 4%; PC1, BCG, HQC stocks are up over 2%.

PVD stock in the exploration and exploitation group is up more than 4%, while PVS in the same group is also up over 1%. It is worth noting that VTP stock in the warehousing and transportation group is up more than 5.5%.

The agricultural production group is witnessing a price increase with the amplitude of HNG stock, and HAG stock is also up nearly 0.8%.

In the top stocks affecting the index, VCB continues to be the leading stock, creating significant pressure on the index, contributing to a decrease of nearly 1.1 points; greater than the combined positive contribution of 3 GAS, SHB, and VHM stocks, which are the three stocks with the most positive impact on the index.

Opening: Slightly green.

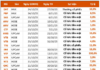

After yesterday’s volatility session, VN-Index opens slightly green, up 0.6 points compared to the previous session to 1,230.66 points. Of which, 9 stocks hit the ceiling, 240 stocks increased, 1,203 stocks remained unchanged, 152 stocks decreased, and 4 stocks hit the floor.

Market movement at 9:23 am. Source: VietstockFinance

|

Similarly, the Large Cap, Mid Cap, Small Cap, and Micro Cap groups are slightly green.

The Vingroup pair, including VIC and VHM, are the two stocks with the most positive impact on the index, and GAS stock is reinforcing their strength. On the contrary, VCB stock has the most negative impact on the index, significantly higher than the other stocks in the top 10 stocks with the most negative impact.

Kha Nguyen