The “thrilling” momentum this afternoon pushed VNI to nearly 1,241 points, equivalent to the 2023 peak, triggering a large sell-off afterwards. Continuous and intense selling pressure pushed liquidity to a staggering 32,000 billion, not to mention deals. The market is highly likely to have reached its peak.

First, today’s liquidity is too high. At the September peak last year, the trading volume was only equivalent to this level. A significant amount of money has been locked in at a time when the market is teetering near its long-term highs.

Second, this sudden surge in liquidity is accompanied by a large drop in stock prices and very narrow breadth, confirming complete control of the selling side. The second-half drop this afternoon was rapid and continuous, indicating intense selling activity. Many buy orders at low prices were forced to be matched.

Third, the leading stocks also experienced very high liquidity and significant price drops. If this group is also sold off, the recovery prospects will be difficult. It is also worth noting that besides the banking sector, other leading stocks such as VIC, VHM, GAS, VNM, MSN… have recently seen modest increases with narrow ranges. These stocks are also affected by overall market movements, which means that the funds are not strong enough or the sentiment among hold-traders is unstable.

In general, the market goes up and down, and no trend can last forever. The accumulated volume over the past 3 months is being released as the leading stocks are being heavily pressured. This shows that the sentiment of testing the peak is very fragile, and when the score is lost too much, it cannot be controlled. The leading stocks were mostly collapsed in the afternoon session almost at the same time, and the breadth immediately contracted rapidly. Previously, in the morning session and the first few minutes of the afternoon session, this group had brought the VNI to touch the previous peak in 2023.

Preserving capital at this time is important; the market does not have any special support information that explains the recent rally, it is simply due to the flow of money. When the money gives signals to withdraw, the risk of correction is high. Although this is just a normal technical correction, for each stock, the volatility can be very large. Therefore, preserving buying power will create an advantage in the future.

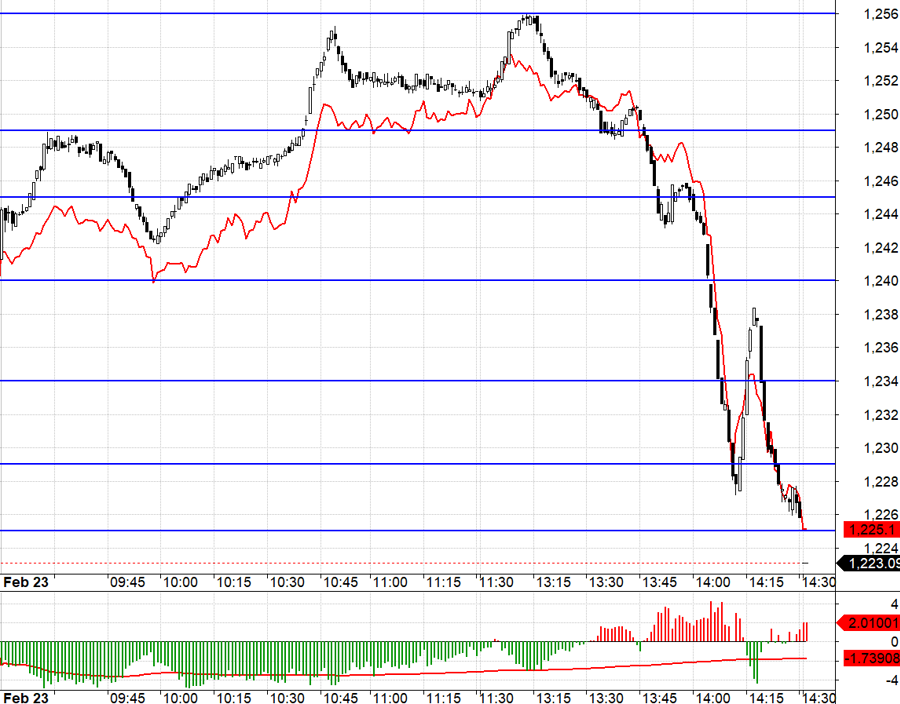

The futures market today showed extremely cautious reactions, maintaining a negative basis in F1 throughout the best upswing of VN30. Until 1:15pm, when VN30 created its second peak testing 1256.xx, the basis remained negative by nearly 3 points. The correction up to 1:45pm was still normal, but when VN30 broke through the morning low and the leading stocks simultaneously saw significant selling volumes, the downward momentum began to increase. VN30 completely broke through the sideways range of the previous 3 sessions, confirming a perfect Short setup that has been laid out for the past few days while F1 maintains the discount.

The short-term market risk is high at this time, although each session may have dips and recoveries. Basically, a large amount of money has been withdrawn at high price levels, and a good discount is needed to attract it back. However, the market is not bad, it simply goes up and down in the short term. Therefore, preserving buying power and waiting for Short opportunities in derivatives.

VN30 closed today at 1223.09. The nearest resistances in the next session are 1225, 1232, 1240, 1249, 1256. Supports are 1219, 1210, 1201, 1196, 1189.

“Stock blog” is a personal opinion and does not represent the views of VnEconomy. The opinions and assessments are those of individual investors and VnEconomy respects the viewpoints and writing style of the author. VnEconomy and the author are not responsible for any issues related to the published assessments and investment opinions.