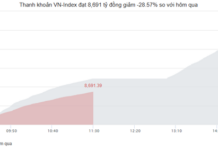

After fierce struggles, today (21/2), most of the trading time was engulfed in red color. VN-Index showed signs of recovery towards the end of the session. Before entering the ATC session, the main index returned above the reference level. However, the upward momentum was not sustained, and VN-Index closed slightly lower as large-cap stocks decreased and lacked leading pillars.

The market lacks a strong leading stock group (illustrative image).

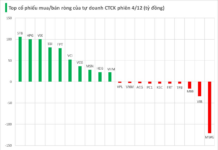

Despite the overwhelming green color, the banking sector has not reached consensus, with modest fluctuations and contributions. BID, CTG, TPB, STB, VPB are among the leading stocks in the market, but their contributions are all below 0.5 points. TPB leads the banking group’s increase, rising by 4%; meanwhile, STB registers the highest liquidity in the market, more than 1,405 billion VND. STB is also the second-most net-bought stock by foreign investors in the whole exchange, with a value of 191 billion VND, second only to MSB (481 billion VND).

The increase in trading volume of STB comes in the context of bank stocks being under scrutiny with regards to information related to the auction of Phong Phu Industrial Park. In its 2024 prospect update report released on February 19, Agribank Securities stated “STB has confirmed the successful auction of Phong Phu Industrial Park with a value of over 7,900 billion VND.” However, Agriseco subsequently pointed out that this information is inaccurate and corrected: “STB is expected to successfully auction Phong Phu Industrial Park in 2024.”

On HoSE, differentiation is evident with 262 declining stocks and 239 advancing stocks. Industries with large market capitalization and influence, such as real estate, securities, construction, … all recorded a dominance of red color. Some small stock groups traded more positively. The insurance sector is predominantly green, with PVI, BMI, MIG all seeing price increases.

Regarding the “huge” transaction that took place in the insurance group, the identity of the buyer of 75 million BHI shares (Saigon – Hanoi Insurance Corporation) has been revealed. Non-life insurance company DB Insurance from South Korea has reported becoming a major shareholder, now holding 75% of BHI’s capital in the session on February 19. Thus, BHI becomes a subsidiary of DB Insurance.

On February 19, BHI recorded the highest trading volume in its history with 75 million shares transferred to foreign investors. The trading value exceeded 1,628 billion VND. With a sudden high liquidity, BHI’s stock price hit the ceiling in two consecutive sessions (19-20 / 02), reaching 25,700 VND/share at the end of the session on February 20, an increase of 24% in just 2 sessions. In today’s session, BHI made a slight adjustment, decreasing to 25,300 VND/share.