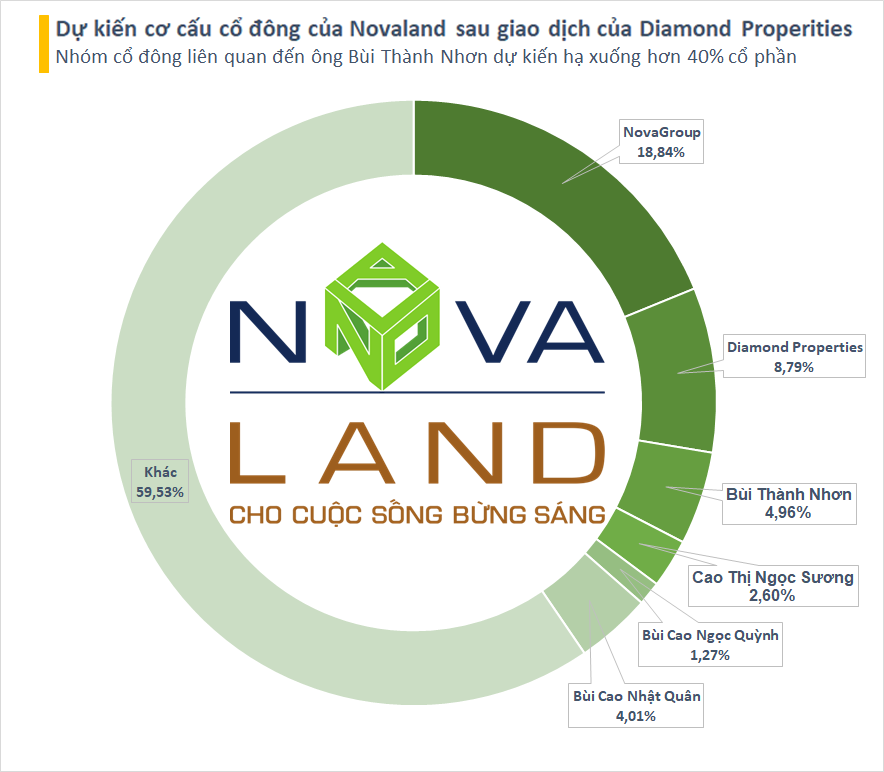

In the latest announcement, Diamond Properties JSC has registered to sell 4 million shares of NVL stock of No Va Investment Corporation (Novaland). The transaction is expected to take place between February 26 and March 26, 2024, through matching orders and/or agreements. If completed, Diamond Properties will reduce its ownership in Novaland to 171.4 million shares (8.79% of the capital).

Currently, NVL shares on the exchange are fluctuating around 17,350 VND/share. Therefore, the company can earn about 69 billion VND.

In the same trading session, Novagroup JSC has sold more than 12.5 million NVL shares from February 1 to February 5, including transactions in which securities companies sold over 159 thousand shares. As of February 6, 2024, NovaGroup still holds 367.4 million NVL shares, equivalent to 18.84% ownership and remains the largest shareholder at Novaland.

With the latest move from Diamond Properties, the group of shareholders related to Chairman of the Board of Directors Bui Thanh Nhon is expected to hold just over 40% of the shares in Novaland. Compared to a year ago, the total ownership of the group has decreased by about 12%, equivalent to more than 210 million NVL shares having been “slipped” out of the hands of shareholders related to Mr. Nhon.

In terms of business performance, for the whole year of 2023, Novaland’s after-tax profit reached nearly 685 billion VND, only about 1/3 of the previous year 2022. In addition, the net cash flow from the business activities of this real estate company was heavily negative at 3,182 billion VND. This means that Novaland had profit but did not actually receive money from core business activities.

Related to this, Novaland has just approved the adjustment of the conversion price into shares for the 300 million USD bond issue in the bond market. Specifically, the new conversion price will be at 40,000 VND/share, more than 2 times the market price of NVL on the exchange. This is the fourth time the company has changed the conversion price of the mentioned bond batch.