|

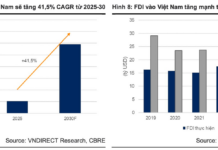

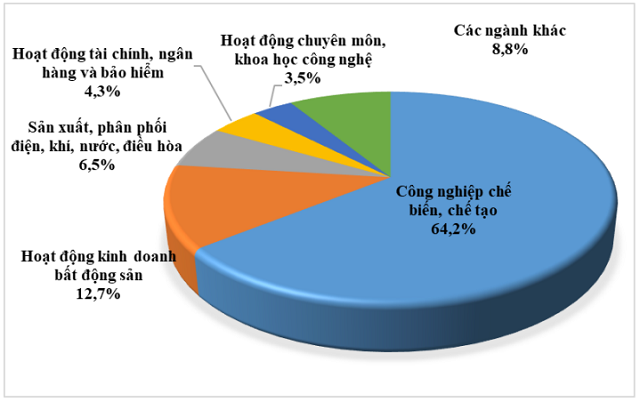

Opportunities In the period from 2022 to 2025, many key transportation infrastructure projects connecting provinces, cities, and economic regions have been approved and quickly started, creating strong economic growth momentum, with a focus on road development: completing the North Ring Road, the Ho Chi Minh City Ring Road 3, the North-South Expressway, and the Ben Luc – Long Thanh Expressway. In addition, many waterway transport routes connecting industrial parks to seaports and large logistics centers, such as Cat Lai port and Cai Mep – Thi Vai port, will be invested in the future. Along with that, expanding comprehensive strategic partnerships with the United States will boost high-tech investment. Every year, US businesses invest about $200-300 billion abroad, but US FDI in Vietnam in recent years is only about $1 billion/year. After elevating the level of cooperation with the US, US FDI is expected to invest in high-tech industries in Vietnam thanks to our large reserves of rare earth and tungsten. According to the “Master Plan on Exploration, Exploitation, Processing, and Utilization of Minerals for the 2021-2030 Period, Vision to 2050”, Vietnam ranks 2nd in the world in terms of rare earth reserves (estimated at 22 million tons). The 2022 announcement by the US Geological Survey stated that Vietnam’s tungsten reserves are about 100,000 tons, ranking 3rd in the world. Challenges According to the assessment of MB Securities (MBS), Vietnam needs to enhance competitiveness in attracting FDI compared to neighboring countries, particularly India and Indonesia. To attract FDI after the pandemic, India has set aside 460,000 hectares of clean land, invested $1.5 trillion in infrastructure, and offered tax incentives for new investment projects. Many major FDI companies such as Samsung, Apple, and Pegatron are increasing their investments in this country. The CAGR (Compound Annual Growth Rate) of FDI inflow into India during the 2018-2022 period reached 9% per year, higher than the 4% per year in Vietnam. Indonesia attracts a lot of FDI thanks to the development of the electric car battery manufacturing industry and cloud computing. The CAGR of FDI inflow into this country in the past 5 years reached 13% per year. In contrast, FDI in Vietnam still focuses on assembling and manufacturing consumer goods and other electronic devices. The second challenge is the risk of power shortage during peak production seasons. Vietnam’s maximum available power generation capacity is about 43,000 MW, but during peak seasons, the maximum power load can reach up to 45,500 MW. With high power load growth, Vietnam may experience a shortage of up to 2,500 MW during peak seasons in the coming years, especially when the El Nino cycle is forecasted to be prolonged and stronger. The risk of power shortage affecting production has caused some investors to cancel their investment plans in Vietnam. The impact of the Global Minimum Tax. Vietnam has officially issued a resolution to apply a 15% global minimum tax to multinational corporations from January 01, 2024. Therefore, companies with revenues above 750 million euros that currently enjoy investment incentives in Vietnam will have to pay additional taxes at the 15% global minimum tax rate. As a result, the tax incentives (tax exemption, reduction) in Vietnam will lose their effect. To adapt to the global minimum tax, some countries that receive FDI, just like Vietnam, have implemented coping policies. Specifically, they have introduced an additional domestic minimum tax to avoid losing revenue from the differential tax. MBS believes that besides losing the effect of the foreign investment incentives policy, the application of the global minimum tax will affect large-scale investment projects, reduce competitiveness in attracting investment, and affect the strategy of attracting investment in advanced technology and high-tech industries. What trends will shape the industrial park real estate industry in the near future?

According to MBS experts, investment capital is shifting toward secondary markets due to abundant supply and low rental prices. In addition, the trend of developing green industrial parks to attract FDI into high-tech industries. Traditional industrial parks only have pure manufacturing plants, housing, and other utility services, losing their competitive advantage. Developing green industrial parks means participating in cleaner production activities, minimizing negative impacts on the environment with the goal of achieving Net Zero Carbon by 2050, which is also a global trend. According to Dinh Le Hanh, founder of Dinhle Group, Vietnam is a developing country with high annual economic growth. Therefore, international investors see Vietnam as a very good market, expecting to find profits and invest with peace of mind. The difficult times recently experienced are a common picture in the world, with many people losing their jobs and no new job opportunities. Even Americans are having difficulties in obtaining home loans due to high interest rates. Therefore, to solve the real estate problem, the capital issue must be solved well. In 2023, industrial park real estate is still a bright spot, with significant investment contributions from FDI groups. However, the priority policy for foreigners buying real estate in Vietnam is still unclear, and the mechanism needs to be clarified so that foreign investors have a place to stay and feel more secure, according to Ms. Hanh. “Overseas Vietnamese who want to buy houses in Vietnam have to rely on relatives to put the property in their names. If disputes arise, they not only lose their assets but also the relationship. So, we are making it difficult for ourselves. Why don’t we let that capital flow into real estate in a legal and natural way? That capital is essential because it is idle money they accumulate from overseas. On the other hand, FDI capital is not ours, it belongs to foreign countries, and they can withdraw their investment when they no longer want to invest,” Ms. Hanh pointed out. Foreign investors need clarity, and FDI capital is a boost for them to move to Vietnam, build factories, and companies for a long time, and they need housing for their experts and staff when they come to Vietnam. Therefore, the Government needs a comprehensive solution to make foreign investors see Vietnam as their second home, invest for the long term, and continue to expand. At the same time, banks need to be transparent and accessible for capital, Ms. Hanh suggested. Bui Huu Tai, Deputy General Director of Tân Đông Hiệp Investment and Construction Group (investor of Tan Dong Hiep Industrial Park B, Di An, Binh Duong), said that it is necessary to keep up with the green trend, especially in industrial parks. “Many investors in industrial parks have lost orders to overseas due to some foreign factories following the green trend, obtaining green certificates, and enjoying tax advantages when exporting to Europe and the US based on the world’s Carbon Agreement,” Mr. Tai shared. Vietnam needs coordination between industrial park developers and production companies, including the Government, to establish a standard for Net Zero carbon, green industrial parks to be able to compete with foreign countries. He added, “Until now, Vietnam has relied somewhat on the low labor cost factor, but now, after economic development, China has escaped from and no longer has cheap labor; they have an average labor cost, and they are facing difficulties in production because of high labor costs. Therefore, Vietnam needs to prepare when there is no longer cheap labor in the region and needs to find a new competitive advantage.” Regarding the cost of developing green industrial parks, Mr. Tai said that Tan Dong Hiep is also implementing some green industrial cluster projects outside the northern region and it does not have a significant impact on the financial situation of the industrial park developer. However, industrial park developers need to establish relationships, especially understanding what the green direction is and how to implement it. If they have no experience, they can cooperate with foreign entities to learn from their implementation techniques. Following the green trend will not increase costs for industrial park developers, but rather bring more advantages, he said. Regarding the recent increase in industrial park rental fees, which increases the excessive supply and causes higher rental prices, which will affect the investment choices of foreign enterprises. However, rental costs only account for 50% of the investment decisions of FDI enterprises. The remaining factors depend on location, trade, logistics, and, most importantly, the openness of the local area and incentives for FDI. The supply at the industrial park is also a decisive factor for FDI enterprises.

|

What are the upcoming trends shaping the industrial real estate market?

In recent times, despite the real estate market being sluggish, the industrial real estate segment remains vibrant and is always seen as a bright spot thanks to FDI capital flow. However, this "lucrative land" still faces many difficulties and challenges due to the competitive pressure from other countries in the region.