According to data from the General Department of Customs, Vietnam’s rubber exports in January 2024 reached approximately 260 thousand tons, worth $365 million, an increase of 92.6% in quantity and 99.8% in value compared to January 2023. The average export price of rubber in January 2024 was $1,404 per ton, an increase of 0.9% compared to December 2023 and 3.7% compared to January 2023…

CHINA ACCOUNTS FOR NEARLY 80% OF VIETNAM’S RUBBER EXPORTS

According to the Ministry of Agriculture and Rural Development, in 2023, the total area of rubber trees in the country reached 910.2 thousand hectares, a decrease of 8.4 thousand hectares compared to 2022; dry rubber production reached 1.29 million tons, a decrease of 46.2 thousand tons compared to 2022.

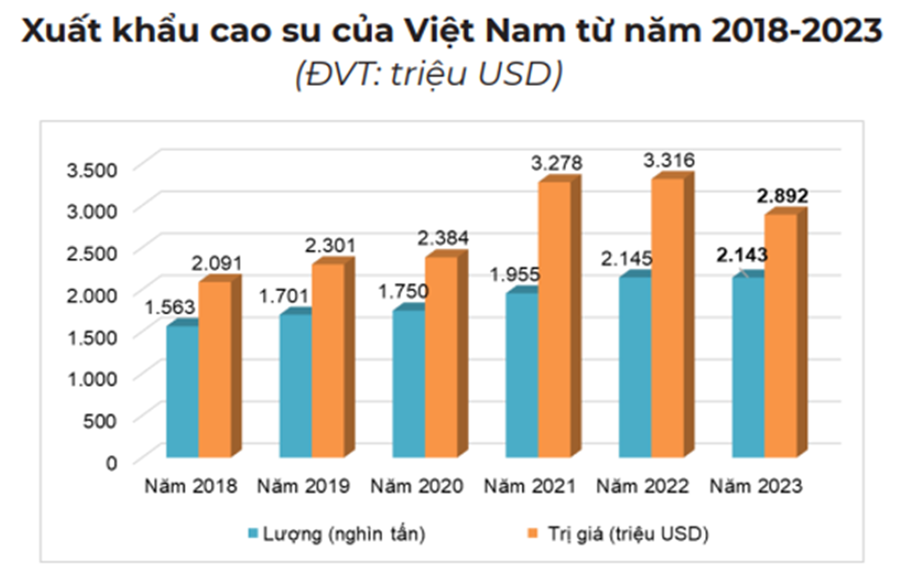

Data from the General Department of Customs and the Ministry of Agriculture and Rural Development show that in 2023, Vietnam exported 2.14 million tons of rubber, worth $2.89 billion, a decrease of 0.1% in quantity and 12.8% in value compared to 2022. In terms of export prices, the average rubber export price in 2023 decreased significantly compared to 2022, reaching $1,350 per ton, a decrease of 12.7% compared to the average export price in 2022.

According to the Industrial and Commercial Information Center (Ministry of Industry and Trade), the main types of rubber exported in 2023 were natural rubber and synthetic rubber (HS 400280), Latex, SVR 10, SVR 3L, SVR CV60, RSS3, SVR 20… Among them, natural rubber and synthetic rubber (HS 400280) still accounted for the largest share in terms of both quantity (67.57%) and value (68.98%) in the total rubber exports of the country, reaching over 1.44 million tons, worth $1.99 billion, an increase of 10.2% in quantity but a decrease of 1.8% in value compared to 2022.

In 2023, many types of rubber exports decreased in both quantity and value compared to 2022. However, the export volume of some types still increased compared to 2022, notably SVR CV60, reclaimed rubber, RSS1, RSS4, SVR CV40, RSS5…, but these types accounted for a small proportion of Vietnam’s total rubber exports.

The average export prices of rubber types in 2023 all decreased significantly compared to 2022, with the most significant decreases seen in compound rubber (HS: 4005) down 22.8%; Skim block down 22.4%; RSS3 down 17.6%; SVR 10 down 15.7%; SVR CV50 down 14.9%; Latex down 14.8%; SVR 20 down 14.2%…

In terms of markets, in 2023, China continued to be Vietnam’s largest rubber export market, accounting for 79.63% in quantity and 78.52% in value of the country’s total rubber exports, reaching 1.7 million tons, worth $2.27 billion, an increase of 6.6% in quantity but a decrease of 4.8% in value compared to 2022. The average rubber export price to this market was $1,331 per ton, a decrease of 10.7% compared to 2022.

In general, Vietnam’s rubber exports to most markets decreased compared to 2022, especially to major markets such as India, the United States, Germany, Taiwan (China), Turkey, Russia, Indonesia, Sri Lanka, Japan, and Spain… However, exports to some markets still grew in quantity, such as China, South Korea, the Netherlands, Singapore, and the Czech Republic…

INDIA IS VIETNAM’S SECOND LARGEST RUBBER EXPORT MARKET

Data from the General Department of Customs shows that in 2023, Vietnam’s rubber exports to India reached over 112.66 thousand tons, worth $156.68 million, a decrease of 4.4% in quantity and 21.7% in value compared to 2022. India is Vietnam’s second largest rubber export market, accounting for 5.26% in quantity and 5.42% in value of the country’s total rubber exports.

In terms of export prices, the average rubber export price to India decreased significantly compared to 2022. In 2023, the average rubber export price to the Indian market reached $1,391 per ton, a decrease of 18.2% compared to 2022.

In 2023, Vietnam mainly exported natural rubber to India. Among them, SVR 10 was the most exported type to India, accounting for 54.85% of the total rubber export volume to India in 2023, with 61.8 thousand tons, worth $84.55 million, an increase of 47.2% in quantity and 20.2% in value compared to 2022. SVR 3L accounted for 22.02% and RSS3 accounted for 8.82% of the total rubber export volume to India in 2023.

The average export prices of rubber types to India all decreased significantly compared to 2022, with the most significant decreases seen in compound rubber (HS: 4005) down 77.3%; Synthetic rubber down 47.5%; Latex down 23.9%; SVR 20 down 19.2%; SVR 10 down 18.4%; Natural rubber and synthetic rubber (HS: 400280) down 18.8%…

The Industrial and Commercial Information Center (Ministry of Industry and Trade) quoted data from the Indian Ministry of Commerce, stating that in the first 11 months of 2023, India imported 1.07 million tons of rubber (HS 4001; 4002; 4003; 4005), worth $1.95 billion, a decrease of 6% in quantity and 23.7% in value compared to the same period in 2022. Indonesia, South Korea, Thailand, Malaysia, and Vietnam are the top 5 rubber suppliers to India.

In the Indian market, Vietnam’s rubber market share has narrowed compared to 2022, while the market share of Indonesia, Thailand, Singapore, South Korea, Malaysia, and China has increased.

PROSPECTS FOR THE FIRST HALF OF 2024

In contrast to the “bleak” situation in 2023, in January 2024, Vietnam’s rubber export turnover doubled compared to January 2023. This is giving rubber industry businesses hope.

The export prices of rubber at the beginning of 2024 have increased compared to 2023. In the global market, the price of natural rubber has reached a record high in 7 years due to increasing demand from China’s electric vehicle industry and a lower production output in Thailand, the world’s leading rubber producer. The natural rubber futures price in July on the Osaka Exchange (OSE) – the reference contract for the Asian market – traded at 298.5 yen ($1.99) per kg on February 19, 2024, the highest closing price since February 17, 2017 (the highest in 7 years). This price is 13% higher than the end of 2023. Prices on other Asian markets have also increased.

At the Shanghai Futures Exchange, the futures contract for rubber for delivery in May is currently at 13,555 Chinese yuan/ton (equivalent to $1.8883,08), while on the Singapore Exchange (SICOM), the March contract is priced at 155.20 U.S. cents/kg, the highest in a year and a half.

A series of factors have simultaneously pushed up rubber prices. Firstly, the booming car sales in China. According to the China Association of Automobile Manufacturers (CAAM), in the first half of 2023, new car sales mainly fluctuated around 2 million vehicles per month. By November 2023, sales had increased by 27.4% compared to the same period the previous year to 2.97 million vehicles, then increased to 3.15 million in December 2024, up 23.5%. The China Association of Automobile Manufacturers expects car sales in the country to reach about 31 million vehicles in 2024.

The high car sales drive the demand for natural rubber. According to Michelin, in December 2023, the demand for tires for new cars in China increased by 30% compared to the previous year. Analysts and rubber traders expect the price of this tire production raw material to continue to stabilize at a high level in the future.

Meanwhile, Gu Jiong, in charge of corporate services and investment at Yutaka Trusty Securities, said: “Due to adverse weather conditions, Thailand cannot increase production capacity enough during the peak production season.” The Thai Meteorological Agency warned on February 19 that severe weather from February 23-25, 2024, in the northeastern, eastern, and central regions of Thailand could cause further damage to the rubber season.

For Vietnam’s rubber exports, China remains the key factor influencing rubber exports. While many export industries are concerned about the tension in the Red Sea and the increase in freight rates, the rubber industry will be less affected by these issues, as the main export market is China. The entire rubber industry has set a target of achieving rubber exports worth $3.3-3.5 billion in 2024.