Despite the divergence in stock prices, the signs of risk in the VNI are becoming evident. The key stocks are not exchanging strongly but rather are compensating each other to maintain a stagnant state in the index. Surprisingly, the liquidity in this session weakened.

The total trading value on both exchanges is around 18.2 trillion, which is not low but still warrants attention. VN30 decreased by 24% in liquidity, reaching about 7 trillion. Decreased trading in both the banking sector and blue-chips in general at this stage is not good because maintaining a high price in large market capitalization stocks requires significant resources. If the low liquidity in the coming days persists and the trading remains active in small market capitalization stocks, the possibility of a general market correction is high.

Naturally, from each person’s perspective, the current story is about which stocks to hold. The divergence is still showing and there is no common denominator for evaluation. Small and mid-cap stocks are still receiving positive money flow, and increasing prices still give a sense of safety, despite VNI struggling at high short-term highs. Therefore, it is advisable to consolidate the portfolio with weak stocks and limited room for further growth to any technical resistance. If the big stocks take away more points, eventually the overall psychology will be affected and the divergence will no longer be as it is now.

The strong foreign capital outflow today is a notable signal. This group accumulated significant stocks in January and is now turning to selling. The largest capital withdrawal is in the third and fourth quarters of 2023. Therefore, the current selling period can be seen as short-term trading rather than a repeat of the trend of net withdrawal along with a sharp increase in exchange rates last year. It is also worth noting that the exchange rate has also returned close to the 2023 peak in recent days.

From the perspective of the VNI index, there is still a bit of room left to the medium-term peak, but the score story depends too much on the key stocks. VIC, VHM, VNM are trying to balance themselves after a breakout in the past few days. The banks with TCB are increasing rapidly, while BID is oscillating around the second peak, and CTG is also hovering at its historical peak, VPB is uncertain, and the remaining banks are too small to pull the index. Opportunities may only appear in a few sessions with new consensus to help the index test its peak.

A more plausible scenario is that large-cap stocks fluctuate against each other, forming a narrow sideways range to create conditions for speculative small-cap stocks. But this could also be the last short-term opportunity. In summary, the risk is increasing and if the market has a strong rebound, consider taking profits and reducing the portfolio further. In a state of uncertainty like this, it is best to take profits based on each stock and avoid buying more.

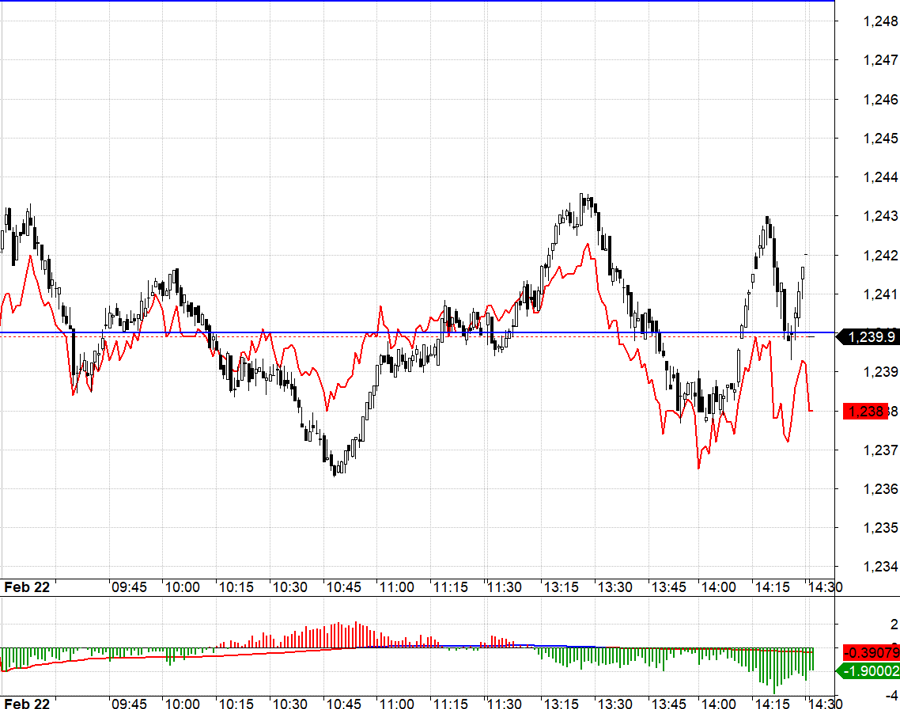

VN30 fluctuated a lot today, but the derivatives market was uncomfortable because the key stocks did not have significant inertia for the underlying index. Throughout the session, VN30 crossed around 1240.xx many times, but Long has too narrow a range and Short is also absent. In general, this kind of sideways and indecisive state benefits stocks but is difficult to trade in derivatives.

VN30 closed today at 1239.9. The nearest resistances tomorrow are 1240; 1245; 1249; 1256; 1260; 1267. Supports are 1234; 1229; 1225; 1219; 1210; 1207; 1200.

“Stock Blog” is of a personal nature and does not represent the opinion of VnEconomy. The views and evaluations are those of individual investors, and VnEconomy respects the opinions and writing style of the author. VnEconomy and the author are not responsible for any issues related to the published evaluations and investment opinions.