The overall market liquidity is still lower than the previous session and the 5-session average, with nearly 16.8 trillion VND recorded on HOSE, lower than the previous session’s 20.5 trillion VND.

Many banking stocks are still in the red, such as STB, MBB, ACB, VPB, VCB. On the other hand, TCB stock has made an impressive breakthrough, increasing by over 3%; while the momentum of SHB stock’s rise has been narrowed, increasing by nearly 1.7% compared to the previous hours.

In the morning session, VND was the highlight of the securities group with a slight increase, but now it also decreased. Stocks such as MBS, VCI, HCM, SHS, VIX all decreased by over 1%.

MWG in the retail group decreased by over 1.7%.

Some construction and real estate stocks with significant point declines are VCG, NVL, PDR, CEO, DXG, HUT and VHM stock also turned back. Conversely, prominent increasing stocks include PC1, LCG, VIC, and CII.

Meanwhile, some large-cap stocks such as MSN, DBC, and VNM remained stable with their price increases.

Stocks such as SBT, BMP, DBT, ASM in the production group; or VRE in the real estate group; pair of stocks PVD, PVS in the mining group; CTR in the information technology group; and the typical VTP in the transportation group have all gained positive increases. Notably, HNG maintains a hard limit throughout the session.

In terms of stocks affecting the index, the Vingroup duo VIC and VRE are contributing majority of the index, after TCB stock. Conversely, the pressure from VCB on the index is increasing. At the end of the session, VCB stock contributed a decrease of 2.3 points.

Foreign investors also increased their net selling strength, nearly 873 billion VND. Among them, the most sold stocks are HPG (nearly 150 billion VND), MSN (107 billion VND), MWG (105 billion VND). On the other hand, DGC was sold the most, over 54 billion VND; followed by ASM (49 billion VND) and IDC (33.7 billion VND).

Morning session: Recovery effort

In the morning session, the VN-Index made a fierce struggle. Despite the effort to rebound since it dropped to 1,226.22 points (-3.82 points), with overwhelming selling pressure, the index temporarily fell into the red during the session. VN-Index stopped at 1,229.52 points, a decrease of 0.52 points compared to the previous session, along with liquidity not much improved compared to the previous average session.

Most of the banking stocks declined. Stocks such as MSB, STB, HDB decreased by over 1%; while other stocks like EIB, VPB, MBB, ACB decreased slightly. Notably, SHB stock made an impressive turnaround, maintaining its green color, increasing by 2.1%; followed by VIB and TCB stocks.

The securities group almost sank into the red, “leaving out” the VND stock with a slight increase of 0.22%.

The real estate and construction group still stood out with green throughout the morning session in stocks like PC1, LCG, BCG, ITA, HQC, BCM, HHV, VCG, CII and the Vingroup duo VHM and VIC.

The manufacturing group has many stars. Notably, LSS stock increased limitlessly for no clear reason, while BMP stock also increased by nearly 4.5%, followed by SBT stock. Large-cap stocks such as VNM and MSN recorded an increase of over 1%, while the “national” stock HPG decreased by 0.35%.

PVD, PVS, and AAH stocks in the mining group are performing well. Meanwhile, in the transportation – warehousing group, VTP must be mentioned with an increase of nearly 5.4%.

In the agricultural production group, HAG increased slightly, and HNG increased to the maximum.

The retail group is quite pessimistic as MWG decreased by over 1%.

In the top stocks affecting the index, VNM, MSN, SHB are making good contributions, trying to balance the sharp price decrease of VCB on the other side.

The foreign investor group sold a net of over 440 billion VND in the morning session, mainly focusing on HPG, MSN, and MWG. Conversely, the most net buying were PVD, DGC, and LCG.

10:25 AM: Tug of war

The market is fiercely going back and forth around the 1,230 point mark. As of 10:15 AM, the VN-Index fell into the price decline zone, losing 0.65 points to 1,229.44 points.

Market liquidity today is lower than the previous session’s average as well as the 5-session average.

The securities and banking groups are “more red than green”. In terms of price gains, SHB stock is showing remarkable performance (+2%) and VND stock (+0.2%). Conversely, stocks like MSB, HDB, STB decreased by about less than 1%.

The construction and real estate group still looks positive with many impressive price increases such as LCG, ITA by nearly 4%; stocks PC1, BCG, HQC increased by over 2%.

PVD stock in the mining group increased by over 4%, while PVS in the same group also increased by over 1%. Notably, VTP stock in the transportation – warehousing group increased by over 5.5%.

The agricultural production group witnessed the highest price increase of HNG stock, HAG stock also increased by nearly 0.8%.

In the top stocks affecting the index, VCB continues to be the leading stock, exerting significant pressure on the index, with a contribution of nearly 1.1 points decrease; larger than the sum of the upward contributions of GAS, SHB, and VHM stocks, while these are the 3 most positive stocks affecting the index.

Opening: Slight increase

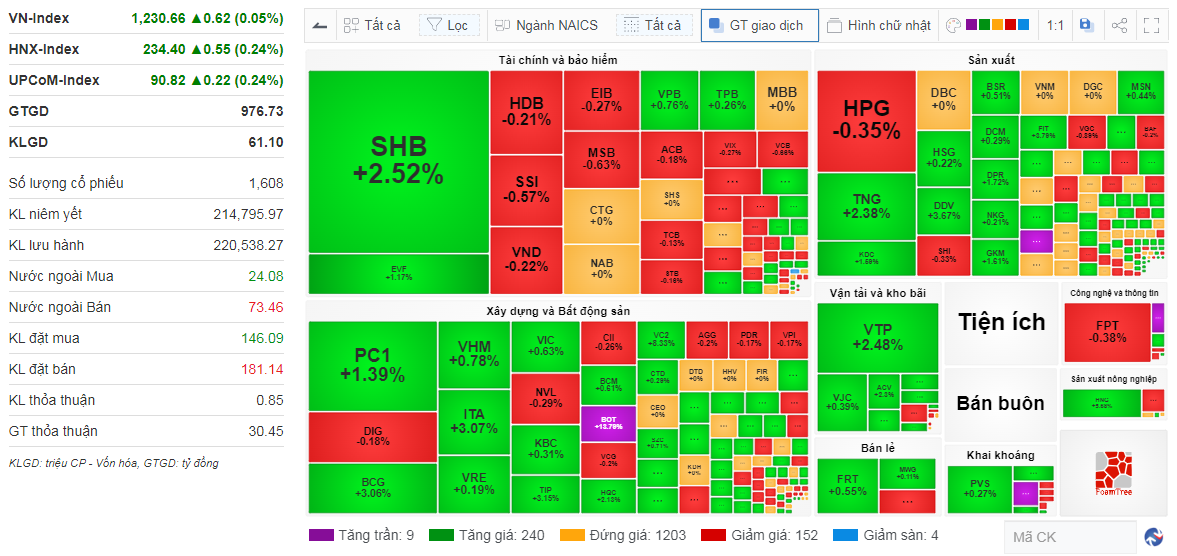

After yesterday’s fluctuating session, the VN-Index opened with a slight increase, up 0.6 points compared to the previous session to 1,230.66 points. Among them, there were 9 stocks hitting the ceiling, 240 stocks increased, 1,203 stocks stood still, 152 stocks decreased, and 4 stocks returned to the floor.

Market performance at 9:23 AM. Source: VietstockFinance

|

Similarly, the Large Cap, Mid Cap, Small Cap, and Micro Cap groups are slightly green.

The Vingroup duo VIC and VHM are the two stocks with the most positive impact on the index, GAS stock follows, providing extra support for this duo. Conversely, VCB is the stock with the most negative impact on the index, quite larger than the other stocks in the top 10 negatively impacting stocks combined, while these are the 3 stocks most positive in the index.

Kha Nguyen