A surge of investors participating in the stock market has led to increasing demand for diverse investment opportunities. Mr. Thanh (30 years old, Hanoi), an individual investor, after a year of struggling with unsuccessful wave trading in 2023, wants to find a more effective investment strategy with high-profit potential.

Meanwhile, Ms. Hoa (25 years old, Da Nang), an office worker with limited experience but stable income, wants to find a long-term asset accumulation channel. This is a very common need in the young investment community nowadays, which ensures the main job while also generating passive income to strengthen financial foundations for future plans.

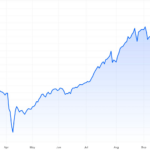

Data compiled from reliable sources has reference value for investors.

For older investors, the demand for maximum effectiveness of idle funds is also high, especially when bank deposit interest rates are at record lows. Ms. Hang (50 years old, Ho Chi Minh City), a self-employed businesswoman, wants a safe place to invest her accumulated funds for many years with a moderately high profit rate.

With the unpredictable market conditions and the intertwined opportunities and risks of the stock market in 2024, it is difficult for non-professional investors to “engage” with limited capital and experience. Therefore, support from experts with knowledge and experience to have an investment strategy that matches the needs is truly necessary.

The role of investment funds and securities companies will become increasingly important in guiding investors. Having an investment strategy that suits the needs advised by top experts from large funds is much better than “betting” on stock market fluctuations.

A guiding compass for investors

In a volatile and unpredictable stock market environment, investors need a guiding compass to avoid going in the wrong direction from the very beginning. According to Ms. Luong Thi My Hanh, Head of Domestic Asset Management at Dragon Capital Vietnam, there are two questions that investors need to think about and answer before investing this year and in the years to come.

Firstly, how do you feel at that time? In other words, what is your risk appetite? Answering this question will help investors determine whether they are risk-averse or risk-seeking individuals, psychologically before making investment decisions, whether they are cautious or confident in adopting suitable approaches. Psychology is a very important factor that greatly influences investors’ decisions, especially for individuals.

Secondly, what is important to you at that time? In other words, what are your investment priorities? The question helps determine your investment goals at that time, what is the focal point: safety, defense, or boldness, whether you want rapid growth or just invest for stable income, short-term or long-term time frames that suit you. By identifying clear goals, investors can choose the right strategy or at least create conditions for advisors to recommend suitable investment products.

In Vietnam, investment products have been developing strongly and are diverse enough to meet all participants’ needs. Large investment funds have built an ecosystem of products suitable for all types of investors, whether offensive or defensive, typical of Rong Ho Menh and Rong Thinh Vuong groups of Dragon Capital Vietnam.

Ms. Luong Thi My Hanh, Head of Domestic Asset Management at Dragon Capital Vietnam, shared at Investor Day Q4 in Hanoi. Source: Dragon Capital Vietnam.

With the goal of capital safety, the Rong Ho Menh group is likened to a “thick shield” with 2 bond funds DCIP and DCBF that can meet investors’ needs. DCIP is an open-end fund specially designed for short-term investment needs (less than 1 year) through a diversified investment portfolio, including defensive assets such as bonds and deposit certificates. The product’s characteristics are high liquidity and a growth target higher than the 3-month bank deposit interest rate.

Similarly, DCBF is a fund operating under the ETF model, and it invests in government bonds, corporate bonds, and securities to seek stable long-term profits. The investment period is more than 6 months with a low average NAV fluctuation and a growth target higher than the 12-month bank deposit interest rate.

For capital growth purposes, the Rong Thinh Vuong group is considered the “sharp spearhead” with 2 representative equity funds, DCDE and DCDS, which are not to be missed choices. DCDS is Vietnam’s first public fund, operating since April 2004. The investment objective of the DCDS fund focuses on long-term growth stocks to optimize profits in various sectors and different market capitalizations. The fund aims for outstanding capital growth in the long term with a minimum investment period of 1 year.

With the same capital growth target, DCDE pursues the “eat securely, wear durably” approach. The fund’s investment strategy is in stocks of companies with a history of regular dividend payments in the past and/or companies with plans to pay dividends in the future in all industries and geographical areas. The fund will prioritize selecting companies with annual dividend growth in its portfolio.

In addition, Dragon Capital Vietnam also offers many other products such as ETF funds, retirement funds, or investment trusteeship,… These products not only suit individual investors but also meet the needs of organizations.