On February 22, 2024, the International Finance Corporation (IFC) and the World Trade Organization (WTO) released their research report on “Trade Finance in the Mekong Region,” the second study in a series of surveys on trade finance in different regions, following the study on West Africa.

The report focuses on three countries: Vietnam, Laos, and Cambodia. The study involved 40 banks and 800 importers and exporters in Vietnam.

UNDERDEVELOPED TRADE FINANCE

The research findings show that domestic trade finance in Vietnam is not only underdeveloped but also costly, dispersed, and limited to basic services. Notably, the coverage of trade finance in Vietnam is very low, despite Vietnam being one of the countries with vibrant trade transactions.

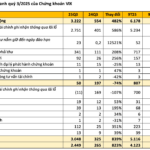

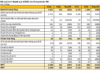

In 2022 alone, banks in Vietnam provided trade finance for only 21% of the country’s total export-import value of USD 731 billion. It is worth noting that banks primarily support domestic enterprises engaged in regional trade rather than large multinational companies involved in global trade.

Many subsidiaries of multinational companies in high-growth and high-value sectors such as electronics and textiles rely less on trade finance.

Furthermore, the report suggests that expanding the scope of domestic trade finance beyond domestic producers would not only enhance the competitiveness of Vietnamese import-export businesses but also stimulate production, strengthen global supply chain integration, and evenly distribute the benefits of trade among domestic producers.

In advanced economies, according to WTO expert Marc Auboin, trade finance utilization reaches 60%, while in developing countries, including Vietnam, the support share of finance for this sector is only about 20%. This calls for greater support from domestic financial institutions to foster robust domestic trade.

There are various reasons why trade finance has not been widely embraced by borrowers and lenders alike. According to exporting companies, high collateral requirements and complex appraisal procedures are among the main reasons why they do not seek assistance from banks.

Specifically, 3 out of 4 companies surveyed indicated that they had no need for trade finance. The working capital of these companies comes from their own resources due to barriers in accessing trade finance. 14% of surveyed businesses did not have access to trade finance in the past 3 years.

In addition, domestic businesses tend to rely more on domestic sources of finance. However, small and medium-sized enterprises (SMEs) and high-tech companies obtain less trade finance support.

The research also reveals that foreign companies and high-tech enterprises face lower collateral requirements to access trade finance compared to non-high-tech companies. It is noteworthy that high-tech companies also receive loan approvals much faster than SMEs and non-high-tech companies.

On the supply side, the report shows that Vietnamese banks rejected an average of 12% of trade finance requests, mainly from SMEs, totaling around USD 20.3 billion in unmet demand.

The reasons for rejection are attributed to insufficient collateral and credit risks. Many banks exercise caution in accepting goods as collateral for loans and lack information about new market segments.

ENHANCING LEGAL FRAMEWORK TO PROMOTE TRADE FINANCE

The report suggests that increasing coverage is even more important than reducing trade finance costs. Thus, it is necessary to develop new tools such as supply chain finance and innovative digital services to reduce costs and improve accessibility.

To achieve this, it is necessary to improve the legal framework to address collateral requirements, digital transactions, central bank conditions, and accountability frameworks. The report also proposes raising awareness among SMEs and domestic suppliers about how to access trade finance.

Mr. Nguyen Quoc Hung, Deputy Chairman cum Secretary General of the Vietnam Banks Association, emphasized that banks do not discriminate and are eager to serve businesses and expand their customer base.

However, large enterprises find it easier to access trade finance due to their financial resources, ability to meet requirements, and stable business plans. On the other hand, SMEs face more limitations, such as instability, weak involvement in supply chains, and failure to meet loan conditions. Additionally, the legal framework for SMEs to access credit is limited, as the Guarantee Fund for SMEs has not been perfected.

Therefore, to improve this situation, according to Mr. Hung, businesses need to enhance their capacity to meet bank and credit institution requirements by increasing transparency in financial reporting and corporate governance, thereby gaining trust from banks in lending activities.

Alongside this, the state should expedite the completion of the legal framework for trade finance. Mr. Hung hopes that the new Law on Credit Institutions, which has been approved by the National Assembly, as well as the issuance of Decrees and Circulars guiding this law by the State Bank of Vietnam, will create favorable conditions for the strong development of trade finance in the future.

Providing his perspective, Mr. Tran Long, Deputy CEO of BIDV, remarks that the report’s findings show that the banking system’s utilization of trade finance for businesses in Vietnam accounts for only 20%, whereas in countries like China and India, it reaches 60-80%.

Agreeing with Mr. Hung’s point on the limitations faced by small and medium-sized enterprises in accessing trade finance, Mr. Long further shares that a study by the Central Institute for Economic Management (CIEM) also revealed that only 25% of SMEs have official access to credit and trade finance, while the rest operate in an unofficial manner.

Therefore, in order to access trade finance, SMEs need to develop themselves further, improve their compliance with state regulations, and enhance their knowledge, capacity, and corporate management.

On the part of the government, Mr. Long suggests that continuous research and improvement of the legal framework are needed to facilitate trade finance activities. This includes permitting and encouraging banks to offer more advanced trade finance methods that other countries have already adopted.

Through media channels, businesses should be informed about the commonly used trade finance products and methods provided by banks and credit institutions.

Banks should boldly diversify their trade finance offerings without solely relying on credit facilities and credit assessment, and make use of advanced methods such as cash flow financing, invoice financing, and export financing. Collaboration with fintech companies and insurance agencies can also help incorporate technology, shorten transaction times, and increase transparency in trade finance.