Hoang Anh Gia Lai JSC (HAGL, code HAG – HOSE) plans to organize its Annual General Meeting of Shareholders in 2024. The meeting is expected to be held in April 2024.

On March 13th, HAGL will finalize the list of shareholders attending the Annual General Meeting in 2024. The content of the meeting has not been announced yet.

Mr. Duc at the investor meeting in December 2023. Photo: HAGL

In the latest development, on February 15th, HAGL announced that it had received a document from the State Securities Commission (SSC) approving the registration dossier for private share placement.

Hoang Anh Gia Lai will proceed with the placement according to the approved dossier and report the results of the private share issuance.

It is known that after many adjustments to the participating organizational structure in the issuance process and the capital use plan, in January 2024, Hoang Anh Gia Lai finalized the plan to privately issue 130 million shares at a price of VND 10,000 per share, raising VND 1,300 billion.

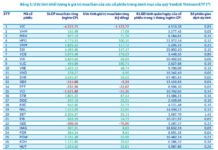

Earlier, also related to the private placement, HAGL adjusted its plan to privately sell 130 million shares. Among them, the expected list of participating investors includes LPBank Securities JSC, expected to buy 50 million shares, increasing ownership from 0% to 4.73% of charter capital; Thaigroup Corporation JSC, expected to buy 52 million shares, increasing ownership from 0% to 4.92% of charter capital; and investor Le Minh Tam (replacing Mr. Nguyen Duc Quan Tung), expected to buy 28 million shares, increasing ownership from 0% to 2.65% of charter capital.

In terms of capital use, HAGL prioritizes to fully repurchase the outstanding principal and interest of bonds issued by the Company on June 18, 2012, with the code HAG2012.300, with an expected value of VND 346.7 billion.

Next, HAGL wants to restructure the debt for its subsidiary, LPAgriculture JSC, through a loan to pay off debt at TPBank with an amount of VND 253.26 billion; and finally, if there is still capital remaining, HAGL will use VND 700 billion to supplement working capital and restructure the debt for its subsidiary, HAGL-HTL JSC.

In terms of business activities, in Q4/2023, HAGL recorded revenue of VND 1,898 billion, up 16% compared to the same period, net profit recorded a profit of VND 1,108 billion, up 377% compared to the same period of the previous year.

The sudden increase in Q4 profit was mainly due to an increase in financial revenue. The main reason was the recognition of VND 240.3 billion in profit from the sale of investments. At the same time, financial costs decreased mainly due to a reduced interest expense of VND 1,424.7 billion from Exim bank

Accumulated in 2023, HAGL recorded revenue of VND 6,932 billion, up 36% compared to the same period, net profit recorded a profit of VND 1,817 billion, up 62% compared to the same period.

It is known that in 2023, HAGL set a target of VND 5,120 billion in revenue and VND 1,130 billion in net profit. Thus, by the end of 2023, Mr. Duc’s company had exceeded 61% of the profit target.