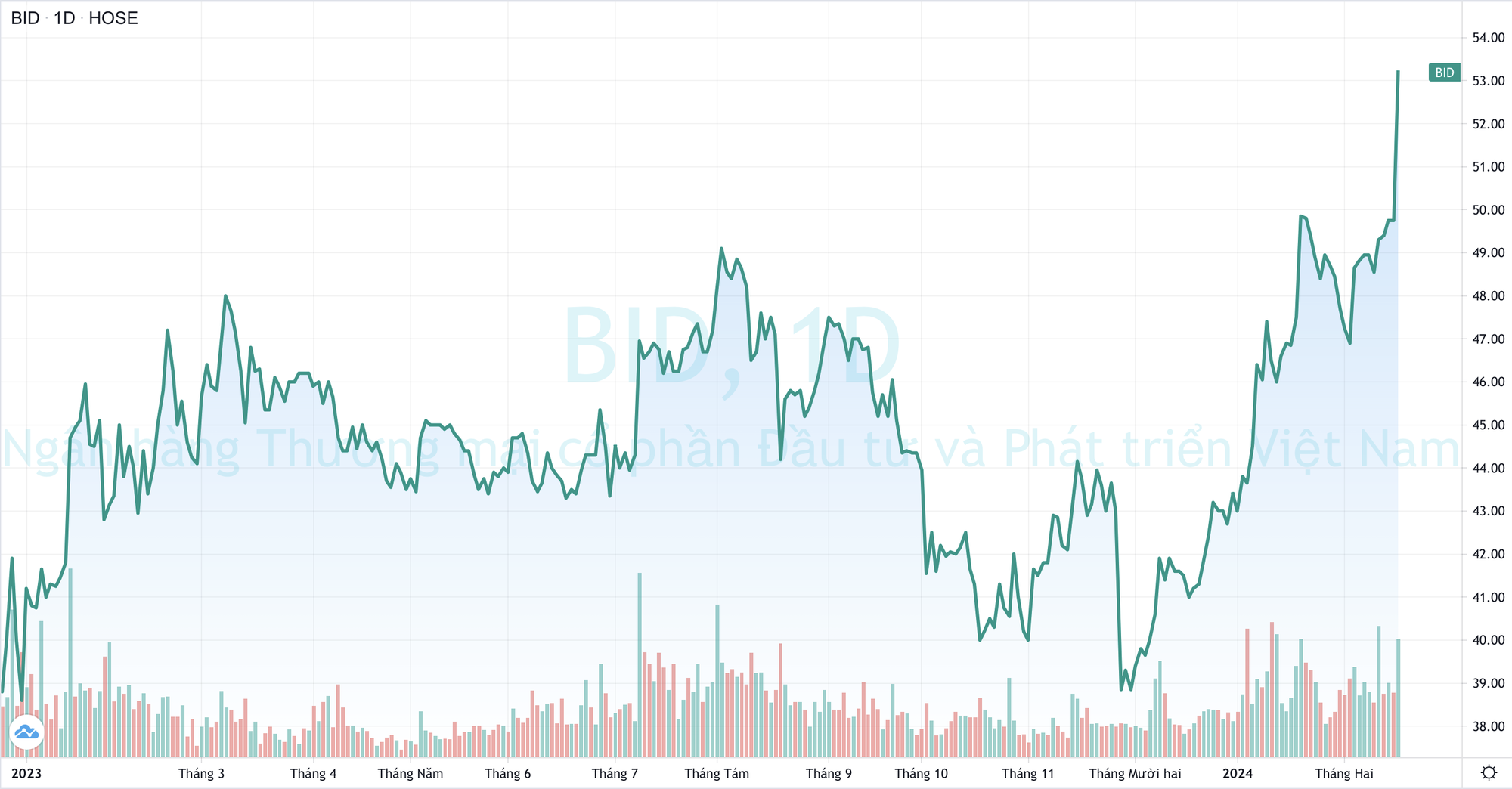

The stock market ended the week on a high note with a strong performance from the banking sector, particularly BIDV (stock code BID). The stock unexpectedly surged to an all-time high of 53,200 VND per share. Compared to the beginning of the upward trend in early November 2023, BID’s share price has increased by nearly 50%.

BIDV’s market capitalization has also increased by an additional 100 trillion VND in less than 4 months, reaching a record high of over 303 trillion VND (~13 billion USD). This solidifies BIDV’s position as the second-largest bank listed on the stock exchange in terms of market capitalization. This is the second time in history that a bank has reached this threshold. Previously, it was Vietcombank, the most valuable name on the Vietnamese stock market with a market capitalization of half a trillion VND.

The strong rise in BID shares has brought joy to shareholders, including Keb Hana Bank. With a 15% stake in BIDV, this investment of the South Korean bank is currently valued at 45.5 trillion VND (~2 billion USD). It is estimated that Keb Hana Bank is currently “temporarily profiting” more than 1 billion USD after over 4 years as a strategic shareholder in BIDV, not to mention the cash dividends it has received.

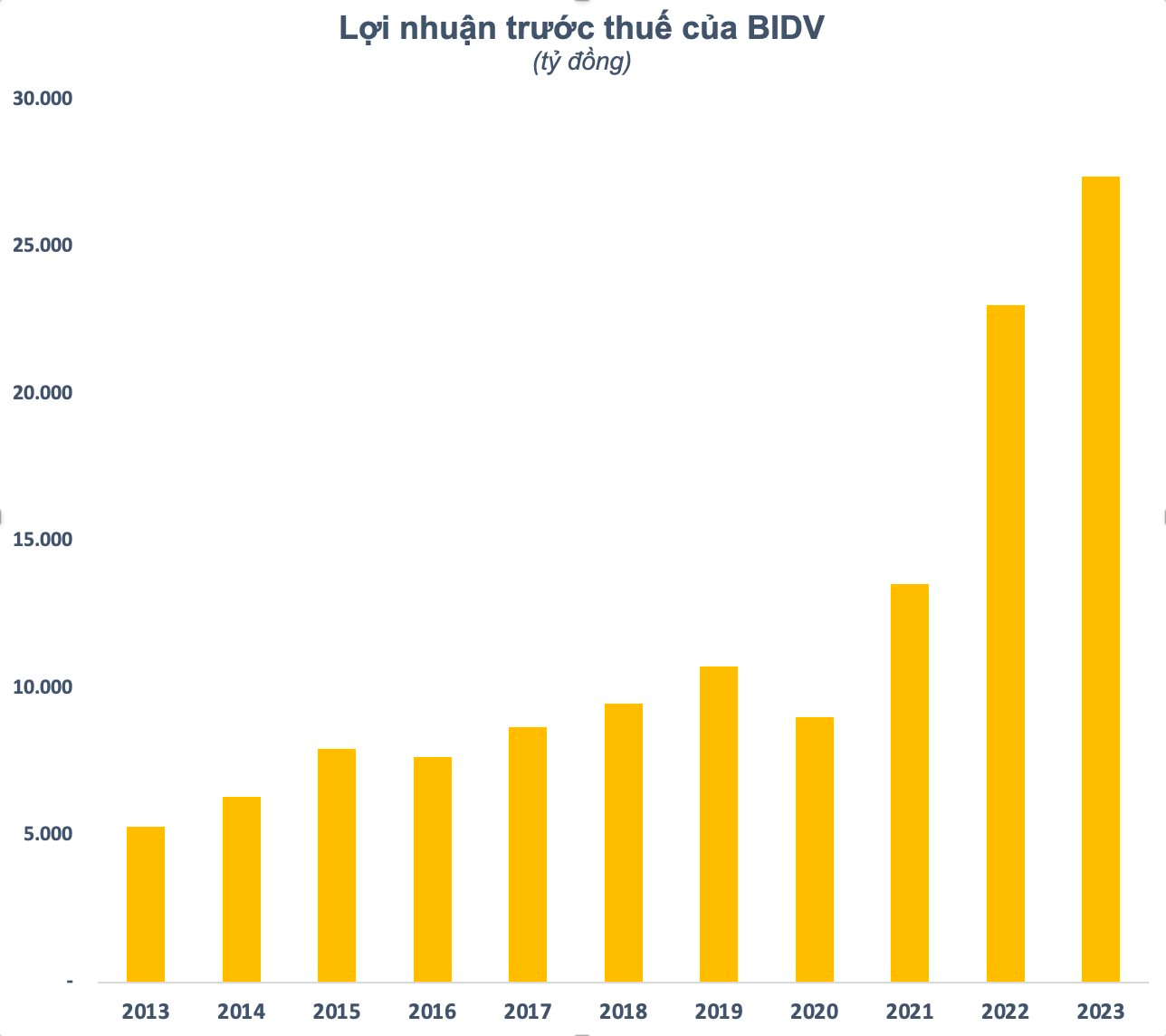

Since Keb Hana Bank became a strategic shareholder in 2019, BIDV has experienced continuous strong growth. In 2023, the bank’s consolidated pre-tax profit reached 27.6 trillion VND, an increase of 20.6% compared to 2022. This is the first time the bank’s profit has exceeded 1 billion USD. With this level of profit, BIDV is the second most profitable bank among the Big 4, only behind Vietcombank (over 41 trillion VND).

By the end of 2023, BIDV’s total assets reached 2.3 quadrillion VND, maintaining its position as the bank with the largest total assets in Vietnam. Customer deposits reached 1.7 quadrillion VND, a 15.7% increase. Customer loans reached 1.78 quadrillion VND, a growth of 16.8% compared to the beginning of the year. At the end of the year, BIDV’s non-performing loans stood at 22.229 trillion VND, corresponding to a non-performing loan ratio of 1.25%.

Regarding the business plan for 2024, BIDV stated that credit growth will be limited to the State Bank of Vietnam’s credit limits, with an expected increase of 14%; Capital mobilization will be managed in accordance with capital utilization, ensuring liquidity and efficiency; Non-performing loan ratio will be controlled at ≤1.4% according to Circular 11…

In a analysis report published in December 2023, Phu Hung Securities (PHS) stated that BIDV is still pursuing its private placement plan into 2024. The bank plans to privately place 9% to investors. Recently, BIDV has been in contact with 38 investors. However, the unfavorable domestic economic situation has reduced demand. BIDV will work with the State Bank of Vietnam and its partners to find the most suitable investors.