The corporate bond market declined in January with a total issuance value of 3.65 trillion, an increase of 19% compared to the same period last year, according to KBSV statistics.

In January, there were only 2 private bond issuances worth 1,650 billion and one public bond issuance by VIC worth 2,000 billion. The real estate group (including VIC, a company with a private issuance of 450 billion) accounted for 67% of the total, while the remaining companies issued 1,200 billion in the construction sector.

In January, 34 companies carried out early redemption, with a redemption value of 7,394 billion, a decrease of 31.1%. The low interest rate environment is the main motivation for companies to redeem bonds issued at high interest rates in the previous period, and it is expected to continue to increase in the coming months as business conditions improve.

The amount of bonds maturing decreased in January. In 2024, it is estimated that there will be about 279 trillion dong of maturing bonds, with over 115 trillion dong being real estate corporate bonds (accounting for 41.4%), followed by financial institutions with over 81 trillion dong (accounting for 29%).

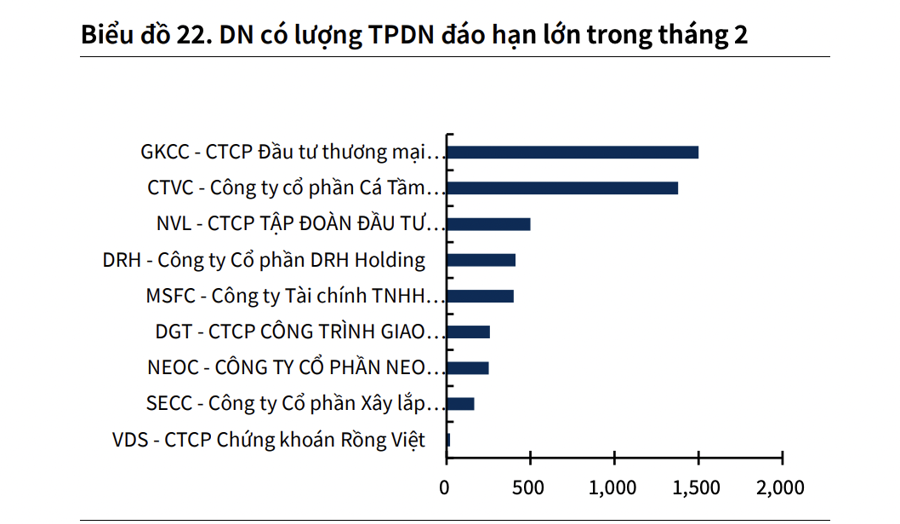

In February, it is estimated that there will be about 4.88 trillion dong of maturing bonds (+335% MoM). Among them, the Real Estate group accounts for 49% and other sectors account for 31%. The companies with large amounts of maturing bonds in February include Gia Khang Investment Trading Services Joint Stock Company, Cá Tầm Việt Nam, Novaland, DRH Holding, and Rồng Việt Securities.

According to VBMA, 7 companies announced late repayment of principal and interest in January, with a total value of about 8,432 billion dong (including interest and remaining debt of the bonds) and 5 bond codes were extended for repayment time, principal, and interest.

In terms of exchange rates, the USD/VND exchange rate fluctuated in the range of 24,200 – 24,600, maintaining a high level since January 2023 in the context of DXY returning to the 104 area due to the hot inflation data – pushing back market expectations of the timing of interest rate cuts; and the negative interest rate differential between USD and VND continues to stimulate carry trade activities.

Accordingly, the exchange rate at VCB also moved similarly to the interbank exchange rate, reaching 24,595 on January 31. The black market exchange rate, under pressure from increasing commercial activities in the pre-Tet period and price differentials between domestic and international gold, continues to maintain a high level at 25,000 on January 31. The black market exchange rate no longer moves in sync with the selling rate of VCB since December 2023 and maintains a difference of about 300 VND up to the present time.

A large USD-VND interest rate differential will make buying and holding USD more attractive, stimulating carry trade speculation (investors using low-interest currency to buy high-interest currency, benefiting from interest rate differentials). Specifically, the 1-month, 3-month, and 6-month USD-VND interest rate differentials are -4.44%, -2.26%, and -1.83%, respectively.

Recent economic data shows signs of a slowdown in inflation. Specifically, although the CPI and core CPI indices in January decreased and remained flat, they were higher than market expectations. The PPI and core PPI indices in January (released later) reached 0.9% and 2.0% (YoY), higher than market expectations, reinforcing the belief that the inflation cool-down process is slowing down. Therefore, DXY and the 10-year US Treasury bond yield have rebounded, while the futures contract implies only 4 interest rate cuts this year, with the first one taking place in June.

Considering domestic factors, the domestic exchange rate is forecasted to continue to be well supported by abundant foreign currency supply from FDI and remittances. In addition, it is believed that the State Bank of Vietnam will continue to maintain loose monetary policy, accepting an appropriate increase in exchange rates and will not intervene unless there are abnormal fluctuations due to inflation remaining under control, while the economy needs to continue to be supported for recovery.

Therefore, the USD-VND interest rate differential and the risk of DXY’s price increase will continue to be two risk factors putting pressure on the exchange rate, especially when geopolitical risks still show no signs of cooling down. KBSV forecasts a 1.5% increase in the exchange rate this year, reaching 24,600 USD/VND.