Ms. Ha Thu Giang – Head of the Credit Department in Economic Sectors, State Bank of Vietnam, stated that the maximum interest rate applicable to non-term and term deposits of less than 1 month is 0.5% per year. The maximum interest rate applicable to term deposits from 1 month to less than 6 months is 4.75% per year, while the maximum interest rate for Vietnamese dong deposits at the People’s Credit Fund, microfinance institutions is 5.25% per year. The interest rate for term deposits of 6 months or more is determined by credit institutions based on market supply and demand for capital.

According to Ms. Giang, as of January 31st this year, the deposit and lending rates continue to decline; the average deposit and lending rates for new transactions of commercial banks have decreased by about 0.15% per year and 0.25% per year, respectively, compared to the end of 2023.

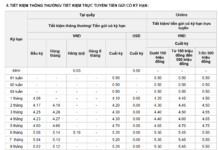

According to our survey, the lowest deposit interest rates in the market belong to the 4 large banks, including Vietcombank, Agribank, BIDV, and VietinBank. Among them, Vietcombank and Agribank have the lowest posted interest rates for 1-3 month terms at only 1.7% per year. The 3-5 month term deposit interest rates at these two banks are only 2% per year; the 6 month to less than 12 month term deposit rates are only 3% per year. The corresponding term deposit rates at BIDV and VietinBank are higher by 0.2% per year compared to the above levels. For term deposits of 12 months or more, the posted interest rates at the 4 large banks range from 4.7-5% per year. As for private commercial banks, their rates are all below 6% per year.

The decline in deposit interest rates leads to a corresponding decrease in lending rates. As of now, the mortgage lending rates at banks have decreased significantly compared to mid-2023. Some banks have reduced their average mortgage lending rates to 5-6% per year during the promotional period. After the promotional period, the floating mortgage lending rates are kept at levels of 9-11% per year.

The lowest lending rates will stimulate homeownership for the public.

Among the Big 4 banks, the rates range from 6-7% per year. Specifically, BIDV and Vietcombank offer the lowest preferential interest rate for real estate loans at 6% per year, followed by Vietinbank at 6.4% per year.

For private commercial banks, the lowest preferential interest rate currently stands at 0% per year and is applied by TPBank. Accordingly, this bank applies a preferential interest rate of 0% per year for the first 3 months, 9% per year for the next 9 months for customers who borrow less than 65% of the total asset value; 7.5% per year for 12 months, 8.6% per year for 24 months, and 9.6% per year for 36 months.

Techcombank currently applies a mortgage lending rate of only 5% per year during the first 3-month promotional period, 6% per year during the 6-month promotional period, or 6.8% per year for the 12-month promotional period.

According to Mr. Nguyen Van Dinh – Chairman of the Vietnam Real Estate Brokers Association, 2024 is the “first brick” to lay the foundation for a new development cycle of the Vietnamese real estate market. In parallel with solutions to resolve legal difficulties and provide capital for the real estate market, the “trust” of customers and investors will continue to be the focus…