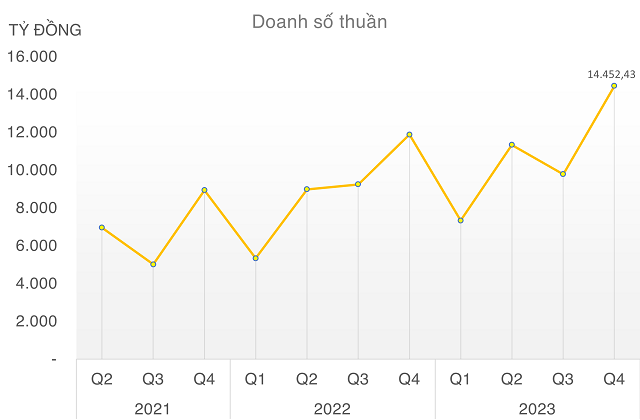

Based on data from 7 companies (C4G, CTD, DPG, FCN, HHV, LCG, VCG), the total net revenue in Q4/2023 reached over VND 14,450 billion, the highest level in many quarters.

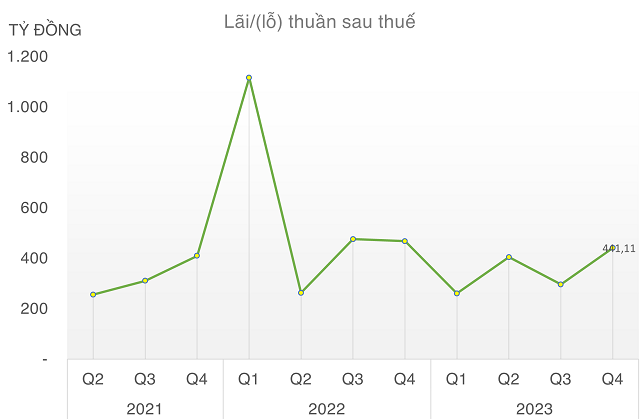

Although the profit did not grow significantly compared to the same period last year, the post-tax profit also reached the highest level of 2023, indicating that the seasonal factor still strongly affected the reporting period as the Government had to rush to disburse funds at the end of the year and companies had to make every effort to increase their workload to achieve their financial goals.

In addition, it should be noted that many companies are involved in various industries, so the improvement in the construction segment may also be offset by reduced positive impact on profit.

HHV is the most outstanding case as it exceeded both revenue and profit targets. HHV’s consolidated revenue surpassed the target by 8%, reaching VND 2,686 billion. The post-tax profit exceeded the target by 7%, reaching VND 362 billion.

Meanwhile, the remaining companies were unable to achieve their profit targets. Following HHV, in order, LCG achieved 80% of the profit target, DPG achieved 73%, CTD achieved 69%, C4G achieved 46%, VCG achieved 40%, and FCN achieved only 8%.

However, it is still necessary to acknowledge the disbursement efforts from the Government and the urgency of companies to help the recorded revenue make significant strides in Q4/2023.

According to the latest report from the Ministry of Finance, the estimated payments reaching by January 31, 2024 (the deadline for disbursing funds in 2023) were VND 662,588 billion, reaching nearly 83% of the plan and 93% of the plan set by the Prime Minister (VND 711,559 billion).

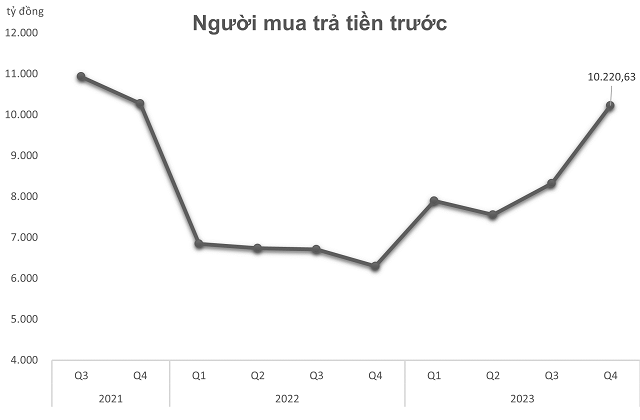

In addition to receiving quick payments, many companies also received generous prepayments from buyers in Q4/2023. These cases include FCN receiving an additional VND 920 billion, LCG and VCG both receiving an additional VND 700 billion, and DPG receiving an additional VND 200 billion in the past quarter.

According to statistics, the total value of prepayments at the 7 above-mentioned construction companies reached VND 10,220 billion, the highest level in the past 8 quarters. As a result, the total cash amount was also recorded to increase sharply to nearly VND 8,800 billion, in which CTD held the most cash and cash equivalents (over VND 2,800 billion). Following that is VCG with cash of VND 2,282 billion, an increase of nearly 80% compared to Q3/2023.

On the other hand, LCG is the company that recorded an exponential increase in cash by 8.5 times compared to Q3/2023, reaching VND 670 billion.

According to the financial statements of LCG in Q4/2023, the additional advances were notably recorded from Project Management Board 7 (+VND 200 billion) and the Department of Transport of Hung Yen province (+VND 502 billion), which are the investors of the North – South expressway project, the Vanh Dai 4 project package.

This will be a very important source of resources to help LCG and other companies have more financial capacity and accelerate the construction progress in the future.

According to the statistics from Mirae Asset Vietnam, listed companies have won many projects in the second half of 2023. Leading in terms of the total value of projects won in 2023 are VCG (VND 68 trillion) and C4G (VND 24 trillion).

With the goal of continuing to boost public investment, 2024 will still be a year of decisive action from the Government to help record additional new contracts of Construction companies. In the first meeting of the Year of the Tiger, Prime Minister Pham Minh Chinh set the goal for the whole country to allocate VND 657,000 billion to public investment, mainly in transport infrastructure investment, and strive to achieve a disbursement rate of at least 95%.